With cybercriminals increasingly using malware and phishing attacks to steal sensitive personal information, it’s perhaps not surprising that a company that makes online security software would want to acquire a business that offers identity theft protection services — even one that has been heavily penalized for not living up to its promises. [More]

lifelock

Identity Theft Company LifeLock Once Again Failed To Actually Keep Identities Protected, Must Pay $100M

Five months after federal and state regulators accused identity theft protection company LifeLock of violating a 2010 settlement in which it paid $11 million for allegedly using false claims regarding effectiveness of its services, the company has been ordered to pay $100 million in penalties and refunds for once again misleading consumers. [More]

Man Uses LifeLock To Track Ex-Wife; Company Didn’t Care

Imagine you found out that your former spouse had opened a fake LifeLock credit monitoring account in your name, and then used it to follow your every financial move for two years? Then imagine that no one at LifeLock will take your query seriously, even after the police get involved. [More]

LifeLock Settles With FTC For $11 Million Over False ClaimsIn Ads

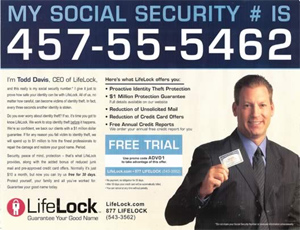

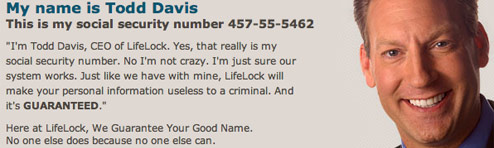

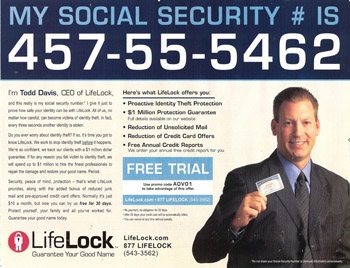

For several years, LifeLock has been so brash about their skills at protecting customers from ID theft that they not only drove around a truck displaying their CEO’s Social Security Number in public, they also advertised his SSN on TV ads. But that hubris has come back to bite them on the rear, as LifeLock has just agreed to a $11 million settlement with the Federal Trade Commission over the bulked-up claims made in their ads. [More]

Finding Legal Lucre In Identity Theft

A slate of companies legitimately profit from identity theft by offering services that the three credit reporting agencies refuse to make easily accessible to consumers. The Times brings us the stories of three such companies that are sucking the venture capital teat all the way to market: