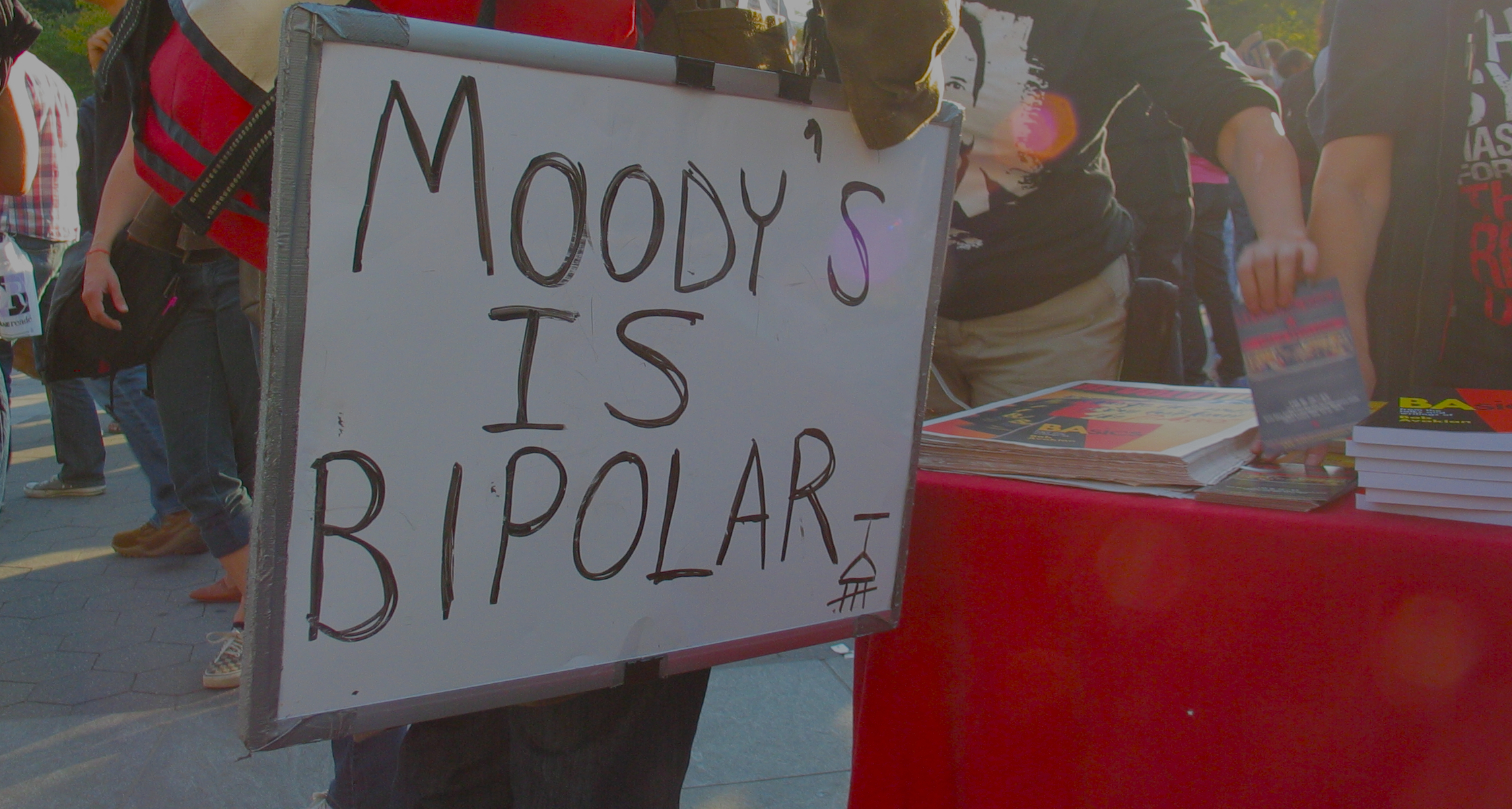

While much of the anger surrounding the mortgage meltdown was focused on shady mortgage lenders and investment banks, a less-discussed but nonetheless culpable party were the credit-rating agencies that rubber-stamped mortgage-backed securities that were sometimes worth about as much as a used lottery ticket. [More]

moody’s

SEC Warns S&P It May Sue Them

In an unprecedented move, the SEC warned S&P that it might be suing it over its rating of a mortgage-backed bond. It’s the first warning a credit rating firm has gotten over its behavior leading up to the financial crisis. [More]

Moody's: Feds Less Likely To Bail Out Bank Of America If Needed

Earlier today, the folks at Moody’s Investors Service cut Bank of America’s credit ratings after it came to the decision that, should the nation’s largest bank fail, it would be less likely to receive bailout support from the federal government. [More]

Americans Falling Behind On Credit Card Payments Again

As a country, we were doing pretty well paying down our credit card debt for most of 2009, but according to Moody’s Investor Services, the number of people who are behind on their payments rose slightly in November. [More]