10 ways to cut your medical bills [MSN Money] “The best time to ask about fees and negotiate prices is before you get treatment. That can be a remedy for any unpleasant surprises when payment comes due.”

personal finance

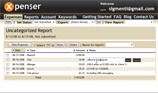

Track Expenses Easily With Xpenser

Looking for a “fire and forget” way to track your expenses and receipts? Check out Xpenser. You can submit data from any device or even phone them in, and Xpenser takes care of putting it all together. Plus it’s free. [Xpenser]

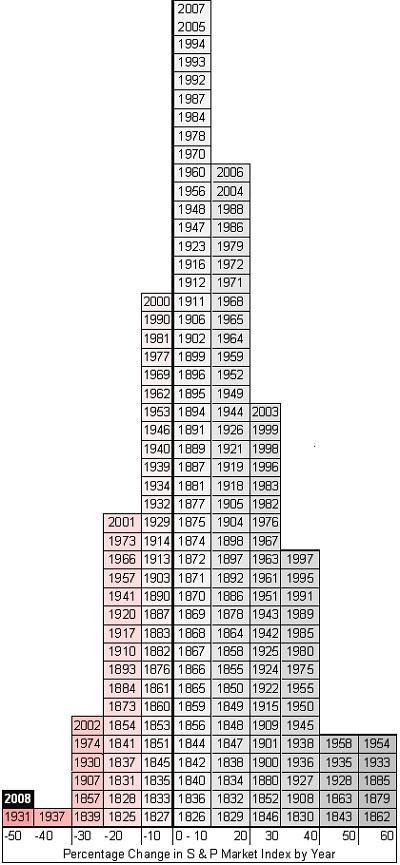

Sexy Graph Demonstrates S&P's Historic Dismalness This Year

Here is a sexy graph breaking down the S&P’s performance from 1825 to present, fitting each year into a column based on that year’s annual returns, from -50% to +60%.

When Your Landlord Won't Refund Your Security Deposit

What do you do if you were a perfectly fine renter, left the place in great shape, but your landlord won’t refund your security deposit?

This Year's Best Stocking Stuffer: Stocks

If you have some extra cash right now, there’s a big sale going on right now you should know about. It’s called the stock market.

What Do I Need To Know Before I Refi?

I am going to meet with him after work today, but was wondering, what sort of things do I need to look out for, and know, going into this? This is my first mortgage ever (I’m 21) and don’t know too much about what’s normal and what’s not. If you could give me any hints or suggestions, that’d be awesome! Thanks so much, and have a great day!

What's The Point Of Credit Repair Companies? (Not Much)

If you have bad credit and have been thinking about working with a credit repair firm, think again. Credit repair services aren’t doing anything that you can’t otherwise do for yourself. They review your credit history, lodge disputes, follow up, rinse and repeat. The appeal of a credit repair service is that they spend all that time resolving issues so that you don’t have to. They can’t take legitimately negative things off your record and they can’t work magic. Any firm that promises or guarantees to improve your score isn’t telling you the whole truth and you should watch out.

Check Your Credit History Year-Round, For Free

Statistics show that 80% of credit histories have at least one error. Most of them are minor and inconsequential but some can have an adverse effect on your credit score, often costing your thousands on mortgages and car loans. I believe credit bureaus were so lackadaisical about accuracy because it forced consumers to buy their credit reporting services. You wouldn’t know there’s an error unless you paid Equifax for a copy of your report. Fortunately, federal law now makes it possible for us to police our own records and force bureaus to correct them, all on their dime. Here’s how:

How To Get Your First Credit Card

I got my first credit card from one of those guys on campus with a folding table and free tshirts. Back then, they gave give credit to anyone who could fog a mirror. No income? No assets? No clue? No problem! The tshirt wasn’t even cool, it was for AT&T, and I got it as easily as my first beer. Nowadays, what the meltdown of our financial system and all, they actually have some requirements to pass before giving you a credit card. Crazy. So what’s a young consumer looking for fresh plastic to do?

On Heels of Bailout, Citi Raises Rates on Millions of Cardholders

We know the credit markets remain seized: late on Black Friday when no one was listening, the Federal Reserve issued a statement that its emergency lending to banks had increased over the prior week. Thus, massive amounts of money continue to flow to large financial institutions in an effort to stimulate economic activity, but by all appearances the money is not flowing into the broader economy. Quite the contrary; as the Fed lowers rates and adds record amounts of loaned cash to bank balance sheets, big banks are actually increasing consumers’ cost of borrowing and reducing their lines of credit. Witness Citibank’s recent adverse actions against cardholders.

Personal Finance Roundup

Simple (and complex) investment strategies [Bankrate] “What’s the best way to invest? The jury is still out on the best strategy, but here we present several approaches used by professionals.”

FDIC Criticizes Banks' Overdraft Fees

It took 18 months for the FDIC to figure out that banks’ practice of clearing checks largest to smallest makes banks a lot of money.

What You Should Tip

Ever wonder what the “right” tip was to give a service provider? Well, wonder no longer as Yahoo Hotjobs offers the following tip suggestions for a variety of workers:

End Of Month Is Best Time For Gadget Haggling

A salesman at a major electronics retailer told FreeMoneyFinance a bevy of tips you can use to bargain down the prices in-store on big-ticket items, like:

Personal Finance Roundup

11 ways to strike gold on Black Friday [Consumer Reports] “We’ve compiled the following savvy-shopper’s guide.”

ReFi Time: Mortgage Rates Drop On New $800 Billion Intervention

If you’re looking to refinance a home and have cash and good credit, now is a good time to pull the trigger. Yesterday the government announced the latest Federal golden bandaid: a pledge to inject $800 billion directly into the credit markets, news which pushed national average mortgage rates for a 30 year fixed to 5.81%, down from 6.07%, according to bankrate. Bankrate also suggest that if you’re trying to refi to act quickly, before rates rise or home values drop.