Say no to tax-rebate gift cards [MSN Money] “Hand…

personal finance

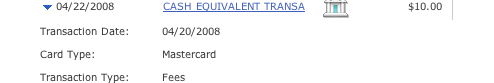

Bank Of America Charges $10 Fee For Paying Parking Tickets

Reader Anthony writes that the financial warlocks…

What Will You Do With Your Economic Stimulus Check?

The first of the economic stimulus rebate checks…

Revenues From Bank Fees Up 41% Over Last 4 Years

LowCards.com points out that fees are a huge source of revenue for credit card companies these days—they’ve gone from $12.8 billion in 2003 to $18.1 billion in 2007, an increase of 41% in 4 years.

Woman eBays $103,254.11 In Debt

This lady is trying to eBay her family’s $103,245.11 in debt. It comes with her house and car (loving family not included). I guess it could be useful if you’re trying to decrease your tax liability, or you just want to feel part of the credit crunch crisis. Maybe you could work out a Prince and the Pauper thing.

../../../..//2008/04/25/going-broke-on-100000-a/

Going broke on $100,000: A sample budget showing how easy it is for a family making six figures and with 2 kids to get sucked into deficit spending. [Dr. Housing Bubble]

10 Ways To Save Real Money

The champagne is dry and crusty, and all the hundred-dollar bills used to light cigars have crumbled into ash. It’s time to tighten our belts and get real about spending less and saving more. Here’s 10 ways to save some serious cash…

How To Thaw Your Frozen HELOC

According to Yahoo Finance, there are several things you can do if you are one of the many homeowners who found out that their home equity line of credit was frozen by the lender. If your HELOC is frozen you can:

Advice On How To Raise Financially Savvy Kids

CNN asks some money experts for tips on how to teach kids about personal finance. Laura Levine, the executive director of Jump$tart Coalition for Personal Financial Literacy, says she uses a special piggy bank for her 3-year-old son—it has four chambers, “one for saving, one for spending, one for donating and one for investing,” and helps teach him that money is not just for “one thing.”

5 Credit Card Scams To Beware

Completely fictional companies pass these charges onto people’s credit card bills and bank accounts and cellphone bills. The processing companies just pass them on and it’s up to consumers to monitor their bills and dispute the charges. So the fake company is just very nice about canceling all the charges from the people who complain, and then they rake in from all the people who don’t check their bills close enough.5. “Cramming”

Completely fictional companies pass these charges onto people’s credit card bills and bank accounts and cellphone bills. The processing companies just pass them on and it’s up to consumers to monitor their bills and dispute the charges. So the fake company is just very nice about canceling all the charges from the people who complain, and then they rake in from all the people who don’t check their bills close enough. [More]

Is Your HELOC In Danger Of Being Frozen?

If you have an open home equity line of credit you were counting on for renovations or other projects, you might want to read CNN Money’s article about how lenders are freezing them around the country. The main triggers for HELOC freezing are credit score changes and a rapid drop in home value in your area. The freeze may also be a computer-determined action, so if your HELOC suddenly goes away and you don’t think it was justified, it may be worth checking your FICO score and then contacting the lender to reopen the line or renegotiate it.

Commerce Bank Workers Only Allowed One Courtesy Fee Reversal Per Customer?

Fun fact, it seems like Commerce Bank employees only get one fee reversal per customer account. I had three fees, two cycle-service charges and an “account inactivity” fee. The supervisor agreed to waive the two cycle service charges but wouldn’t budge on the inactivity fee. I popped back in a few days later and tried speaking to a different rep to see if I would have better luck. He wasn’t able to do it for me and he was even surprised to see that the two cycle service charges were gone. “I’ve never seen more than one of them waived before,” he said. “I guess they must have had two different people punch in requests…” So that sounds like the normal rule might be only fee reversal per employee per customer account. Just something to keep in mind should you be doing fee battle with Commerce Bank.

../../../..//2008/04/18/this-guy-says-he-saves/

This guy says he saves $500 a year on groceries by buying the whole cow from local farms. [Lifehacker]

Banks Canceling All App-O-Rama Player's Credit Cards?

Are credit card companies cracking down on “app-o-rama” (AOR) gamers, those folks who do a slew of credit card applications at the same time for to get as many bonus offers, credit lines, and 0% balance transfers as they can? After some of these FatWallet forum members did an AOR, all their credit cards were closed with one bank. For one guy, stook2001, this meant five new Citicard credit card accounts as well as three already existing Citicard accounts in good standing. The only reason given for the closing was the number of inquiries on his credit report. AOR thrived when credit card companies were throwing all sorts of enticing promotional offers in a desperate drive to get more customers. Now that credit card defaults are rising and credit card companies are trying to get rid of customers that might end up as liabilities, AOR could be just as on its way out as a no-doc stated income interest-only option-ARM mortgage.

The 9 Ways to Get Rich

The personal finance blogger at Can I Get Rich on a Salary has detailed nine ways he believes people can become rich. His list includes the following: