A foreclosure firm listed “Bogus Assignee” as the mortgage owner on the documents they submitted to the court to process the foreclosure. That’s one of the many oddities surfacing in the investigation of a Florida foreclosure firm for allegedly using improper documentation to speed up foreclosures. Another is an employee “Linda Green” who signed of on thousands of foreclosure affidavits claiming to be executives from Bank of America, Wells Fargo, U.S. Bank and other lenders. [More]

loans

GMAC Bungled Foreclosure Affidavits In 23 States

GMAC Mortgage is taking the eye-opening step of stopping evictions in 23 states because the affidavits used to support the kickouts contained information the employees didn’t themselves personally know to be true, and they were sometimes signed without a notary present, according to a company statement. [More]

GMAC Halts Evictions In 23 States

GMAC has told brokers and agents to immediately stop evicting homeowners in 23 states. In a memo, the Ally Financial Inc. subsidiary cited “corrective action in connection with some foreclosures” that may need to be taken. Smells like some people got foreclosed on that shouldn’t have, though we’ve been hearing scattered reports about that for a while without the banks doing much, so why drastic action now? Have they uncovered something massive? [More]

Massachusetts Regulators Rarely Acted Against Subprime Brokers And Lenders

An investigative report finds that Massachusetts regulators only acted against 3% of its licensees during the sub-prime peak, the lowest among fellow New England states, while publicly preening that it was being “aggressive.” In fact, as foreclosures rose during ’06-’08, enforcement actually dropped. Forget who watches the watchdogs, who watches? [More]

Turn Store Financing Offers Into Interest-Earning Free Loans

Store financing offers like 0% down, pay nothing for 6 months, etc, can be a way to lure those who really shouldn’t be buying stuff into purchasing, but if you actually have the cash in hand already, you can leverage them into the equivalent of an interest-earning free loan. [More]

Student Loans, Gateway Drug To Debt Slavery

One of the most important lessons students learn in college is how to get into debt and stay there. It’s crucial to the success of the Republic. An indebted population is easier to control; needing to pay off crushing debt – a debt that if defaulted on has been stripped of many normal consumer protections and rights – graduates more willingly shuttle into cubicles, becoming the square pegs demanded by the square holes. After a few futile years of floundering idealism, their souls have been successfully jackbooted into powder and they’re ready to keep the thumb on the next generation of would-be drones so as to protect their empire of matchsticks. But how did we get here? This chunky infographic examines the origins and (d)evolution of the student loan leviathan. [More]

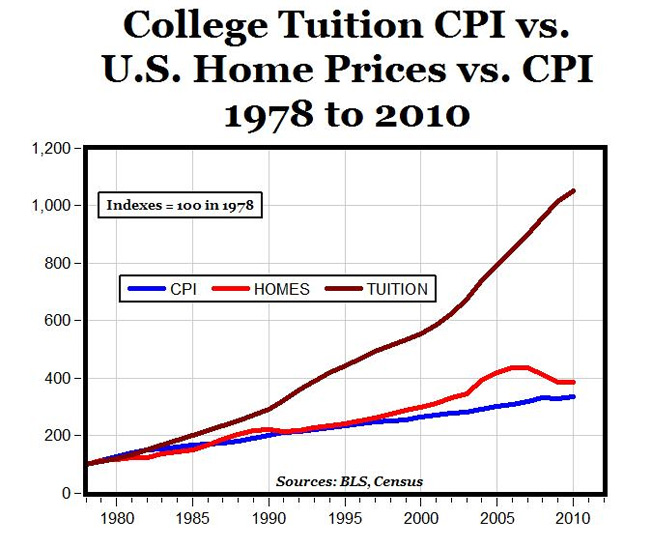

When Will The College Tuition Bubble Burst?

This is a chart from the Carpe Diem blog showing the increase in college education costs, U.S home prices, and the consumer price index. If we had a housing bubble, the skyrocketing costs of higher education is a super bubble. [More]

Loan Applicant Receives Rejection Letter Calling Her 'One Crazy Ass Bitch'

When the owner of a Seattle beauty salon had her application for a loan from the Rainier Valley Community Development Fund denied last year, that was bad enough. When she later received what appeared to be a second rejection letter for the same loan application, she discovered that the reason for her inability to get the loan was that she is a “crazy ass bitch.” [More]

CitiFinancial Auto Keeps Deducting Payment On Zero Balance Loan, Triggers Overdraft Fees

Marc’s monthly budget just exploded into a mess of overdraft fees thanks to CitiFinancial Auto’s negligence, and now he’s not sure how to get them to actually do anything to fix it. [More]

Self-Styled Robin Hood Banker Pleads Guilty

An ex-vp at a bank plead guilty last week to modifying over 100 loans to make it look like the customers were still current on their loans instead of overdue. This was not a money-making scheme, he was trying to help them. Nevertheless, it was fraud, and he could face up to 30 years in prison and a $1 million fine. [More]

25 Percent Of American Consumers Now Have Low Credit Scores

Before the recession hit, roughly 15% of Americans had FICO credit scores below 600. But after the past couple of years of late payments, defaults, and foreclosures, that number has grown to 25%, or about 43 million people. At the same time, the number of people with excellent scores (800 to 850) has increased nearly 5% from pre-recession average, which the Associated Press says is partly a result of people cutting spending and working to pay off loans more quickly. [More]

Countrywide Sued For Discriminating Against Black And Latino Mortgage Buyers

The Illinois AG filed a lawsuit this week against Countrywide, alleging that the now imploded mortgage lender steered blacks and Latinos into riskier subprime loans more often than whites, even when they qualified for safer mortgages. [More]

Arizona Becomes 16th State To Punch Payday Lenders In The Face

Arizona is about to say goodbye to predatory payday lenders who issue loans with annual interests exceeding 460%. On Thursday a decade-old law will expire, capping interest rates at 36%. The predatory lenders begged to keep the law in force, but voters and the legislature just sat back and gave the industry a big, slow, deserved punch right in the face. [More]

Guess Who Said It?

Let’s play a game. Can you figure out who said the following? “You’re a loser. Why don’t you just jump in front of a train?” “You a f***ing thief, you know. “I’m gonna find you and you gonna be walking like a b***h on the side of the street.” “I’m the guy who’s gonna end your life. That’s who I am.” Find out the answer after the jump! [More]

Fix Mortgage Errors By Promising The CSR "Phone Fun," At Least At Wells Fargo

According to a lawsuit filed in New Jersey, a CSR at Wells Fargo’s Home Mortgage Division refused to correct a payment error for Jamie Nelson unless she had some “phone fun” with him first. Phone fun, in this case, seemed to mean naked pics of the woman. She’s suing for emotional distress, since you can’t take someone to court simply for being a skeevy jackass. Wells Fargo says they’re taking the allegations seriously. [More]

265,000 Homeowners Stuck In "3 Month" Trial Loan Period For 6+ Months

Newly released data shows 265,000 homeowners are trapped in loan mod limbo, stuck in “3 month” trial loan periods for over 6 months, reports ProPublica. [More]

Some Homeowners Worse After Getting Rushed Into Gov't Loan Mod Program

Despite fulfilling every obligation under trial government-sponsored loan modification programs, some homeowners can end up far worse off than if they had never joined up at all, Propublica reports. That’s because if they’re denied a permanent modification, they have to pay the entire amount that was being discounted, often within a very short period of time. This pushes already strapped families past the breaking point. [More]

Man Seals Self Inside Foreclosed Home

Now we finally understand the secrets of the pharoahs: a bunch of angry people in Stony Ridge, Ohio have sealed up a home with the homeowner inside, with his permission, leaving only a golf ball-sized hole in the front door. The man, Keith Sadler, says he fell behind last year after paying on his mortgage for 12 years, and that his bank promised to work with him but instead proceeded with foreclosure. [More]