Yesterday, Walmart deployed its QR code-based Walmart Pay mobile application in more stores in Arkansas and in stores across Texas. In a piece of news with curious timing, CurrentC, the mobile payment solution that was supposed to serve as a merchant-backed alternative to payment systems from Apple and Android, has been delayed again and the company behind it has laid off half of its employees. [More]

mcx

Apple Pay Unavailable At Home Depot As Retailer Upgrades Payment Terminals

Though Home Depot was never officially a partner with Apple’s Apple Pay mobile payment platform, which allows users to pay using credit card information stored their phones, the home improvement chain’s NFC-enabled checkout terminals worked with Apple Pay — until recently, that is. The retailer has begun the process of upgrading its in-store payment system, meaning that Apple Pay and other mobile payment platforms are now unavailable. [More]

Walmart-Led Apple Pay Competitor Requires Months Of Exclusive “Breathing Room”

Even though it hasn’t launched, mobile payment system CurrentC is already making headlines, and not just for being hacked. It’s also the reason iPhone 6 users can’t use Apple Pay at some of the country’s biggest stores, including Walmart, CVS, and Best Buy. But the CEO of the Walmart-led consortium behind CurrentC says that its backers won’t be blacking out Apple Pay forever. [More]

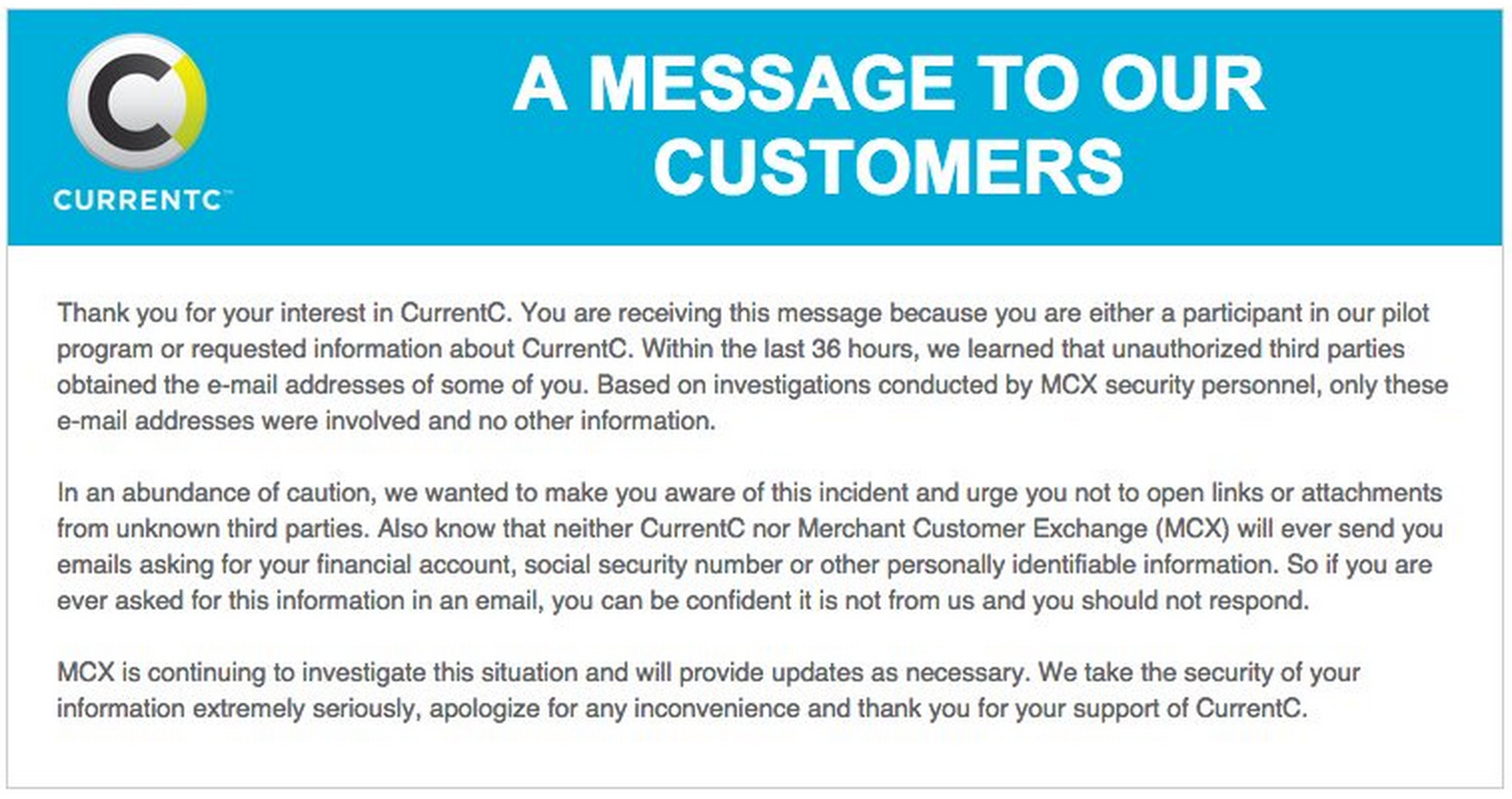

CurrentC, Walmart-Led Competitor To Apple Pay, Has Already Been Hacked

A number of major retailers, most notably Walmart, have yet to allow shoppers to use the recently launched Apple Pay system at checkout, and national drugstore chains Rite-Aid and CVS stopped offering Apple Pay as an option after only a few days. That’s because all of these retailers are part of a consortium working on a competing system called CurrentC, which by the way, has already been hacked. [More]