They tell us if we can get someone to sign up, and be approved, that we have guaranteed that that customer will shop at our store, on average, three times more often than they would have if they didn’t have a card with our store’s name on it.

personal finance

Store-Branded Credit Cards Triple How Often Cardholder Shops There

Don't Get Cheated On Closing Costs

Some homebuyers are pissed because when the actual line item fees for various closing costs come in less than the estimation, their closing agents are simply pocketing the difference. How do you fight back? This article on LawyersandSettlements says,

Personal Finance Roundup

Eight Ways to Slash Travel Costs [Yahoo Finance] “Get creative with these eight tips, travel off the beaten path a little, and save some of your cash for when you get home.”

Latest And Best Online Savings Accounts Rates

Now that interest rates have fallen, online savings accounts aren’t offering the same kind of return as before, but you can still stay liquid and get more than what you get in a brick and mortar bank. Here’s some online saving accounts offered by FDIC-insured banks ranked by the interest they pay out:

Where's My Stimulus Payment?

The IRS has a tool that lets you find out when your Stimulus Payment will arrive. Just punch in your social, filing status, and number of exemptions on your 2007 taxes. Its usefulness is limited, though, as it can’t tell you when your payment arrive until about a week before they send out the check.

Reach Chase Bank Executive Customer Service

If you have a problem that regular customer service hasn’t been able to solve, give this gal working in the Chase Bank executive customer service office a shot: 713-262-3866, Michelle Crabtree. Although, she figures in an upcoming reader complaint, and not favorably. If you have a specific credit card complaint, that info is here, and the general Chase Bank executive customer service desk is 800-242-7399.

BoA Closes Your Credit Cards If You Ask Why They Increased Your APR

It’s evident the pendulum swung too far in terms of giving away too much credit, but now it seems to be swinging back in the opposite direction just as hard, with banks getting too tightfisted, even when it doesn’t make sense. For instance, the APR on James’s BoA credit card jumped from 9.32% to 13.99%, and shortly after he called to see about getting it back, they closed all three of his credit cards. One was a Gold account with a lifetime APR of 7.99%, the other had a 1.99% APR. Just last month, he received an offer to transfer $15,000 to the 1.99% card. Obviously at least one department in Bank of America thinks he’s a good credit risk. It appears some other expressionless faces of the massive dodecahedron that is the entity called Bank of America disagreed.

The Chargeback Blacklist

The ChargeBackBureau sells merchants a blacklist with names of customers who have done chargebacks. Merchants are supposed to be able to access its lists and deny transactions to customers if they see they’re chargeback-prone. When a consumer is put on the list, they get sent an email warning them they’re “going to have trouble purchasing goods or services on the Internet in the future.” ChargeBackBureua’s headquarters are conveniently located in Panama, which is convenient for its American clients, as such databases are illegal in the US. Chargebacks are an important tool for consumers to fight back against merchants who won’t give you what you paid for. Here’s how to do one. If a merchant won’t do business with you because you stood up for your rights before, then you shouldn’t do business with them either.

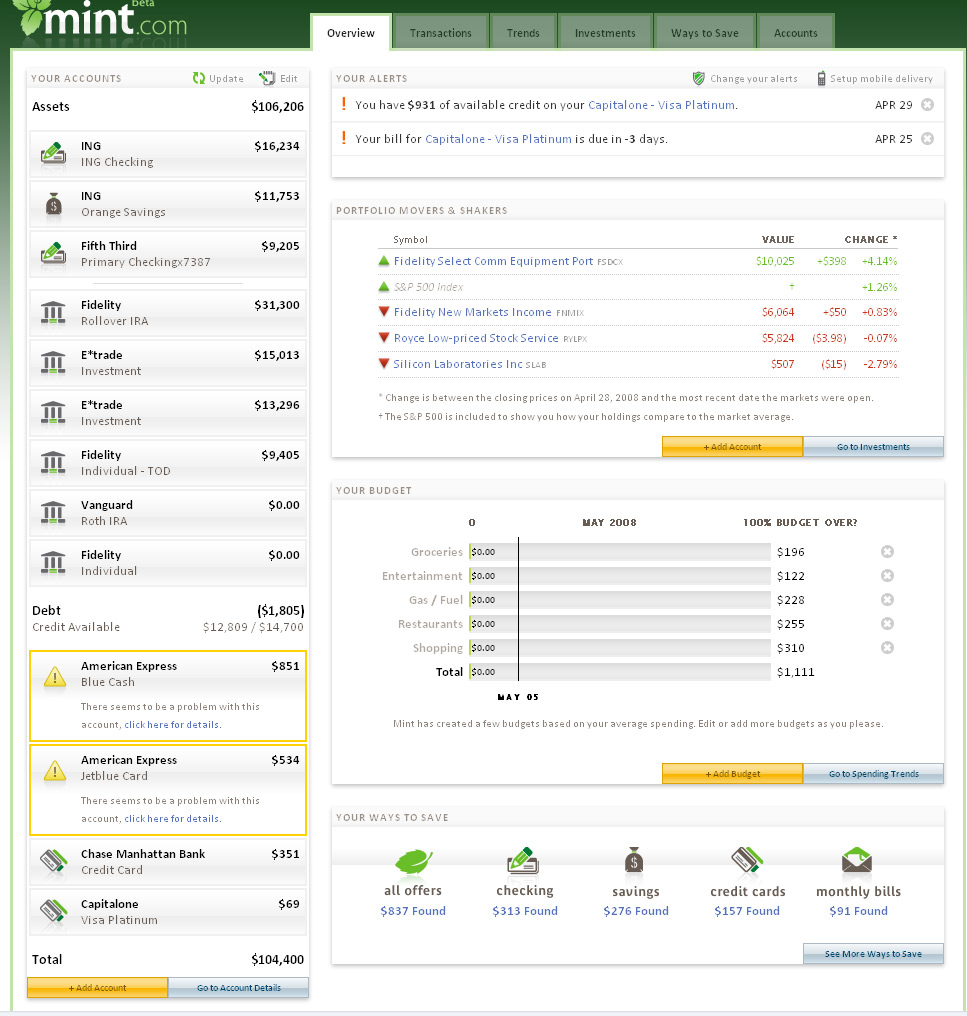

Mint.com's Plans For Portfolio Recommendations

I asked Mint.com whether they would be adding some features to their new investment tracking tool similar to what they do with credit cards and banks. When you add your credit cards and banks to Mint, it has a section where they recommend different credit cards to switch to and show you how much savings or lower APR you can get. In response, CEO Aaron Patzer said that in the future they will identify the lowest cost brokerage for you based on how often you trade and with how much money, as well as, and, this is very important, exposing management fees and expense ratios.Very cool. Investors could really benefit by such transparent access to investing-rleated feesFor a good perspective on how fees can really chew up your nest egg, read our post, “How Your 401(k) Is Ripping You Off“

Consumer Bankruptcies Up Nearly 50% From A Year Ago

The number of people filing for bankruptcy continues to increase, as bad mortgages and the rising price of [insert noun here] squeezes every last penny out of debt-laden consumers. The American Bankruptcy Institute says the number of filings was up 47.7% in April from a year ago, and up 7.1% from March ’08.

Review Of Mint.com's New Investment-Tracking Features

I got to check out personal finance management site Mint.com’s new investment-tracking component before the private beta launches tomorrow. You can now add Brokerage, IRA, 401k and 529 assets. The two biggest things it offers are line graphs, and a way to see all the fees, dividends, deposits and withdrawals in one, clear, organized window. Unlike with the credit card tracking, they don’t seem to be making any suggestions about how you might save money by switching to a different investment firm. You also can’t yet push assets between accounts through Mint. As before, you will have to give up your username and password to your various financial services to let Mint scrape the data. The new brokerage features are hardly mind-blowing, but by having investment-tracking now Mint can basically be your entire financial dashboard, you just can’t touch all the levers yet. Sexy screenshots, inside…

12 Ways To Save Money Without Scrimping

Some economists think we’re starting to pull out of our not-recession. For those of us who believe them and want to save without putting too firm a dent in our wallets, consider these twelve tips endorsed by the Wall Street Journal.

../../../..//2008/05/02/personal-finance-management-site-mintcom/

Personal finance management site Mint.com is launching a beta for its new investment tracking system on May 6th. [Mint]

Government Cracking Down On Anti-Consumer Credit Card Practices

In a surprising departure from the norm, the government is actually cracking down on some of the more egregious credit card practices. Usually they say that including more tiny print is sufficient enough consumer protection. Some things they’re addressing: creating a mandatory minimum payment period, forbidding double-cycle billing, and prohibited APR from being raised on an outstanding balance. The proposals are simply that, proposals, at this point, with finalization expected by year’s end, and we’ll see what happens after all the exceptions and industry lobbying groups get factored in the equation. The specific anti-consumer credit card practices getting attacked, inside…

../../../..//2008/05/01/people-are-not-willing-to/

“People are not willing to modify their lifestyle in order to live on what they earn – that is the real problem.” Larry Winget, author of “You’re Broke Because You Want To Be” on the root cause of the current economic crisis. [AllFinancialMatters]