For most people, the IRS now has all the information it needs to estimate how much you owe in taxes, or how much of a refund you are due. So why is the burden on you to tell the federal government this same information? It may have something to do with the millions of dollars that H&R Block, Intuit (maker of TurboTax), and others have spent lobbying to maintain their exclusive arrangement with the IRS. [More]

income tax

DOJ Sues To Shut Down Liberty Tax Franchisee For Giving People Fake Jobs Based On Their Hobbies

Federal prosecutors are asking the court to shut down a Liberty Tax Service franchise in South Carolina, alleging that these locations have deliberately prepared false and inflated federal tax refunds by giving them income from fictional jobs and claiming children that don’t exist. [More]

IRS Agrees To Share Copies Of Fake Tax Returns With Victims Of Identity Theft

After lawmakers called on the Internal Revenue Service for more transparency for victims of identity theft, the agency says it will give those people copies of fake tax returns filed using their name and information. [More]

Undercover Investigation Finds Serious Problems With Paid Tax Preparers

With the deadline for filing your annual tax return coming quickly, millions of Americans are putting their 1040s and other forms in the hands of largely unregulated paid tax preparers. But a new undercover report from the National Consumer Law Center finds that many of these preparers either don’t know what they’re doing or are allowing taxpayers to file false information. [More]

You Get Two Extra Days To File Your Taxes This Year

When April 15 falls on a weekend or holiday, as it does this year and did last year, the IRS cuts you a break and gives you until the next business day to file your taxes. That means tax procrastinators won’t have to file until April 17, giving them two extra, frantic days to delay the inevitable. [More]

The Insanely Wealthy Keep Finding Ways To Pay Even Less Income Tax

You probably don’t get to have one the 400 highest adjusted gross incomes in the U.S. without having a clever accountant — and probably an entire law firm — at your disposal. So it shouldn’t come as much of a surprise that the folks who have attained that level of wealth are paying less income tax these days than they were in the early ’90s. [More]

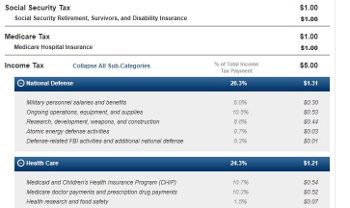

Check Your "Tax Receipt" To See Where Your Money Is Going

Here’s one receipt you might want to have checked… Even though today isn’t offically “Tax Day” (that’s been moved to April 18 this year), the White House has gotten into the spirit with its online “Federal Tax Receipt” calculator that intends to show you where your tax money is being spent. [More]

What To Do When An Employer Goofs Up Your Tax Form

Although it’s tempting to duck and cover to protect yourself from the onslaught of tax forms filling up your mailbox these days, it’s a good idea to examine the numbers on your W2s and 1099s to ensure they’re accurate. If an employer or bank screws up and reports it gave you more money than it really did and you don’t notice, you’re on the hook for the extra taxes. [More]

Fun Summer Project: Get Your Tax Records In Order!

Inc. magazine has published a list of tips on how to get your home business tax documentation in order right now, so next year’s tax filing will be trouble free. Sure, this isn’t the most exciting staycation idea ever, but on the other hand anything you can do at home you can do in your underwear with a six pack of beer. I should really become a motivational speaker. [More]

Tips For Those Filing Their Taxes At The Buzzer

If you’re going all Duke-Butler with your income taxes this year, Kiplinger’s Mary Beth Franklin has some tips you might find helpful. Here they are, posted with permission: [More]

Making The Most Of Medical Expense Tax Deductions

Kiplinger has advice on on how to maximize your medical expense deductions at tax time. You can only deduct out-of-pocket expenses that exceed 7.5% of your adjusted gross income, so you should try to bundle medical procedures in the same year if possible. [More]

How The IRS Picks Its Audit Targets

The IRS doesn’t just draw potential audit victims out of a hat. There is actually a method to its cruel madness, as outlined in this 2006 IRS.gov post spotted by Jim Wang of Bargaineering. [More]

Friday Is The Cutoff To Pay Estimated '09 Taxes Without Penalty

January 15th is the last day you can pay estimated taxes for 2009 without worrying about the IRS’s 4% interest penalty. For most people, you need to have paid 90% of what you owe for 2009 or have a good reason why you didn’t (e.g. casualty, retirement). Kiplinger notes that even if you can’t pay the full amount, pay whatever you can by January 15th to reduce the amount that’s penalized. [More]

A Value-Added Tax In America? What?

The Washington Post writes that a national sales tax, known in other countries as a value-added tax or VAT, is getting some attention in DC, even among Democrats, who traditionally don’t favor regressive taxing schemes. The article notes some pros and cons about a VAT, as well as the small problem that imposing a 25% sales tax on everything would be political suicide.

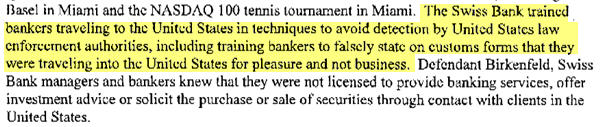

Senator Recommends That UBS Be Shut Down For Helping Thousands Of U.S. Citizens Cheat On Their Taxes

Another update to the disgruntled computer technician story: Sen. Carl Levin told ABC News that Swiss banking giant UBS’s banking license should be revoked until the bank “cleans up its act.” The bank is accused of arranging “undeclared” accounts for an estimated 19,000 US citizens, effectively “hiding” $18 billion from the IRS.

Did UBS Help Rich Americans Hide Billions Of Dollars In Liechtenstein?

Following up on yesterday’s story about a disgruntled computer technician who turned over the bank records from the LGT Bank of Liechtenstein, ABC News says that UBS Bank may have helped set up the secret accounts and been responsible for hiding as much as $20 billion dollars of U.S. money.

Tax-Relief Company Agrees To Refund $1.5 Million To Scammed Customers In 18 States

JK Harris & Company is a tax-relief company in South Carolina that promises to help people settle IRS debts for “pennies on the dollar” by helping them file an Offer in Compromise (OIC) on their behalf. What they didn’t tell consumers is that “the IRS accepts only a small number of these kinds of cases,” writes digtriad. What they also didn’t mention is that they’ll accept your money even if they know you won’t qualify for an OIC, and they won’t give refunds. “In many cases, JK Harris did not even apply to the IRS to help consumers as promised. But the company still refused to give those consumers their money back.” Now JK Harris has made an agreement with attorneys general in 18 states to change its advertising and pay $1.5 million in restitution.

Your Economic Stimulus Payment Questions Answered By The IRS

The IRS has a new and improved stimulus payment FAQ up and running on their website, so if you have additional questions you should check it out. Of note, the IRS has now definitively said that those who owe back taxes, or have delinquent child support payments or student loans will have their payments offset.