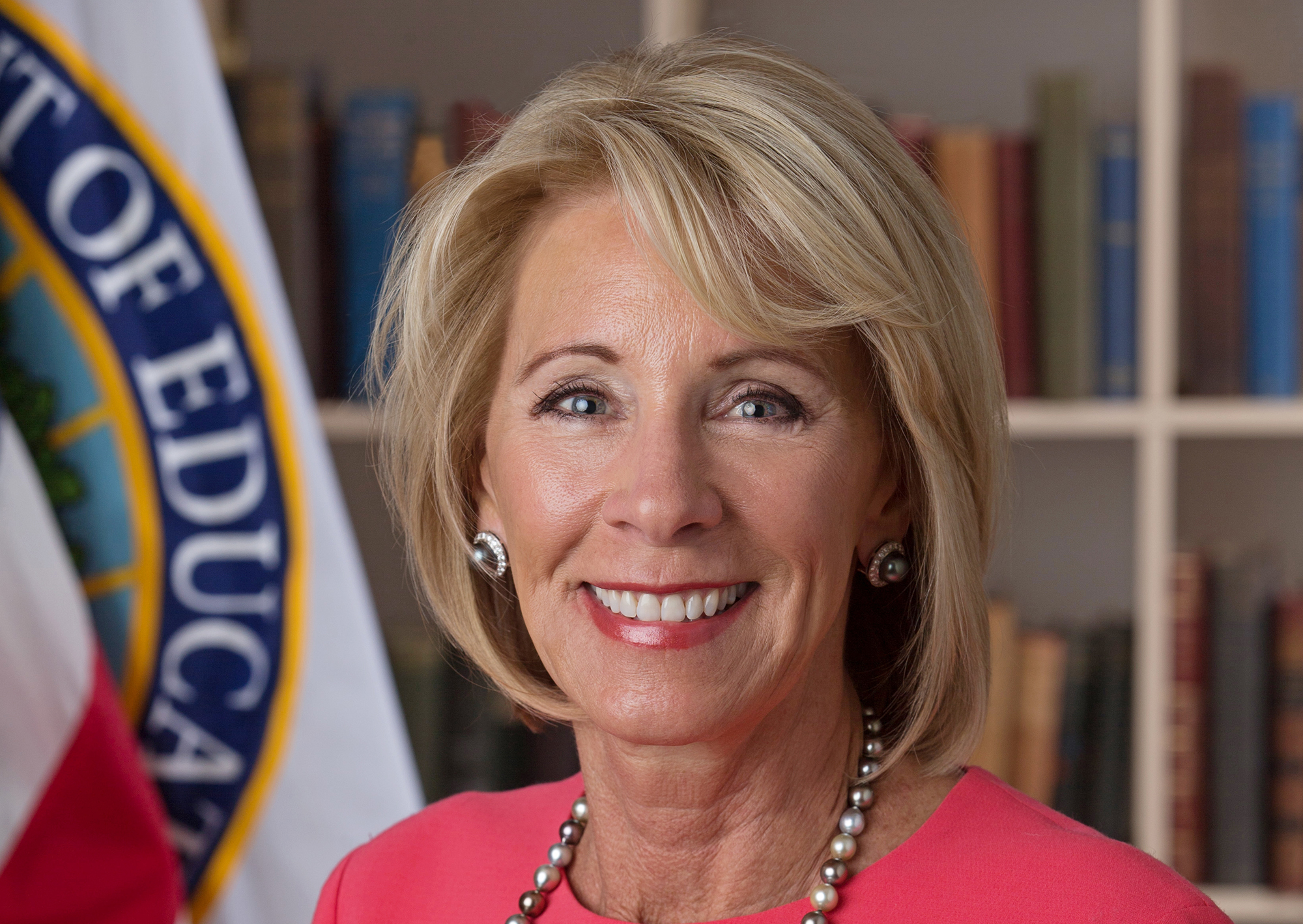

Education Secretary and champion of for-profit colleges Betsy DeVos is once again siding with this controversial industry and against students who were defrauded by schools that tricked them into paying top dollar for a bottom-dollar education. [More]

loan forgiveness

Student Loan Borrowers Face Delays, Bad Information About Loan Forgiveness Program

The Department of Education’s Public Service Loan Forgiveness program allows student borrowers a way to eventually erase federal student loan debt by working for the government or at a non-profit for 10 years. Students have already accused the government of failing to keep its promise, and a new report not only appears to bolster this claim but shines a light on other concerns about other roadblocks to loan forgiveness. [More]

Trump Administration Looking To End Student Loan Forgiveness Program

This October will mark the first time that student loan borrowers who have worked for 10 years with the government or a qualifying non-profit will be eligible to have their debts wiped clean. It may also be the last time, as the Trump administration is reportedly targeting this and other Department of Education repayment programs for elimination.

[More]

When Education Dept. Said Your Student Loan Would Be Forgiven, It May Not Have Meant It

One way to erase federal student loan debt is to work for the government or at a non-profit for 10 years. However, thousands of people who received notices from the Department of Education that their federal student loans were going to be forgiven through this program may still be on the hook for this debt, as the Department now says these notices are not binding. [More]

20,000 For-Profit College Students Ask Education Dept. To Cancel Their Student Loans

As the fallout continues from the collapse of Corinthian Colleges Inc. — former operator of Everest University, WyoTech, and Heald College — the Department of Education is trying to sort through nearly 20,000 loan-forgiveness requests from former students who claim that CCI and other for-profit colleges misled them into taking out huge student loans. [More]

Legislation Would Require Private Student Loans Be Forgiven If Borrower Dies

Shortly after the death of their daughter, a New York couple’s grief was interrupted by a battle with an entity they never imagined: her private student loan lender. Inheriting a dead child’s student loan debt is a problem too many parents have had to face, and one that a new piece of legislation aims to eliminate. [More]

CFPB: Many Of The 33 Million American Workers Eligible For Loan Forgiveness Aren’t Using It

Are you working in a job that serves other Americans — in a school, hospital, city hall perhaps — while living saddled with student loan debt? You could be part of the more than 33 million workers eligible to have student loans forgiven, a large number of which aren’t even aware they can do so. The Consumer Financial Protection Bureau says loan forgiveness program are too confusing for many to take advantage of, leading to a large number of wasted opportunities. [More]

Loan Co-Signers Should Not Be On The Hook With The IRS If The Debt Is Forgiven

We’ve written numerous stories over the years about parents who co-signed student loans for their children and then were stuck with the payments when their child passed away or could not find employment. Sometimes lenders will choose to forgive that debt, but even then some are making a mistake that could continue to hurt the co-signer at tax time. [More]

The CFPB Answers Your Student Loan Questions, Part 3: Defaulting And Loan Forgiveness

In the second set of questions and answers about student loans, the Consumer Financial Protection Bureau’s Student Loan Ombudsman Rohit Chopra made a few mentions of the various service-specific loan forgiveness programs out there. Here, he gets into more detail and responds to questions about the one topic no one ever hopes to face: default. [More]