With several states’ governors already saying they will opt out of the Medicaid expansion intended to bring health care to millions of currently uninsured Americans, some are calling it the death knell for this portion of the Affordable Care Act. But others say that the federal subsidies will be too tempting, and that it’s just a matter of time until these states decide to take part in the program. [More]

insurance

Texas Governor Says No To Medicaid Expansion

Last week, while states like Florida and South Carolina were stating their intentions to opt out of the portion of the Affordable Care Act that expands Medicaid coverage to millions of Americans, Texas — where approximately 2 million currently uninsured residents would have been eligible for coverage. remained oddly quiet on the matter. That is, until Governor Rick Perry declared his intention this morning. [More]

My Parents’ House Was Struck By Lightning And Burned Down. What’s Next?

When you’ve escaped from a late-night fire and lost your home and all of your belongings with it, what do you do next? That’s what Rudy wants to know, on behalf of his parents. Last week, their house caught fire hours after being hit by lightning. They got out alive, and are about to begin rebuilding their lives. But first: the insurance claim. An adjuster from Allstate is coming today. Rudy wonders whether the Consumerist Hive Mind have experienced this kind of catastrophic loss and massive insurance claim, and have any advice for his family. [More]

Leaky Dishwasher Wrecks Hardwood Floor And Ceiling Below, Sears Shrugs

Sometimes, you buy a defective appliance and your only problem is that that the appliance doesn’t work. It’s sad, but you replace the item, either using a warranty or by purchasing a new one. Sometimes the company will stand in your way, and you have to fight them for a replacement. And then sometimes your defective appliance warps your hardwood floor, leaks through to your basement ceiling, and causes more than $4,000 worth of damage. That’s what happened to Nachos Grande and his wife (not his real name) when they bought a defective Whirlpool dishwasher from Sears. [More]

Travelers Refuses To Believe Dad Is Dead, Sends Him Check For Mom’s Totaled Car

Charoo’s father is dead. Unfortunately, his name is still on the title of the car that he once owned, now driven by Charoo’s mom. She was in a car accident and the vehicle was totaled. Fine, just cut the lady a check so she can get a new car. Except the title was still in the name of both members of the couple, and the check has both of their names on it. Travelers refuses to issue a check to only Charoo’s mom, even with a death certificate and other documentation. Meanwhile, the bank refused to accept a check made out to a dead man. [More]

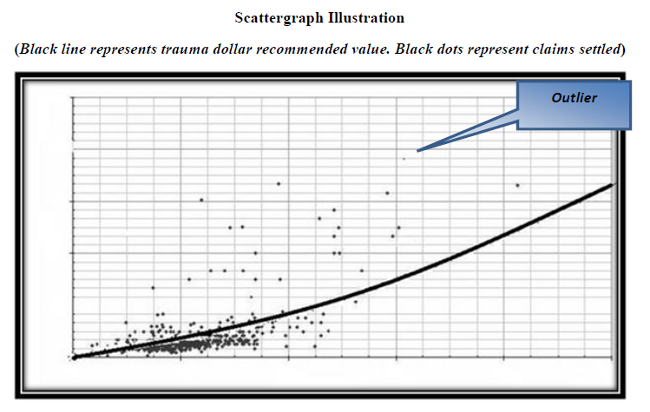

Report: Insurance Claims Systems Adjusted To Lowball Payouts

A former insurance company executive has authored a report for the Consumer Federation of America detailing how easy it is for the country’s largest insurers to tweak their computerized claims system in order to issue payments to injured policyholders that are less than what they should receive. [More]

Is $15/Month To Best Buy Worth A New Replacement Phone?

Phone insurance plans are often not worth the money you spend on them; especially since many credit cards already include extended warranty protection at no extra cost. But a Best Buy customer in California feels burned by Best Buy’s Mobile Phone Plan after she paid more than $250 in insurance payments and had her broken iPhone replaced with a refurbished device that cost less than what she’d paid out. [More]

Report: Forced-Place Insurance Pushing Homeowners Into Foreclosure

If you’ve got a mortgage on your home, it needs to be insured. So if you stop paying that insurance premium, the bank will often go out and get insurance for you. Problem is, according to Bloomberg News, those policies cover less, cost more and will likely just end up putting you into foreclosure anyway. [More]

Doctors Skip The Whole Insurance Thing By Charging Monthly Retainers

What if, instead of paying hundreds — or even thousands — of dollars each month for health insurance that you may not even be taking advantage of, you paid a retainer of somewhere between $39 to $79 a month to your primary care physician? Some doctors say this kind of service can work out to the benefit of both caregiver and patient. [More]

Insurer Sells Couple The Wrong Policy. Is An Apology Enough?

More than two years ago, a Florida couple called up a supplemental insurance provider to take out a disability coverage plan in case the wife became pregnant. Her work doesn’t cover maternity leave, but the policy would help pay the bills while cared for the child. That is, if the insurer had sold them the correct policy. [More]

Steps To Cut Costs For Glasses And Contacts

It can be expensive to keep your sight straight. Thankfully there are ways to keep down the costs for glasses or contact lenses. [More]

How I Lost $470 To A Vindictive, Abusive, Extortionist eBay Buyer

Justin used to sell on eBay until policy changes made it a more favorable marketplace for buyers than for sellers. But he still has his account and a good feedback rating, so he’s helping a friend sell off some gold coins worth a few hundred bucks each. They’re shipped UPS with signature confirmation and full insurance. The coin itself goes inside a plain envelope, placed inside a sealed cardboard UPS document mailer. This plan worked for 25 shipments, until the buyer from hell wandered into Justin’s life. [More]

How Going To HR Made A Health Insurance Co-Pay Hike Less Huge

The beginning of a new year often brings an unhappy change: rate and co-pay hikes for your health insurance. E’s insurer made a change to ER visit copays that, given that his daughter is being treated for cancer and makes more frequent emergency visits than most children, would have cost the family a lot more money. So he turned to his company’s HR department for help…and actually received it. [More]

How To Get Out Of Private Mortgage Insurance

Banks typically make homeowners with less than 20 percent equity add private mortgage insurance (PMI) premiums to their mortgage payments. The insurance helps the lender guard against the borrower defaulting on the loan. Owners who want to lower their payments can work toward getting rid of the insurance, but doing so can be tricky. [More]

States Push Insurers To Pay Off On Policies

Silly insurance companies, forgetting to pay off policies owned by beneficiaries of dead policyholders. Good thing state governments are there to help refresh their memories. [More]

Determining The Right Amount Of Life Insurance

If you rely on someone else’s income or financially support others, the decision of whether or not to buy life insurance is easy. Determining the right amount to buy is far more difficult, requiring an alchemy of guesswork involving lost income, projected expenses and life expectancy. [More]

Insurance Company Allianz Will Cover Your Next Space Flight

Just because you’re ready to drop $200,000 to take a quick trip into space with Richard Branson, there’s no reason you shouldn’t take out some travel insurance in case you lose your luggage or your medical coverage doesn’t extend beyond the stratosphere. At least that’s what German insurer Allianz is thinking. The company is rolling out a new policy, that could cost up to $10,000, for space travelers who want to play it safe. [More]

How Removing Your Late Spouse From A Car Insurance Policy Raises Your Premiums

Statistically, married people are safer drivers than unmarried people, and car insurance premiums vary accordingly One of the things that Dan had to take care of after his wife died was taking her off the car insurance policy. While the GEICO employee he spoke to was very kind and helpful, his new premium caught him by surprise. Removing his wife from the policy didn’t cut it in half: it raised it by ten percent. [More]