An anonymous reader says both his and his wife’s Discover cards—the accounts are separate—had their due dates moved up by four days in June. He called Discover, “and they stated that they sent out notices in the mail 45 days in advance warning of the change, which I don’t remember seeing. Regardless, they were able to revert my due date starting in July. You may want to have your readers closely check their Discover Card statements.”

late fees

Capital One Charges Woman $29 Late Fee For Paying Too Early

Jason writes, “My wife just sent me an email saying that she paid ‘too early’ (before the new statement was generated) and got charged a ‘Late Fee’ of $29!” He says she called Capital One and got the fee waived, but it’s a good reminder that if you make a payment before the new statement period begins, your card provider will likely apply the payment to the previous statement period, and will still expect a fresh payment from you by the new due date. Just make sure your payments aren’t scheduled so early that they’re applied to the past and you’ll be fine.

House To Pass Credit Card Reform, Tell The Senate To, Too

The House is expected to pass the Credit Cardholders’ Bill of Rights Act today, and the Senate is considering similar legislation. The Senate battle will be harder, but you can help!

Tennessee Pushes Back Against Late Fees By Credit Card Companies

Although it has yet to pass into law, the Tennessee Senate Commerce Committee has approved a bill that requires creditors to count the postmark date of a payment as the payment date, not the day they say they receive it.

Chase Wants You To Pay Your Taxes By Credit Card. Don't.

Chase has emailed its customers a friendly reminder that if you can’t pay your taxes this year, you can charge them on your Chase credit card! Even the IRS site suggests you consider using a credit card if you can’t pay your debt. However, before you do something as debt crazy as charge up a high credit card balance, consider the following points and make sure you’re doing the most financially responsible thing.

Chase Shrinks Credit Due Dates Without Warning, Profiting Off Fees

Got a Chase credit card? Check your bill to see if the due date shrunk. For the past ten months, the due date on reader NDphoxylady’s four Chase credit card due date was the fifteenth. Then, without warning or notice, it became the tenth. NDphoxylady only noticed when she was charged a $39 late fee and a $20 finance charge. When she complained to Chase, they told her that simply changing the due date on the bill was adequate notice. Nu-uh

Maloney Introduces Credit Card Bill Of Rights; Lending Institutions Smirk

The Credit Card Bill Of Rights Act, which was introduced on Thursday in the U.S. House of Representatives, would limit interest rate hikes and late fee penalties that credit card companies use to unfairly squeeze profits from customers.

Capital One Won't Really Close Your Credit Card, Will Secretly Continue To Bill You

When Capital One “closes” your credit card account, they’ll continue to allow automatic withdrawals even though the account is closed. But they won’t send you a statement—you know, because it’s closed!—so that you’ll end up with late fees. Quenten experienced this first hand when he closed his account recently, and now Capital One has sent his account to collections over a $38.00 late fee for two 38-cent charges that he never knew about.

Verizon Will Waive Late Fee Only If You Pay Through The Automated Phone System

Verizon was willing to refund the late fee on reader Steve’s bill, but only if he paid through Verizon’s automated phone system. Steve instead offered to give his billing information to the Verizon CSR to whom he was speaking, an offer that was refused. Steve writes:

I used to work at a call center for a certain mobile provider. I understand exactly what reps deal with. I’ve had my manager tell me I need to cut back on bathroom time. I’ve had them tell me I need to get my calls shorter. I’ve had them tell me I can’ waive reconnection fees. I’ve been there. I know.

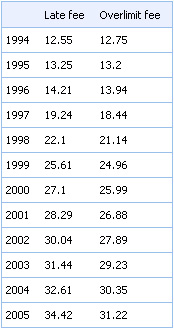

Credit Cards Fees Doubled Over Ten Years

Since 1994, credit card late and overlimit fees have more than doubled. We’re no economist, but that doesn’t seem to keep pace with inflation.

Got A Late Fee? Ask For A Credit

Next time a late fee mars your bill, ask to have it waived. It helps to have a history of timely payments made in full, as Five Cent Nickel discovered when his Citi Mastercard was hit with a $39 late fee plus finance charges.

I was, of course, really bummed. After all, we’ve never paid a late fee or an interest charge to a credit card company. Was the streak about to end? Not if I had anything to say about it!

Capital One’s Credit Trap

Way back when we were 19 years old and getting our first credit card, Capital One sent us a pre-approved card with a $500 limit. Yippie! We soon found out that no matter how early we sent our payment in, we always got a late fee. Every. Single. Month. After writing letters and causing a fuss, we cancelled the card. Imagine our suprise when, so many years later, reader Tim sends us a Business Week article explaining how and why Capital One uses various tactics to increase fees. In this case, it’s over limit fees, but the whole deal sounds very similiar to the problems we had with Capital One back in ’99.

HSBC: Fee Sharks?

Reader Chandra wrote to us today about her short-but-tumultuous relationship with HSBC’s credit card division. In the span of two months Chandra applied for a card, made a $300 payment (mailed 8 days early) on a $700 balance, got hit with a $35 late fee and a $15 pay-by-phone charge, and cancelled her account. She claims to have good credit and is just baffled by HSBC’s inability to process a payment without assigning a penalty.