The New York Times has an interesting article about a couple in California who are suing their real estate agent (who is conveniently also a mortgage broker) for allegedly artificially inflating the appraisal on their home by $100,000. A few days after moving in to their new home, says the NYT, “they got a flier on their door from another realty agent. It showed a house up the street had just sold for $105,000 less than theirs, even though it was the same size.”

lending

World Economy Feels The Mortgage Meltdown

On a day when United States markets were closed in observance of Martin Luther King’s Birthday, the world’s eyes were trained nervously on the United States. Investors reacted with what many analysts described as panic to the multiplying signs of weakness in the American economy.

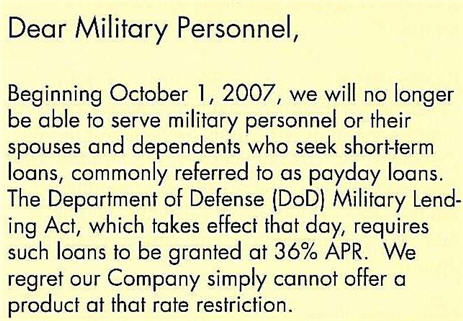

Payday Lenders Can't Afford To Lend You Money At Only 36%

The Leftwing Conspiracy blog scanned a cute pamphlet that a payday lender is distributing to try to drum up sympathy now that there’s a rate cap on loans given out to military personnel. Boohoo!

../../../..//2008/01/18/now-that-salliemae-buy-out-deal/

Now that SallieMae buy-out deal has crumbled and they’re facing much higher borrowing costs due to the subprime fiasco, the unpopular student lender will shed 3% of its workforce, or 350 jobs, mostly CSRs at their call centers.

BREAKING: Bank Of America Buys Countrywide, CEO Gets Up To $115 Million Parachute

Hey there, sports fans: Bank of America will buy everyone’s favorite evidence-forging subprime lender, Countrywide for a cool $4 billion dollars.

Countrywide Says It's So, Like, Totally Not Going To Go Bankrupt, OK?

Reacting to the bankruptcy rumors, Countrywide spokesman Rick Simon said, “There is no substance” to them “and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company.”

So, if you’re seeking better interest rates, and are morally flexible about who you give your money too, look for companies that are in dire need of an infusion of cash. Who’s the predatory lender now? Don’t you feel cool?

86,000 Mortgage Related Jobs Cut In 2007

A new study says that 86,000 mortgage related jobs were cut due to the weakening housing market, says CNNMoney. Diabolical mustache-twirling evidence-forging lender Countrywide unburdened itself of the most workers, cutting 11,665.

Sallie Mae Will Make Fewer Student Loans In 2008

Student loan lender Sallie Mae said today it plans on making fewer loans in the future “in the wake of federal legislation last year to reduce subsidies for student lenders,” reports Reuters.

Stockton, California Shows Us How Bad The Mortgage Meltdown Can Get

Steve Carrigan is in charge of economic development for Stockton. He says bank loans made it a party every day.

Will Car Loans Be The Next Credit Meltdown?

Gone are the days of the three-year car loan. The length of the average automobile loan hit five years, four months in October, up more than six months from 2002, according to the Federal Reserve. And nearly 45% of loans written today are for longer than six years. Even some staid lenders owned by the carmakers, such as Toyota Financial Services and Ford Credit, are offering seven-year financing. And a few credit unions, particularly in the West, are tinkering with the eight-year note.

Foreclosures Up 68% From Last Year

Foreclosure tracking firm RealtyTrac has announced November’s foreclosure numbers and, while foreclosure activity is down 10% from last month’s number, the news isn’t happy. Foreclosures are up 68% from November 2006, with 201,950 foreclosure filings—up from 120,334 this time last year. Also worth mentioning, last year’s numbers weren’t exactly low—they were up 68% from 2005.

Fed Approves Plan To Curb Irresponsible Lending

The Fed has unanimously approved a new plan to tighten provisions designed to prevent predatory mortgage lending, as well as help to decrease the number of consumers who irresponsibly take on debt that they cannot afford to repay.

../../../..//2007/12/17/fewer-borrowers-will-qualify-for/

Fewer borrowers will qualify for mortgage insurance, due to tightened restrictions following the subprime…

Paying Off Consumer Debt: Home Equity Or No Home Equity?

If you have consumer debt, you’re probably looking for a strategy to pay it off. Some people use a home equity loan as a way to get a lower rate, others use 0% balance transfers, still others just call their credit card company and ask them to lower their rates.

Freddie Mac Will Be Losing A Few Billion More, Decides To Stop Buying So Many Bad Loans

“If I were you, I would want in this time period someone running one of these companies (Fannie Mae and Freddie Mac) to err on the side of pessimism rather than optimism,” he said.

Hey, good point.

The Subprime Meltdown From The Perspective Of A Housing Counselor

Coppedge saw it coming in slow motion. Around this time last year, she was mostly dealing with renters who were behind on payments. Rarely did she counsel at-risk homeowners. When she did, they were usually suffering a one-time setback such as job loss.