If your FDIC-insured bank implodes, how long does it take for the FDIC to start paying depositors? Ever since IndyMac imploded, the question has no doubt been on many people’s minds. One reader emailed me saying that he had asked the his banker about how long it might take. Allegedly, the banker squirmed around before finally saying that the FDIC had 20 years to pay people back. This is not true.

indymac

10 Banks That Could Be Next To Go Under

IndyMac bank going under probably has you wondering, is my bank next? Various analysts are predicting that hundreds of small and regional banks could collapse in the next year. Here’s the top 10 list of the nation’s most troubled banks…

Help! How Can I Make Sure My Money Is Covered By The FDIC!?

The FDIC says there were over a billion dollars in assets at IndyMac that were not covered by the FDIC. Why not?

Banks Put 8-Week Hold On IndyMac Checks

People who got their money from IndyMac are facing new challenges as other banks put extended holds on releasing the funds when the checks are deposited. WaMu is putting 8-week holds on the checks. Wells Fargo is putting holds on amounts over $5,000. If you deposit more than that, Wells Fargo will only let you have access to the first $5,000. The Office of Thrift Supervision is looking into whether this is ok or not. Good, we needed something like this, that panic wasn’t looking frothy enough.

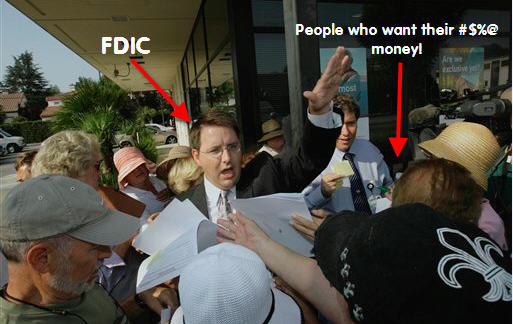

What Does A Bank Run Look Like In 2008? A Lot Like 1912.

The FDIC was created in 1933 by the Glass-Steagall Act, and provides $100,000 of deposit insurance to checking and savings deposits. “Bank panics” used to be fairly common, and the FDIC was intended to instill confidence in the banking system after the Great Depression. The most recent big failure, that of California bank IndyMac, will cost the FDIC between $4 and $8 billion, and they estimate that about $1 billion of IndyMac’s deposits are “potentially uninsured,” meaning that the depositors had more than $100,000 on deposit. So what does a bank run look like these days?

IndyMac Failure Demonstrates That The FDIC's Customer Service Skills Could Use Some Work

We’re always told not to worry about our bank failing because our deposits are insured up to $100,000 by the FDIC. Well, in case you were wondering what happens when a bank actually does fail, look no further than the great state of California, where IndyMac has been taken over by federal regulators and its customers are getting a taste of all the FDIC has to offer.

Regulators Seize IndyMac In The Second Largest Bank Failure In U.S. History

Ever hear of IndyMac Bancorp? Well, it’s gone! Federal regulators seized the California bank spawned by Countrywide founder Angelo Mozilowhich, which had giddily doled out mortgages to lenders without requiring proof of income. Rather than blame the second largest bank failure in U.S. history on the subprime meltdown, the charmingly politicized regulators at the FDIC blamed the bank’s demise on Senator Charles Schumer (D-NY). Huh?