Crapple writes: [More]

index funds

Index Funds Vs Fees Behind The Financial Advisers Curtain

“Guide to Transparent Investing” is a 53 page PDF about how financial advisers are ripoffs and you can do all your investing by putting your money in index funds. The basic principles they promote are to figure out how long you want to invest for, pick a portfolio based on your timeline and risk tolerance, and put the money in index funds. Set it, forget it, and spend more time doing the important things in life, like gardening and getting your scuba diving certification.

What Are "Expense Ratios?"

For the new investor considering mutual funds, one important comparison basis is their expense ratio.

Comparing Index ETFs and Mutual Funds

We understand that investing in index exchange trade funds (ETF) can be a good option for beginning investors, but what if you’re also looking at mutual funds, and you want to compare purchase costs between the two?

Financial Advisors Often Give Poor, Expensive Investing Advice

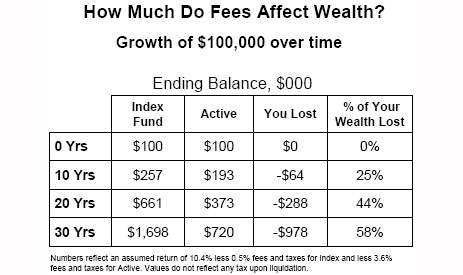

Want to get some investment advice that is expensive and doesn’t perform any better than other, less costly options? If so, ask your broker or financial advisor for investing advice. They’re much more likely to point you toward an investment with a “load” — a fee that ranges in price but generally runs 3% to 5% of your investment’s value — simply for them “recommending” it (some would say “selling” it is more accurate.)

An Argument For Index Funds

FreeMoneyFinance has a nice piece on why he invests mainly in index funds.