Last week, the Consumer Financial Protection Bureau took a big step toward reining in irresponsible, predatory lenders by taking its first enforcement action against a large payday loan operation accused of robo-signing court documents related to debt-collection lawsuits, illegally overcharging military servicemembers and their families, and trying to cover these actions up by destroying documents before the CFPB could investigate. [More]

payday loans

Payday Lender To Pay $19 Million For Robo-Signed Collections & Overcharged Servicemembers

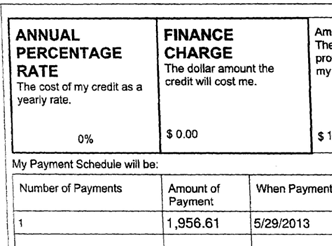

FDIC & OCC Ask Banks To Please Stop Issuing Payday Loans As “Direct Deposit Advances”

While many payday lending operations are not directly tied to federally insured banks, some of the biggest names in banking — most notably Wells Fargo — offer what are effectively payday loans via “Direct Deposit Advance Loans.” But today the FDIC and the Office of the Comptroller of the Currency have given some guidance to the banks they regulate, basically saying “That’s enough of that, don’t ya think?” [More]

Where Did All Those Internet Payday Loan Ads Go?

High-interest short-term loans are illegal in many states, but for a brief moment, lenders sought customers in these states anyway. In ads online and on TV, you may have noticed them: commercials that played up the companies’ Native American ownership, which made them totally legal in states where payday loans are normally illegal. “Nice try,” said state regulators. [More]

What’s Worse Than A Payday Loan? A Payday Loan Scammer

Short-term, high-interest payday loans are illegal in several states, but that doesn’t stop consumers from trying to get their hands on quick cash. So when they see a website offering to hook them up with a payday lender and get them up to $1,000 in about an hour, it may seem like a good deal. That is, until that loan never shows up and the borrower has even less money in her bank account. [More]

Auto-Title Lender Skirts Law By Giving Away Cash For Free

Several cities in Texas have recently enacted laws intended to drive out or rein in short-term, high-interest lenders offering auto-title loans, in which borrowers put up their cars as collateral for short-term loans averaging around $1,500. But one lender has figured out a way to get around those laws — by giving away free cash and redirecting customers elsewhere when they need to refinance. [More]

Online Payday Lender Western Sky To Stop Funding Loans Sept. 3

If you’ve watched daytime TV in recent years, you’ve more than likely seen ads for Western Sky Financial a payday lender operating out of a tribal reservation in South Dakota. Facing lawsuits from around the country and increased scrutiny from regulators over triple-digit interest rates for its short-term loans, the company has announced it will stop funding new loans on Sept. 3. [More]

How Payday Lenders Fought To Stay Legal In Missouri

The state of Missouri has about one payday or car-title lender for every 4,100 residents. The interest rate on short-term loans has an average APR of 455% statewide, when the national average is a still-horrific 391%. When a coalition of churches, unions, and community groups tried to cut the maximum interest rate to 36%, the effort failed miserably. Here’s why. [More]

Report: Some Credit Unions Are Still Involved In Payday Lending

Loans from federal credit unions are currently capped at 18%, though some qualifying short-term loans can go as high as 28% (plus a $20 fee). These numbers are far below the standard three-digit APRs you see on payday loans, but a small number of credit unions are still figuring out ways to hook customers up with these questionable, high-interest loans. [More]

How Predatory Lenders Get Around The Law To Loan Money To Military Personnel

In spite of the Military Lending Act, a law intended to prevent predatory lenders from gouging military personnel with exorbitant interest rates and mountains of fees, some of these lenders have figured out ways to work around the very specific limits of the law, targeting active-duty service members with loans that are almost indistinguishable from the ones forbidden by the Act. [More]

Installment Loan Borrowers Being Saddled With Unnecessary Insurance Add-Ons

Installment loans are typically, shorter-term, high-interest, loans to borrowers with severely damaged credit. These loans usually have longer terms than the 2-3 week turnaround for payday loans, and the borrower agrees to pay the money back in equal, monthly installments, but some of those who have worked at installment lenders say these loans are laden with charges aimed at getting around interest-rate rules and keeping the borrower in a cycle of indebtedness. [More]

Report Claims Payday Loans Result In Net Loss Of Money, Jobs

Among the reasons given in support of payday loans — short-term, high-interest loans intended to get the borrower through to the next paycheck — is that they ultimately provide a net good to the economy, allowing the borrower to keep spending and earning interest for the lender. But a recent report casts some doubt on that belief. [More]

State Lawmakers Consider Limits On ‘Payday’ Lawsuit Loans

We’ve written a lot over the years about standard payday loans — short-term, high-interest loans from non-bank lenders — and similar deposit-advance loans offered by some of the nation’s largest banks. But there is a growing form of short-term loan that lawmakers are concerned about — loans to plaintiffs of pending lawsuits. [More]

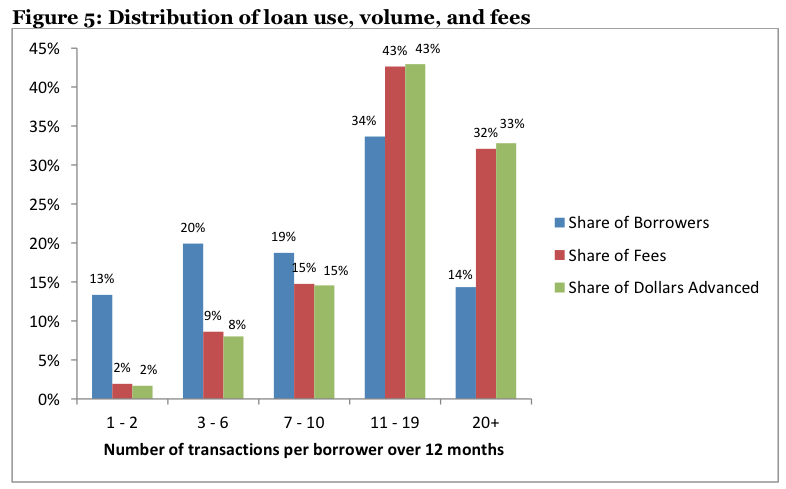

The Average Payday Loan Borrower Spends More Than Half The Year In Debt To Lender

The idea of the payday loan — a short-term, high-interest loan intended to help the borrower stay afloat until his next paycheck — is not inherently a bad notion. However, a new study confirms what we’ve been saying for years: That many payday borrowers are taking out loans they can’t pay back in the short-term, and that lenders rely on this revolving door format to keep the fees rolling in. [More]

Report: Average $951 Car-Title Loan Results In $2,142 In Interest

If you live in any of the 21 states where car-title loans are available, you’ve probably seen the TV commercials touting the ease of this short-term borrowing option. But a new report claims that the average car-title loan results in revolving door of debt and a mountain of interest payments. [More]

Professor Tries, Fails To Defend Payday Lending As Legitimate Form Of Credit

Most regular readers of Consumerist know that we’re not exactly fans of payday loans, which charge upwards of 25 times the interest of a high-interest credit card and hundreds of times the interest on a standard loan. And yet, there are people — well-educated people at that — who stick with the argument that payday loans are a good thing. [More]

Senators Call For An End To Payday Lending By Banks

Four of the nation’s largest banks — Wells Fargo, Fifth Third Bank, U.S. Bank and Regions Bank — are involved in high-interest, short-term loans that may not always be called “payday” loans but might as well be. Thus, a group of five U.S. senators have asked regulators to put a stop to the practice altogether. [More]

Wells Fargo Called Out For Continuing To Offer Payday Loans

The Community Reinvestment Act of 1977 requires that FDIC-insured banks be examined and rated on whether or not they are meeting the banking needs in each of the communities in which they are chartered. But a pair of advocacy groups claim Wells Fargo deserves a lowered CRA rating because of loans that smell a lot like payday loans. [More]