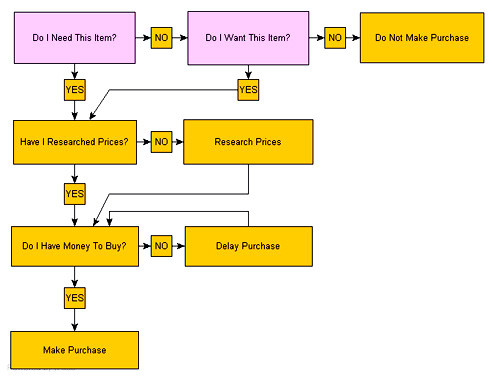

During one insomnia-filled night, the blogger behind No Credit Needed decided to make this flowchart to illustrate how they make their financial decisions. Pretty neat. I think there should be an extra step before the Make Purchase that says, “Am I Sure I Still Need And/Or Want This Item?” Large version inside.

money

Personal Finance Roundup

Beware these 5 insurance traps [MSN Money] “You might think your pets, your kids’ toys and your personal problems are your own darn business. But insurers watch these things — and they could cost you.”

Report From Finovate '08: Round 3

We spent yesterday at Finovate, a yearly roundup of new personal finance services available online. Here’s a recap of some of the afternoon presentations, including a mortgage comparison service that promises greater transparency, a new credit simulator feature from Credit Karma, and a site that uses reverse auctions to get banks to bid on your money.

Report From Finovate '08: Round 2

Round 2 of the Finovate presentations includes online financial planning, the “match.com” of stocks, and Facebook banking. Let’s dive in and find out what they’re all about:

Video: Credit Crisis As Antarctic Expedition

Antarctic explorers trudge across the icy wastelands, heavily laden with rucksacks, bound together with rope. This is a good metaphor for understanding the credit crisis, and Paddy Hirsch from American Public Media is going to lay it down on you. Oh no! There’s a crevasses. Yay! Here comes Henry Paulson to come save the banks in his helicopter. The money meltdown is definitely much more digestible, and fun, in stick-figure and whiteboard form. Full video inside.

Report From Finovate '08: The Latest Personal Finance Tools

I’ve been dispatched by our cigar-chomping editors to midtown NYC to check out the 14 new personal finance software apps getting demoed at Finovate 2008. I’ll be reporting here and letting you know about the latest tools from the frontlines of the personal finance revolution.

../../../..//2008/10/14/dow-ended-the-day-by/

Dow ended the day by shooting up 936.42 points, 11%, ending at 9387.61, it’s largest one-day point gain in history. [Newsday]

Europe vs USA: Who's Handling The Crisis Better?

The debate on the BBC news right now is who is cooler, America or Europe. Europe is getting props for acting speedily and decisively in contrast to Paulson’s pace, which is getting characterized as dawdling and indecisive. Some of the very policies Treasury derided, they’re now considering since Europe enacted them. The ex-Reagan economic adviser talking head says it’s nationalizing risk, a backdoor way of calling them socialists. However, it wasn’t until Europe’s “socialistic” actions did the markets rebound. Who is right? Only time will tell; we’ll see if the rally sustains or is just another fitful shiver in this economic fever dream. The key here is confidence, and it seems to be the most precious and rare commodity on the face of the earth right now.

Getting Married, What Do I Do With My Money For Now?

WooHoo! I got a job! Right out of college and everything. With an awesome sign-on bonus! Now what am I supposed to do with all this money? I know I have options. Stock Market (HA!), bank, and under my pillow. I would put it in the bank but I have a wedding coming up in less then a year to pay for and I want to know my options for making good quick investments. Please help!

What's The Best Personal Finance Software?

Slate tested a slew of personal-finance tools recently, and Mint and Quicken Online were the top two winners, with Mint only a point behind. Besides the advertising disguised as “ways to save,” one area where Mint lost points was not being able to create custom categories. Three days later, Mint announced that they were enabling custom categories. So, in a do-over, Mint would probably win. Plus it’s free. UPDATE: Quicken Online just launched a basic tier of service for free. The dance continues!

../../../..//2008/10/13/stock-markets-finally-rose-with/

Stock markets finally rose with investors heartened by coordinated global intervention into the financial crisis and amid signs that the credit freeze was beginning to thaw a bit. [WSJ]

Leading Hotels Still Kinda Committed To Selling 5-Star Rooms For $19.28 Per Night

The Leading Hotels of the World want you to know they are still committed to offering 6,000 five-star hotel rooms for $19.28. The contest, originally conceived as a way to honor the association’s 1928 formation, is proving ironically successful, fusing a modern giveaway with 1928 technology. That whole email do-over idea? Silly! Forget it even existed. The group has gone and hired themselves some internet sherpas to help run the contest, and here’s what they’ve come up with….

How Can We Save Our Debt-Swamped Government?

The United States is $10.2 trillion in debt. Like countless Americans, our government has spent beyond its means and needs help getting back on its feet. We recently received a panicked email from White House Budget Director Jim Nussle…

People Think Coupon Users Are Cheapskates, Unless You're Hot

If you use coupons in a store, your fellow shoppers are probably negatively judging you as being cheap, according to a new study. The stigma extends to those around the coupon redeemer as well. However, if you’re hot, you get a reprieve. The study had people watch consumers cash coupons, and then interviewed the participants afterward for their reaction. The stigma is lessened if you don’t know the person using the coupon, the coupon is of high value, if they’re in a different line, and if the coupon-user is a hottie. Researchers proposed that the reason for the coupon-hating is “the modern consumer tends to prize status and luxury over thrift.”

US Muses Backing All Deposits, No Deposit-Insurance Ceiling

In order to stem the tide of panic-stricken morons taking out all their cash from banks and further destabilizing the financial system, the US is considering a proposal to completely back ALL deposits. This would mean that there would be no deposit insurance ceiling. So even if you had more than $100,000 in the bank, even if you had $1,000,000 in the bank, the government would give you back ALL of that money if your bank failed. The proposal is only in discussions right now, and several different agencies would have to agree that there was “systemic risk” in order to enact it. Europe has already guaranteed all deposits, however, and in order to keep large corporate accounts from emigrating overseas, the US may be forced to follow suit within a few weeks.

What Are "Collateralized Debt Obligations?" Watch These Champagne Glasses.

There’s a lot of funky financial terms getting thrown as we try to explain how the money meltdown started in the first place, and one of the funkiest is a CDO or “collateralized debt obligation.” Luckily, Paddy Hirsch from Marketplace is here to explain it using just champagne glasses, a whiteboard, and a sexy British accent..

PHOTO: Wall Street Bull Had Blue Balls Today

The balls of the famous Wall Street bull got painted blue today. Before they were cleaned, a Gothamist reader snapped this pic. In terms of the creative comic output it’s sparked, this may be the funniest economic meltdown ever. [More]

How To Find Some Extra Cash

A few weeks ago, part of our advice on how to handle these tough financial times was to increase your emergency fund. Obviously this is something that most people would like to do — have more cash in their lives — but how exactly can this be accomplished? MSN has some suggestions on how to find some extra cash: