Uber’s Xchange Leasing program, which allowed Uber drivers to lease new cars that they could pay off by picking up passengers, was heavily criticized for charging lease rates far in excess of what drivers could get elsewhere, but it wasn’t until Uber realized it was losing boatloads of money on the program that it was in jeopardy — and now it’s being put to bed forever. [More]

leasing

4 Things To Know About Uber’s Singapore Leasing Program & Recall Issues

For nearly two years, Uber has offered a car leasing program that aims to remedy one of the biggest obstacles for those who wanted to sign up as a driver, but didn’t haven anything to, you know, actually drive. While some Uber drivers have expressed their frustrations with the Xchange Leasing program, a new report suggests that those taking part in similar programs outside of the U.S. are facing more than high monthly payments; they’re dealing with allegedly defective and dangerous vehicles. [More]

Why Don’t Device Manufacturers Just Start Leasing Phones To Consumers?

When phone carriers like Sprint and T-Mobile are happy to rent phones to customers, and Apple is the one phone manufacturer with its own network of stores to sell phones directly to consumers, what’s there to stop Apple from just leasing phones to customers directly? Even carriers would like this idea better, since they could sell iPhone leases instead of needing to buy them from Apple first. Everyone wins… but would consumers like this idea? [More]

Uber Launches Car Leasing Program To Attract More Drivers

There’s one big obstacle for anyone who wants to sign up as an Uber driver and hit the road — if you don’t have a car, you’ve got nowhere to put any passengers. Uber wants to make it easier to attract potential drivers, launching its own auto leasing subsidiary unit that will bring the ride-hailing company into the financial services industry. [More]

Death Is No Excuse For Not Paying Your Car Lease

We’ve written before about people who co-signed a loved one’s loan and were left owing the debt after the borrower passed away before the loan was repaid. But even if you weren’t the co-signer, you might still end up being on the hook for thousands. [More]

Ask These Questions Before You Sign Your Next Lease

Are you looking for a new apartment or house? Apartment Therapy has some advice about what questions you should ask before putting your name on a new lease. We’re featuring this on Consumerist because there is advice about negotiating extra fees and deposits for cats, a crucial topic for our readership. [More]

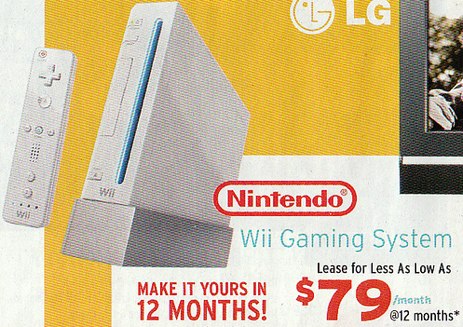

Kelly’s Will Rent-To-Own You This Wii For $948

Here’s a perfect example of what a ripoff rent-to-own or “lease-purchase” (to use the Kelly’s phrase) arrangements are to the consumer. This $250 Wii console can be yours for only $79 a month, and after 12 months, it’s yours to keep. By that time, you will have paid $948 for it. By comparison, if you charged it to a credit card with 18% interest, you could pay $23 a month and have it paid off after 12 months. Kelly’s offer will cost you $673 more than paying with the credit card.

5 Car Lease Myths

Mark Solheim over on Kiplinger thinks leasing cars has a bad rap, and that more people should be doing it. “If you know what you’re looking for and negotiate smart—and get over the five myths below—leasing can be a good deal.”

What to Do With A Vehicle At The End of A Lease

A reader wrote into Bankrate and asked what he should do with his truck now that the lease was up. Should he buy it for the residual price, or simply lease a new truck?