What to do, what to do, when you’re merging and want to be the biggest without being too big? Divest, of course. And that’s where Rite-Aid finds itself today: in order to sell itself to Walgreens and allow their onetime-competitor to become the biggest drugstore chain in the country, it’s ready to shed several hundred stores to build a new third-place competitor. [More]

mergers and acquisitions

Report: Albertsons In Talks To Acquire Price Chopper, Expand To More States

According to those ever-mysterious “people familiar with the matter,” the northeastern grocery chain Price Chopper is in “advanced talks” with national chain Albertsons in an acquisition deal. The acquisition could still fall through, but it would mean that the closely held grocer could have a new owner after more than 80 years as a mostly family-run company. [More]

Giddy Investors Already ‘shipping Comcast, Verizon, Sprint, T-Mobile Mergers Under Trump Administration

This is shocking, we know, but: big businesses really like to make money. And when you’re already as huge as, say Comcast, one of the best ways to make oodles more money is to snap up another company and start raking in its revenues, too. Could Comcast snap up Verizon? Charter grab Sprint? At least one tech stock analyst thinks that deals like this, which might sound outlandish today, could be on the table soon. [More]

PepsiCo Announces Purchase Of Kombucha Company KeVita

For the second time today, a giant soda company has announced an acquisition of a smaller company that makes drinks that are a lot less sugary. Earlier today, it was Dr Pepper Snapple spending $1.7 billion on flavored water maker Bai Brands. Now comes news that PepsiCo is acquiring KeVita, a brand known for its kombucha offerings. [More]

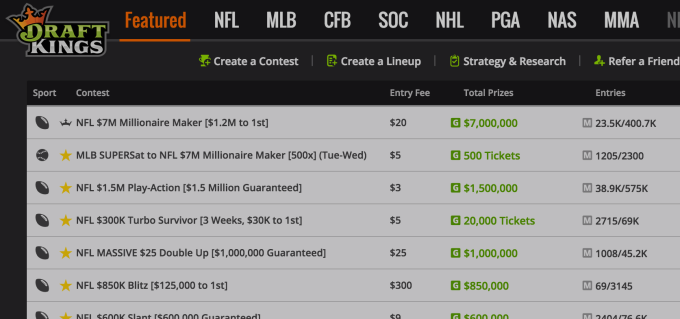

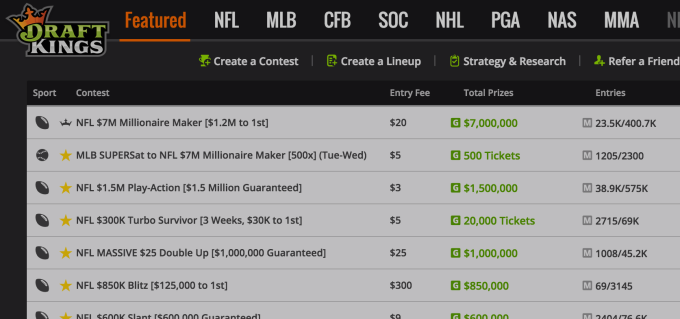

FanDuel & DraftKings To Merge In Daily Fantasy Wedding

After months of speculation and denials about a possible merger, the two biggest names in daily fantasy sports — DraftKings and FanDuel — have finally confirmed that they are indeed getting hitched. [More]

Twitter May Sell Vine For Cheap Instead Of Closing It Down

A few weeks ago, Twitter upset creators and fans of its six-second looping video service, Vine, by announcing its plans to close down the app. That may not be the case, though: there are reportedly some suitors that want to take Vine off Twitter’s hands for a low price and keep it alive. [More]

Rumors Of DraftKings & FanDuel Merger Heat Up Again

Nearly four months after DraftKings and FanDuel shot down rumors they were considering a merger, those “people familiar with the situation” are once again whispering about wedding bells between the two largest players in the daily fantasy sports industry. [More]

CenturyLink Snapping Up Level 3 For $34 Billion To Make Internet Service Voltron

Boo! If you think mergers and acquisitions are scary, than two huge companies have a special Halloween morning treat for you: CenturyLink and Level 3 announced this morning that the former is acquiring the latter for $34 billion. [More]

Verizon Executive: We’re Still Waiting For More Info On Yahoo Breach

Yahoo’s data breach affecting the accounts of half a billion customers will probably have an effect on its pending acquisition by Verizon, and that effect will be a “material” one that will affect how much Verizon pays. A Verizon executive explained at a technology conference today that the company still needs more information about the hack before tying the knot. [More]

AT&T, Time Warner Stock Prices Fall Slightly Amid Merger Skepticism

Before the $85 billion merger of AT&T and Time Warner was official, it was already being decried by people in both presidential campaigns, consumer advocates, lawmakers, and former regulators. Amid this backlash to the news, both companies’ values have taken a bit of a ding today. [More]

Why AT&T Is Buying Time Warner, And Why So Many People Aren’t Happy About It

The time from new rumor to signed deal was only about two days, and yet here we are: AT&T is putting the moves on Time Warner, planning to bring the content powerhouse under its roof. This proposal will now, of course, have to grind its way through the gears of government approval. But while this proposal is a giant deal for two giant companies, the name that’s likely to come up more than any other in all the comments back-and-forth is neither Time Warner nor AT&T, but rather a competitor: Comcast. [More]

AT&T Confirms $85 Billion Acquisition Of Time Warner Inc.

After two days of “people close to situation” leaking information about a possible merger between AT&T and Time Warner Inc., the two companies have confirmed the deal which is valued at around $85 billion. [More]

Reports: Possible AT&T/Time Warner Merger Valued At $85 Billion

This morning, the world woke to find out that AT&T and Time Warner were getting cozy and maybe thinking about moving in together. Now comes news that talks have heated up and that a nearly $90 billion deal could be in the offing. [More]

Report: AT&T May Be Trying To Buy Time Warner

With the acquisition of DirecTV complete and in the rear-view mirror behind it, AT&T is reportedly setting its eye on a new target to go out and buy: venerable media brand Time Warner. [More]

Report: Kroger Isn’t Interested In Buying A Few Hundred Walgreens Stores

If you know anyone who’s interested in buying around 650 grocery stores, Walgreens and Rite Aid would like to hear about it. The two drugstore chains need to find a buyer for between 500 and 1,000 stores to get their merger approved by the Federal Trade Commission, and no one is interested. [More]

Supervalu Selling Off Save-A-Lot Supermarket Chain For $1.4B

Supermarket operator Supervalu will have one fewer chain in its portfolio soon, after announcing that it’s selling off discount grocer Save-A-Lot to a Canadian investment group for $1.37 billion. [More]