The failed marriage of Office Depot and Staples has claimed another CEO. Nearly three months after Staples chief Ron Sargent made his sad exit, the Depot’s top exec Roland Smith announced his departure. [More]

murders and executions

China Okays Merger Of Former U.S. Beer Giants

The final country that needed to weigh in on the mega-merger of beer giants SABMiller and Anheuser-Busch InBev has given its blessing to the sudsy nuptials. This morning, Chinese regulators approved the deal, effectively clearing the road for the acquisition to move forward. [More]

Verizon Will Spend $4.8 Billion To Acquire Yahoo

Yahoo — home to all those email addresses you use for subscriptions you’d rather not have anyone else know about, and the Flickr account you probably haven’t updated since 2010 — will soon be under the same umbrella as former web 1.0 rival AOL, with Verizon agreeing to acquire the ancient online operation for $4.8 billion. [More]

Anheuser-Busch/SABMiller Mega-Merger Gets Justice Dept. OK, After Miller Agrees To Sell All U.S. Brands

The $107 billion (with a b) merger of beer titans Anheuser-Busch InBev and SABMiller has cleared a major hurdle today, with the U.S. Justice Department signing off on the merger — under the condition that Miller divest itself of all its remaining U.S.-based businesses. [More]

Why Danone Paid $10.4 Billion For Almond & Organic Milk Company

French food giant Danone already takes up plenty of supermarket dairy shelf space, with everyday brands like Dannon, Activia, and Oikos. So why is the company spending $10.4 billion to purchase WhiteWave, the American company behind organic brands like Silk almond milk, Horizon, and Earthbound?

[More]

Alaska Airlines Might Not Drop Virgin America Name After Merger

Two months after Alaska Airlines put $4 billion on the table and bought up Virgin America, the soon-to-be fifth largest airline operating in the U.S. is spilling the beans — kind of — about its future, and that might include keeping the recently purchased carrier’s name. [More]

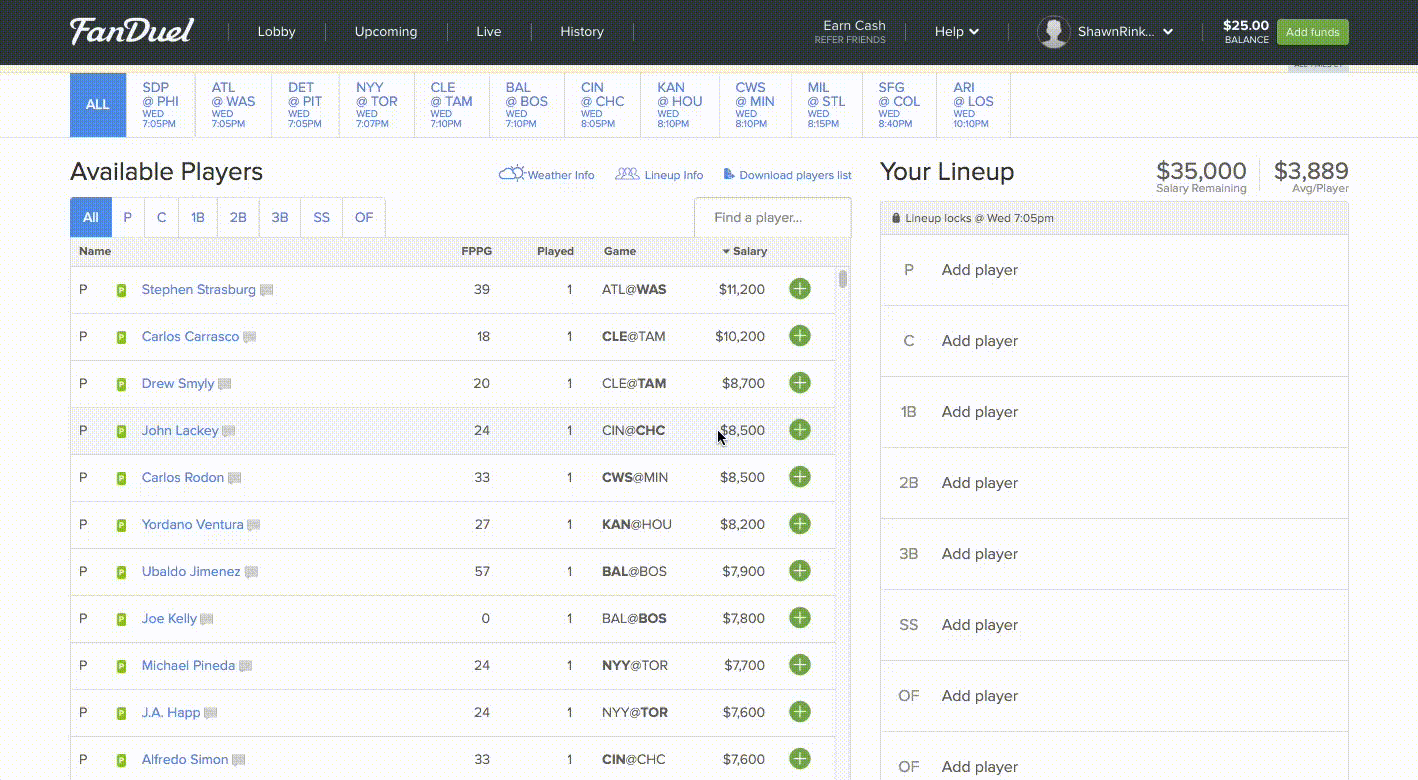

FanDuel: Report Of DraftKings Merger Is “Speculation”

The two biggest names in the world of daily fantasy sports (DFS) are keeping mum about a report claiming the two companies are considering a merger. [More]

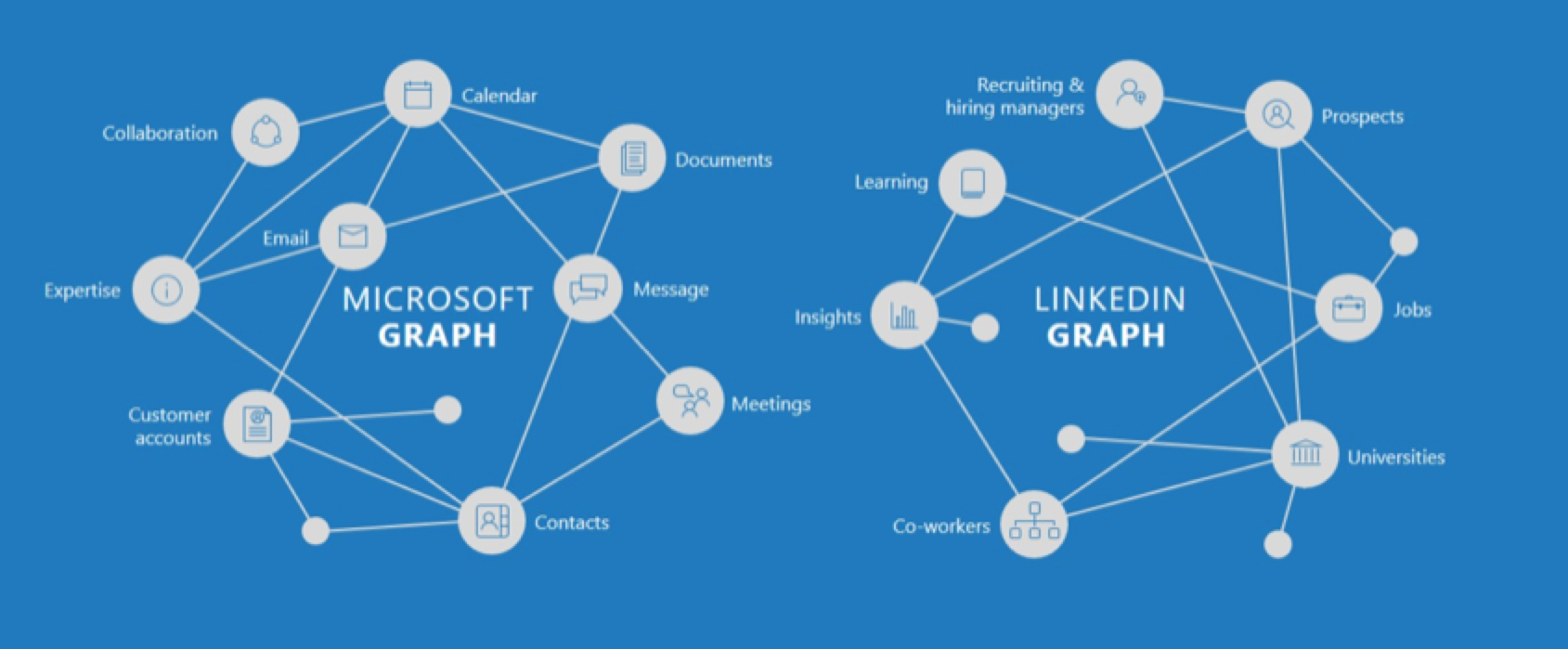

Why Is Microsoft Spending $26 Billion To Acquire LinkedIn?

Microsoft will soon have your resume on file — or at least the resume of a few hundred million LinkedIn members. The two companies announced a deal this morning that would see Microsoft pay $26.2 billion to acquire the job-networking site. [More]

Monsanto Says $62 Billion Bayer Merger Offer Is “Financially Inadequate”

A day after aspirin king Bayer officially offered $62 billion to acquire Missouri seed and pesticide giant Monsanto, the deal already appears troubled, with Monsanto’s board of directors saying the offer isn’t sufficient. [More]

Bayer Officially Offers $62B For Monsanto

Bayer officially wants to expand its CropSciences business and become the world’s largest producer of seeds, pesticides and agricultural chemicals, bidding $62 billion for Monsanto. [More]

Fitbit Looks To Turn Its Fitness Trackers Into Wearable Digital Wallets

When most of us think of wearable fitness trackers, Fitbit is probably the brand that comes to mind, but the growing popularity of multitasking smartwatches from Apple, Samsung and others means Fitbit is eventually going to need to offer more than just health data. So it comes as little surprise that the company is looking toward the future by acquiring mobile payment technology. [More]

Bayer Reportedly Looking To Acquire Monsanto For $40 Billion

When you hear the name Bayer, you probably think of aspirin or other drugs, but the German company has a number of facets, including its sizable CropScience division that produces seeds, pesticides, and other agricultural products. Now comes news that Bayer may be looking to become the world’s largest player in this field (forgive the pun) with a possible acquisition of Monsanto. [More]

FCC Officially Gives Green Light To Merger Of Time Warner Cable & Charter

A couple weeks back, both the FCC and the Justice Department made it clear that they were not going to challenge the massive merger of Time Warner Cable, Charter Communications (and the third wheel of the merger á trois Bright House) after putting some conditions on the deal. Today, the FCC officially confirmed that it has given its blessing to this marriage of inconvenience. [More]

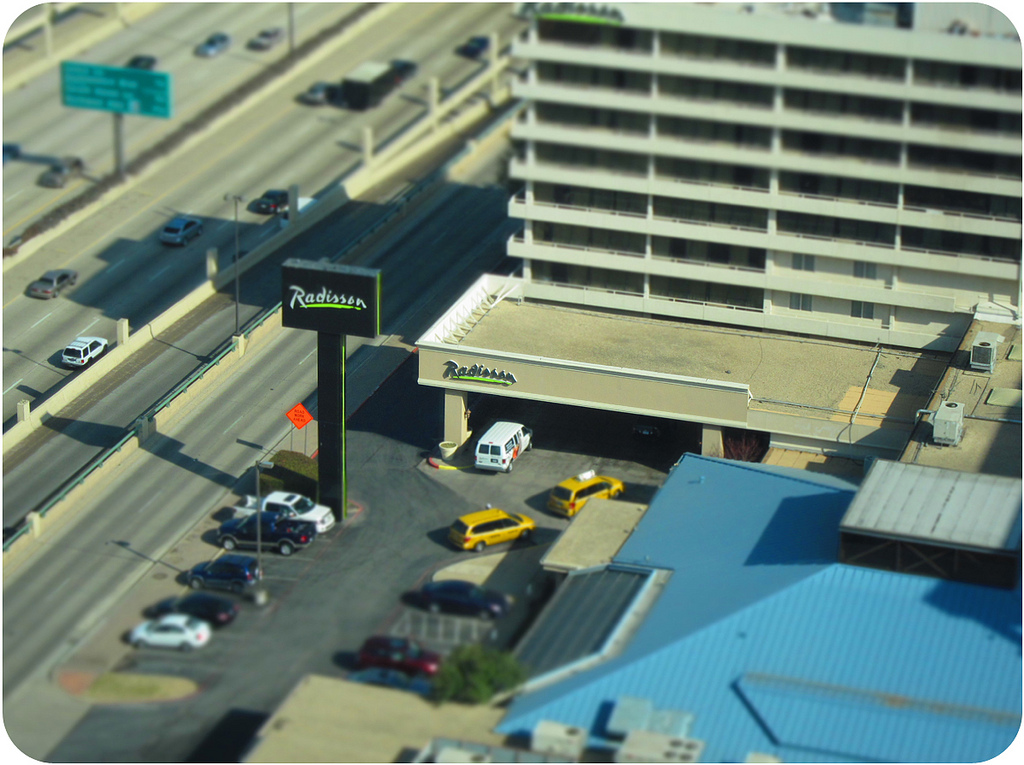

Owner Of Radisson Hotel Chain Purchased By Chinese Conglomerate

Just weeks after China’a Anbang Insurance Group bowed out of its bid for the Starwood Hotel brand, another Chinese hotel group has gobbled up a different group: Carlson Hotels, the operator of the Radisson chain. [More]

Comcast Reportedly Looking To Buy DreamWorks Animation For $3B

Comcast already owns a mammoth cable/broadband company, a major TV and cable TV network, amusement parks, and a movie/TV/video production and distribution company responsible for money machines like Jurassic World and the Despicable Me/Minions movies. But that’s not enough, apparently. The boys and girls from Kabletown are also looking to add DreamWorks Animation to their shelf. [More]

5 Things You Should Know About The Approved Merger Of Time Warner Cable & Charter

Earlier today — almost exactly a year after rejecting the merger of Time Warner Cable and Comcast — both the FCC and the Justice Department gave their blessing to the marriage of TWC and Charter. But what does that really mean for the millions of consumers who will be affected by the merger? [More]

Sherwin-Williams Buys Valspar For $11.3B, Will Really Cover The Earth

Simply walking past the paint aisle at your local home improvement store is enough to make many hearts race and palms go sweaty — what with all the choices. But those walls of swatches might belie the fact that many of those paint brands are owned by the same companies — and that industry could consolidate even further now that Sherwin-Williams has agreed to put itself in the mixing stand with Valspar for $11.3 billion. [More]