Sarah has $40k+ in student debt that went into default after she got sick and had to spend a lot of money on medical care. She’s been paying it off, but one of the companies that owns one of her loans, NCO Financial, has told her that unless she signs a legal document that says she can pay $260 a month, they’re going to place her account back in collections and start harassing her even more than they are now (they’re already calling her daily at home and work)…

insurance

How To Save On Homeowners Insurance

With the economy in the dumper, it seems like everyone is looking for ways to save on everything. Not wanting to stand in the way of this lovefest for saving, we’re proud to bring you six ways to save on homeowners insurance from Smart Money:

Hospital Bills Woman For Waiting 19 Hours Without Seeing Dr

Amber Joy Milbrodt waited for 19 hours in a Dallas emergency room to get her broken leg fixed without seeing a doctor before she finally left. Two weeks later, she got a bill for $162. The hospital says it was for when a nurse checked her vital signs. “She’s not paying for waiting…She’s paying for the assessment she received.” said Rick Rhine, the hospital’s vice president in charge of billing. “It should have been more like them paying me for having to sit in the emergency room for 19 hours,” Amber told The Dallas Morning News. Amber says she’s not going to pay the bill.

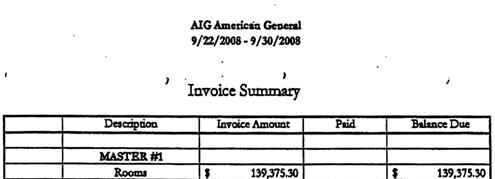

Backlash: Outrage Forces AIG To Cancel Second Pricey Hotel Party

AIG has decided to cancel a second pricey hotel party for their brokers after receiving another loan from the Federal Reserve for $37.8 billion dollars. AIG defended throwing a $400,000 week long bash for its top independent insurance agents and some AIG employees immediately after the bailout — claiming that these events were “standard industry practice” and that they must continue. They announced that they would go ahead with another event at the Half Moon Bay Ritz-Carlton in northern California. 50 AIG employees were expected to attend.

Test Your Personal Finance Skills With These Quizzes

Kiplinger has two quizzes named “Financial Truth or Bunk?“, and they go through some of the more popular tips you’ve heard about personal finance, including lines like:

- You can’t lose money investing in bonds.

- Stay-at-home moms or dads need life insurance, too.

- Don’t buy a red car — it’ll cost more to insure.

- Dollar-cost averaging boosts investment returns.

- The percentage of stock in your portfolio should equal 100 minus your age.

Confronted With Hotel Bills, AIG Says, "This Is Totally Normal!" And "We're Having Another One!"

AIG says that the “retreat” that ABC News reported on the other day was really just an event for AIG’s top independent agents — and that only 10 employees were present out of 100 attendees. Here’s how they explain in a press release:

I Am Going To Kick Your Ass Unless You Get Life Insurance

The expression on the little guy’s face in this banner ad seems say, “I’m gonna kick your ass unless you get some freakin’ life insurance.” Maybe even throw in a “sucker” at the end there. Seriously, what’s his deal? He’s sooo angry!

Medicare Costs Going Up In 2009, So Be Ready To Compare Plans

If there’s one group of Americans who don’t carry their weight and need to pay more money to the healthcare industry, it’s those layabout senior citizens! That’s why their Medicare drug premiums are increasing by an average of 31% for the 10 most popular plans beginning in 2009. If you were with Humana, formerly the cheapest Medicare drug plan you could get (its premium was $9.51 in 2006), you can expect to pay $40.83 per month in 2009, an increase of 60% over this year’s rate. As you would expect, Humana is no longer the cheapest option—so it may be time to shop around for a new plan.

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.

What Types Of Accounts Are FDIC Insured? Are My Investments Safe?

What accounts are FDIC-insured? Which aren’t? Now that a fund that markets itself as the world’s “first and longest running money fund,” suddenly found itself in the nearly unprecedented position of having to “break the buck,” we thought we’d help clarify. Here we go:

AIG's "Strength To Be There" Commercials Are Suddenly Hilarious

When Treasure Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill last night to discuss giving AIG an unprecedented $85 billion loan, do you think they had a laugh about AIG’s commercials? We picture Paulson saying something like, “Ha, ha, ha… ‘strength to be there.’ That’s rich! Rich! Ha! I’m on a roll!”

Feds Loan AIG $85 Billion

The Federal Reserve Bank of New York will lend AIG $85 billion. Explaining the breathtaking move the Fed said, “a disorderly failure of A.I.G. could add to already significant levels of financial market fragility and lead to substantially higher borrowing costs, reduced household wealth and materially weaker economic performance.” They’re not just dumping out the public purse on the counter, though. FBNY will take a 79.9% stake in the company, the collateralized loan is for two years, and is expected to be paid off by selling off assets. NYT writes, “the bailout is likely to prove controversial, because it effectively puts taxpayer money at risk while protecting bad investments made by A.I.G. and other institutions does business with.” You can say that again.

What Merrill, Lehman, And AIG Customers Need To Know

NYT’s Ron Leiber breaks down what you need to know and do if you are or were a customer of Merrill Lynch, Lehman, or AIG…

Chairman Of Advantage Rent-A-Car Investigates 49-Day Repair Claim, Waives It

Earlier this summer, we wrote about how Paul was being gouged by Advantage Rent-A-Car on repairs that had to be made after his rental was damaged in a hit and run. Paul was willing to pay the repairs on the vehicle, but Advantage wanted almost double the amount. After we posted his story, Paul was able to get in touch with a higher-up at Advantage who passed him along directly to the Chairman. Here’s what happened.

CVS Employee Calls Customer A 'Fucking AIDS Freak'

His response was “Whatever, somebody needs to come deal with this because I’m about to go off…”

Beware Balance Billing

When insurers don’t pay the full amount of the bill, health-care providers are going after patients to make up the difference. It’s known as “balance billing,” and it’s often illegal, BusinessWeek reports. Under state and federal laws, doctors and hospitals generally need to be dealing with the insurers, instead of pressuring vulnerable patients. Have you had any success with fighting balance billing? Leave your story in the comments.

Disney Reneges On Ride Injury Payment Promise, Reader Wins With EECB

Disney, inventors of childhood itself, told Daniel they would foot the bill after he got injured on their California Adventure ride. Then when Daniel and his wife Jane tried to collect, they got strung along for months by Garth Steever in guest claims. When they finally locked him down 11 months after the incident, Garth told them Disney changed its mind. By this time, the medical bills had already been sent to collections. Then Jane read about how to send an EECB on The Consumerist, and stormed the ramparts of Cinderella Castle. Here’s her letter, and success story…

Help! Chase Suddenly Wants Me To Buy Tons Of Flood Insurance!

Reader Nate and his wife recently bought their dream home, which they admit is more modest than most people’s dream homes, for $60,000. During closing, they wrote in their offer “that if the home was found to be in a flood plane we withdrew our offer,” but were happy to find out that the house was, in fact, not in a flood plain. That is, until Chase, decided that their house was in a flood plain after all and is requiring $185,000 in flood insurance.