Obviously a lot of preparation goes into being an athlete, but let’s ignore all of that and focus on the gory numbers.

money

Where Saving Money and Ethics Collide

The Mighty Bargain Hunter blog presents us with a money-related ethical dilemma: what do (should) you do when someone has priced an item way too low? He shares several stories that illustrate how this quandary can occur, and the response alternatives primarily boil down to two options:

Move Over Museum Curators, Bank Of America Wants Your Job

Cash-strapped art museums across the country are turning to an unlikely source for new exhibitions: Banks. According to a story in the New York Times, Bank of America, Chase, and a number of other global entities have put together traveling art exhibits and are offering them to museums across the country.

Personal Finance Roundup

Understanding the Federal Budget [Get Rich Slowly] “We cannot have informed discussions about taxes and government spending if we don’t have the baseline information.”

Personal Finance Roundup

Household Cleaning Hacks that Save You Money [Wise Bread] “Here is an assortment of ways to get more bang for your cleaning buck and efforts.”

Minimizing the Cost of Raising Kids

The choice to have a child is usually not a financially-focused decision. And we’re not so crass to suggest that it should be a dominant factor. But the cost of raising a child properly should at least be one of the factors that couples consider before they take the plunge into parenthood. Why? Because raising kids is a very expensive undertaking.

ATM Skimmer Ring Hits Chicago Suburbs

Reader Kellie reports being the victim of an ATM skimming scam in the Chicago area. Mostly, she was amazed that the thefts weren’t reported in the local media, and she asked bank employees why. Here’s what they told her.

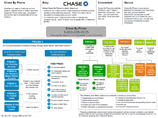

Chase Bank By Phone Telephone Tree Map

Should you ever get lost in the Chase bank-by-phone tree, this function map may help you. Or it may explode your brain all over the receiver. The choice is yours.

Should You Have a Mortgage in Retirement?

A growing personal finance debate centers around whether or not individuals should have a mortgage when they retire. A surprising number of retirees maintain a mortgage — 4 in 10 in 2007 — but is this good financial management?

48% Of Mortgages Underwater By 2011

48% of all mortgages could have negative equity, being a debt greater than the underlying house is worth, by 2011, says Deutsche Bank. Someone please tell Brooklyn. After a few weeks of checking out apartments in Gowanus, Park Slope and Red Hook, everyone’s asking prices are still like the good times are just around the corner. [FORTUNE] (Thanks to Michael!) (Photo: kevindooley)

Personal Finance Roundup

Be your own landscaper [CNN Money] “These dirt-cheap landscaping tricks will spruce up your yard now – and keep it looking good next year too.”

Do You Talk To Friends About Your Finances?

A recent Huffington Post article wondered if talking about personal finance was “the final taboo.” Talking about money can feel as revealing as a strip-tease with none of the fun, but for something as complex and individual as your financial future, a one-way conversation with the internet or personal finance columnists isn’t enough.

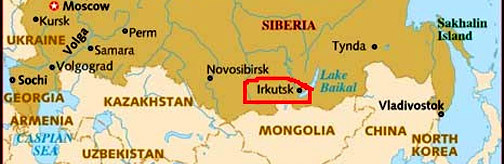

BoA Strands Customer In Siberia With No Money

Bank of America has cut off Shannon’s debit card and says she has to get a new one. This would otherwise be a minor inconvenience except for the fact that Shannon is in Irkutsk, Russia on a 2-week Trans-Siberian trek.

Nobody Look At The Paypal Secretly Adding New Fees

Starting in June, Paypal started assessing a fee of 2.9% on on purchases marked “goods” or services” to personal accounts. They can do whatever they want, but the problem is they were very quiet about it. Almost sneakily so.