What do those little letters, CD, ER, SR, etc, after a brand name drug’s name mean? The exact terminology varies, but they usually translate to the same thing: unnecessary ripoffs.

personal finance

TJX Credit Card Theft Crew Busted

The world’s greatest bank thief is in custody. For ripping off over 45.7 million consumer’s credit cards from TJ Maxx, and other retailers, authorities pressed charges on Miami mastermind Albert Gonzalez and 11 others. The stolen numbers were sold to other scammers who manufactured fake debit cards and drained their victims’ accounts. The breach stemmed mainly from TJ Maxx stores using an unsecured wireless router.

WaMu Online Banking Treats You Like A Criminal

With all the focus on the girl rocketing across the desert in a supersonic purple dildo, Washington Mutual forgot to mention one thing. When you sign up for a new account with them online instead of in person, be prepared to be treated like a criminal at every turn. Here’s Brett’s story of why he and his partner don’t bank with WaMu, and never will again…

Extreme Makeover Home Edition Leaves Homeowners In Perdition

Some of the winners of ABC’s Extreme Makeover Home Edition (EMHE) got a boobie prize. The Free Money Finance blog has found a few examples of EMHE recipients now in foreclosure, because after the workmen, camera crews, and glitz left, they were left with more house than they can afford. In one case, the town is hosting dinner raffles to help keep the family afloat. Here’s an extreme makeover for you: how about giving the people a house that fits their budget? I guess that doesn’t sell as many Twinkies.

14 Ways To Save On Drugs Big Pharma Doesn't Want You To Know

It’s no secret that prescription drugs are expensive, but it is a bit of one that they don’t have to be. Dr. Edward Jardini’s book, How To Save On Prescription Drugs, has 20 methods that anyone can use to drastically cut the costs of long-term medications, without sacrificing quality. Here’s 14 of them:

99-Cent ATMs At NYC McDonald's

Tip for the savvy traveler visiting New York: all the McDonald’s in New York have ATMs with only 99-cent fees. However you will probably have to put up with a freelance “doorman” bumming for change on your way out.

Get 75% Off Your ATT ETF By Switching To Pay-As-You-Go

If arguing for completely getting out of your AT&T early-termination-fee isn’t your thing, you can try doing what Felix did and get 75% off it.

Are You Ready For Death? Financially Speaking.

According to Bankrate, 57% of Americans do not have a will, leaving their personal finance, guardianship of children, and many other end-of-life decisions in the hands of strangers (state judges.) The lynchpin of a solid estate plan is having a will, but Vanguard suggests you also need the following assembled to leave your loved ones in good shape following your death:

Personal Finance Roundup

5 Mortgage Fees to Watch Out For [Smart Money] “Here are five fees to watch out for and how to avoid paying them.”

If My Bank Collapses, How Long Before The FDIC Pays Up?

If your FDIC-insured bank implodes, how long does it take for the FDIC to start paying depositors? Ever since IndyMac imploded, the question has no doubt been on many people’s minds. One reader emailed me saying that he had asked the his banker about how long it might take. Allegedly, the banker squirmed around before finally saying that the FDIC had 20 years to pay people back. This is not true.

HSBC Extends 3.5% APY Online Savings To Sept 15

HSBC sent around a big cheery email to let everyone know that they’ve extended the promotional 3.5% rate on their online savings account until September 15th.

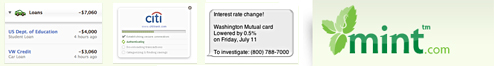

Mint Adds Loans, Mortgages, CC APR Changes

Popular personal-finance management site has added some cool new features. You can now add your student and auto loans, monitoring balances and getting reminders when it’s payment time. Over 1000 lenders were added. Mortgages are now supported, letting you set auto-reminders for when payments are due. The site also now tracks your credit card interest rate, sounding the klaxons when your rate goes up. This gives you a chance to negotiate a better rate (here’s a sample script) or port your balance to a lower-rate card (here’s how). More banks and other features have been added, with investment and home value support on the way, bringing it closer to the promise of being your free one-stop total web-based personal finance dashboard.

2008 Consumer Action Credit Card Survey Declares Credit Cards 'Really !@$% Evil!'

Credit cards are so much worse than you thought, according to the 2008 Consumer Action credit card survey. Creditors have carte blanche to do pretty much whatever they want, including randomly changing terms, conditions, and rates, even to cardholders with perfect payment histories and pristine credit scores.

So What's Replacing Boarded-Up Payday Lenders? Credit Unions!

Consumers in Washington D.C. have apparently flocked to credit unions since the district outlawed payday lending last year. Payday lenders whined that lending without 300% APRs was utterly unaffordable, but credit unions are proving that it’s possible to make long-term, low-dollar loans with interest rates as low as 16%.

Ben Popken On "To The Point" (And A Debate Over Personal Finance Advice)

Here’s the clip of the To The Point radio program I was on yesterday. There was a bunch of people on, you can hear me at 23:30 talking about the Grocery Shrink Ray and 37:30 talking about the customer service hotline Sprint set up for Consumerist readers. It’s a great show and I love Warren Onley’s voice, but I have some issues with the advice some of the other guests gave on the show that I need to address. Here’s what I would have said had I been asked some of their questions…