Yahoo, one of the few remaining old guard Internet biggies still standing, has been trying to reinvigorate its business in the last few years, even spending oodles of cash in an effort to stake claims in the streaming video and daily fantasy sports markets. But so far, consumers have responded with a shrug and the company’s stock price has continued to fall since the beginning of 2015. That’s why the Yahoo board will reportedly be looking into the possibility of getting out of this whole “Internet” thing. [More]

murders and executions

Pfizer To Buy Allergan For $160B, Create World’s Largest Drug Company

If the giant pharmaceutical companies of the world seem quite big enough to you already, well, that just means you probably aren’t a major investor in or CEO of one. But the major investors and CEOs do think bigger is better, and so to that end two of them are merging to create an even bigger drug behemoth and take it overseas. [More]

Kroger Buys Midwest Grocer Roundy’s For $800M

The merger bug has been hitting the supermarket aisle for several years now, and it continued Wednesday as Kroger announced it would buy midwest grocery chain Roundy’s – the owner of Pick ‘n Save – for a cool $800 million. [More]

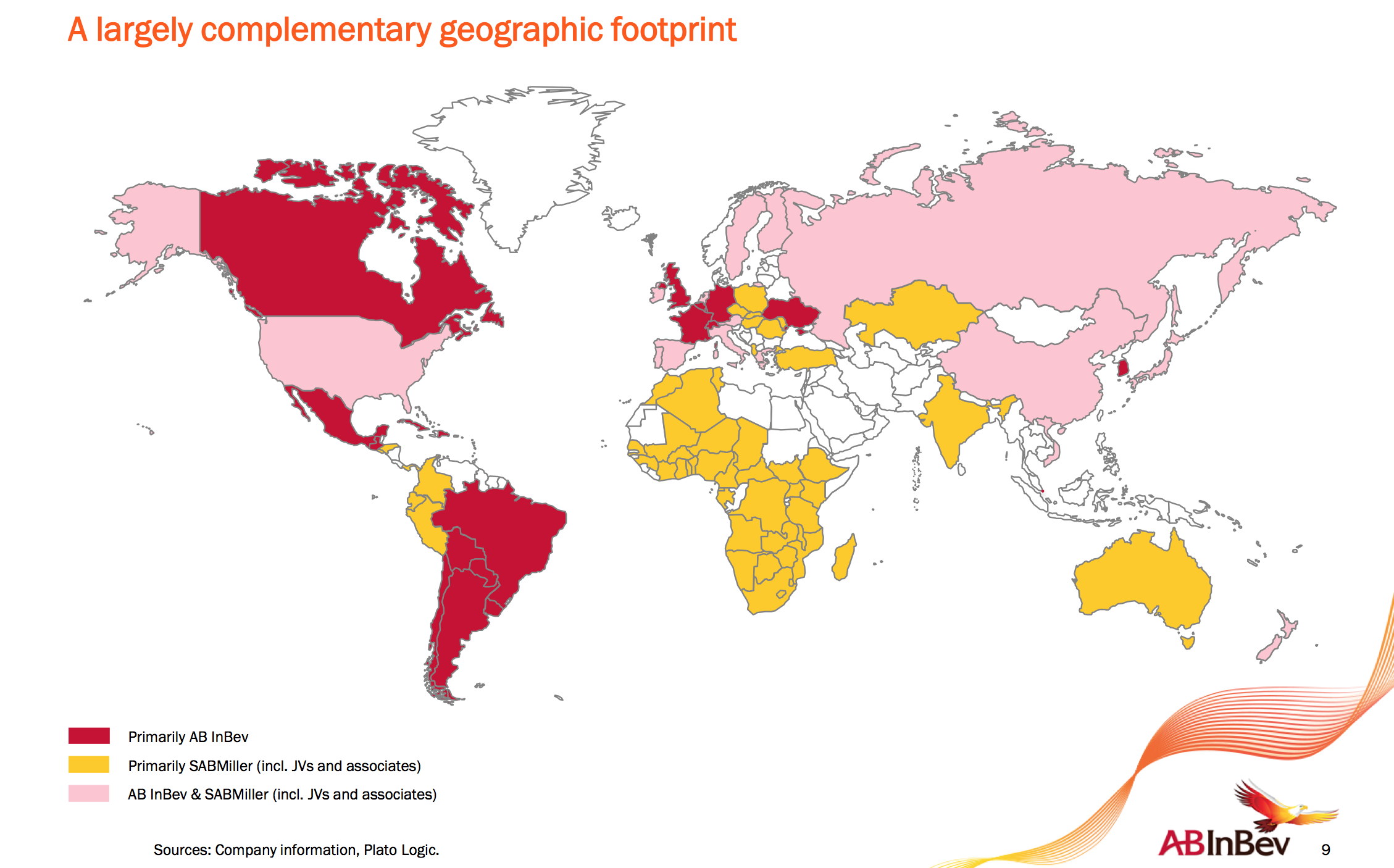

Anheuser-Busch InBev, SABMiller Finalize Merger, Agree To Sell MillersCoors Brand To Molson For $12B

After receiving more time to finalize its offer to acquire SABMiller, Anheuser-Busch InBev made a formal $107 billion bid for the company on Wednesday. The deal includes a record $75 billion loan and confirms the anticipated divestiture of SABMiller’s stake in its largest brand: MillerCoors. [More]

Anheuser-Busch InBev Gets More Time To Finalize Mega Beer Merger Offer

Anheuser-Busch InBev — the Belgian-Brazilian maker of “America’s beer” — was supposed to finalize its offer to acquire SABMiller by Oct. 14. That deadline was extended until this afternoon, but just like that really wealthy international student at college who never seemed to get his work done on time, AB InBev has been granted another extension. [More]

Budweiser & Miller Inch Closer To Altar With Agreement On $104.2B Deal

Last week, leadership at beer giant SABMiller was not thrilled with Anheuser-Busch InBev’s official marriage proposal, saying it “substantially” undervalued the company. But today Miller announced that the boards of both companies had reached an agreement on principle for a merger valued at $104.2 billion. [More]

Broadcasters Ask FCC To Halt Merger Of Time Warner Cable & Charter

While Time Warner Cable’s current merger à trois with Charter and Bright House is getting significantly less attention than TWC’s recent failed fling with Comcast, but these nuptials aren’t without their detractors. [More]

Budweiser Maker Officially Offers $104 Billion To Buy Miller

After SABMiller rejected a $100 billion takeover offer from Anheuser-Busch InBev, the world’s biggest beer company has come forward with a sweeter offer of $104 billion. [More]

Miller Reportedly Turns Down $100B Takeover Offer From Anheuser-Busch

With the deadline of Oct. 14 looming for Anheuser-Busch InBev to make a firm offer to acquire fellow beer biggie SABMiller, a new report says that the company’s early informal suggestion of “Hey, what do you guys think of $100 billion?” was turned away for being too low. [More]

Cablevision Agrees To Sell Itself For $18 Billion To European Telecom Giant Altice

While most U.S. cable/Internet operators have been looking at their fellow Americans as merger partners, New York-based Cablevision has made a $17.7 billion deal to sell itself to Altice, a Netherlands-based telecom titan. [More]

Anheuser-Busch InBev Asks Miller To Consider Taking Its Hand In Merger Marriage

It’s a mega-merger that’s been hinted at for years, but today it moved out of the realm of “people close to the situation” and into an an actual confirmation from Anheuser-Busch InBev that it has talked to the folks at SABMiller about combining the two beer giants into an even larger beer titan. [More]

Comcast CFO Says Failure Of Time Warner Cable Merger Is “Blessing In Disguise”

Comcast spent a year and a half, and untold millions, pushing for regulators to approve its $45 billion acquisition of Time Warner Cable. And then, when regulators said they would try to block the deal, the mega-merger evaporated. You might expect Comcast executives would still be stewing about their failed attempt to take over most of the cable and broadband service for both New York and Los Angeles, but at least one C-level suit at the company is trying to put it behind him. [More]

Hotel Industry Comes Out Against Merger Of Expedia & Orbitz

You might think of Expedia, Hotels.com, Hotwire, Travelocity, and Trivago as competitors in the online travel-booking business, but most people probably don’t know that all of these brands fall under the Expedia Inc. ownership umbrella. And so will Orbitz if the pending $1.6 billion merger of the two companies is approved. The leading hotel industry trade group says that this consolidation has gone too far. [More]

Comcast Reportedly Looking To Buy Vice Media, Or Maybe BuzzFeed, Or Maybe Vox…

Now that Comcast is done crying itself to sleep every night about its forced breakup with merger partner Time Warner Cable, the company is getting back to doing what it does best: No, not providing adequate cable/Internet service (don’t be silly!), but acquiring other businesses. [More]

The Death Star Finally Getting Its Satellite: FCC Moves To Approve AT&T, DirecTV Merger

The $49 billion merger of AT&T and DirecTV began so long ago, there aren’t many of alive who can tell the origin story of this long-delayed marriage. Today, it looks federal regulators are willing to give their blessing to the union. [More]

Smaller Cable Companies Concerned About AT&T/DirecTV Merger’s Impact On Prices For Regional Sports Networks

As we’ve seen with the ongoing locals sports broadcasting messes in Houston, Los Angeles, and Philadelphia, pay-TV operators with exclusive regional and team-specific networks sometimes put too high a price on their content, meaning other providers can’t afford to carry these stations and large swaths of fans are left in the dark. And a trade group representing small and midsize cable operators are worried that this problem may only get worse without certain conditions being put on the pending $49 billion merger of AT&T and DirecTV. [More]

Verizon Not Interested In Buying Dish

With everyone else in the cable/Internet/wireless business gone merger-mad, the only thing that telecom titan Verizon has purchased recently is AOL for a few billion bucks. The company has long been suggested as a prime buyer for satellite TV service Dish, but a top Verizon executive says that’s just not happening. [More]

CVS Buying Target’s Pharmacy Business For $1.9 Billion

If you’re a Target shopper who picks up your prescription refills at the same time you get your groceries, towels, toilet paper, and whatever else you buy at the big-box retailer, your Target’s in-store pharmacy could soon be run by CVS. [More]