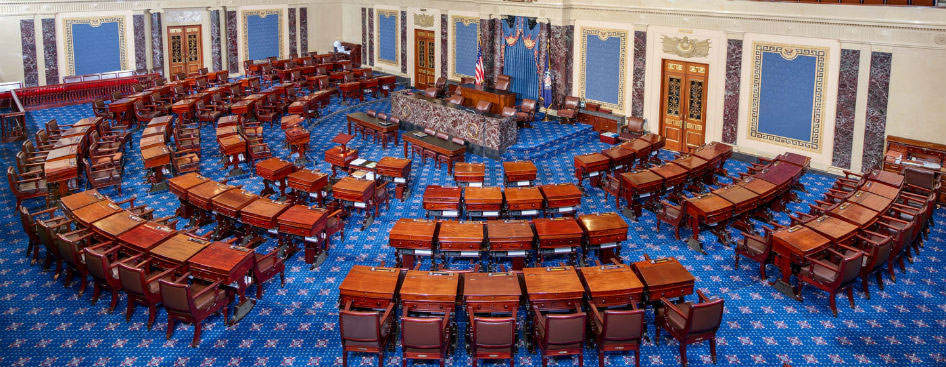

If anything is true of 2017, it is this: Confusion reigns. And nowhere do we see that more than in healthcare, where failed repeal attempts, executive orders, sudden, out-of-the-blue policy changes, and general unpredictable chaos have dominated the news.

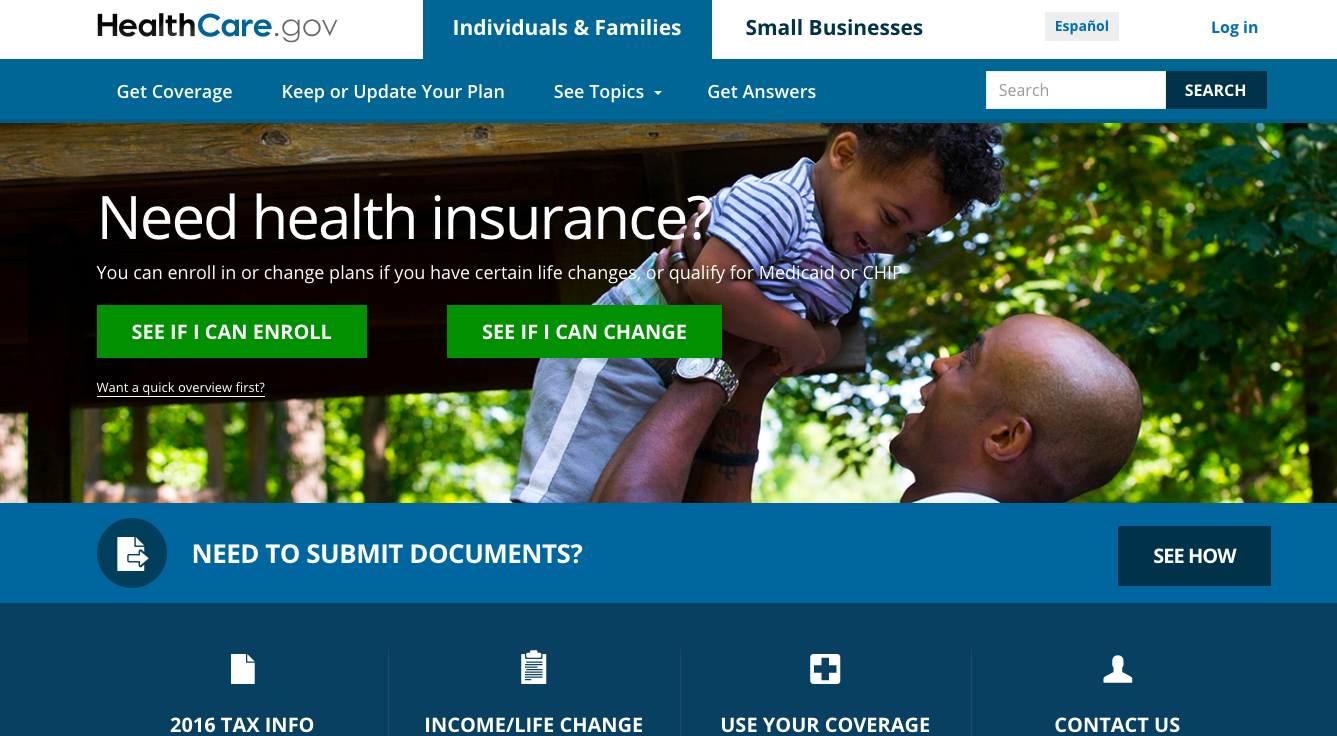

But the fact remains that Americans still need access to medical care, and for those who don’t have insurance through their employer or the government, the 2018 Open Enrollment period for individual insurance plans officially begins on Nov. 1. So what are the things everyone should know, but which may have been overlooked amid the maelstrom? [More]