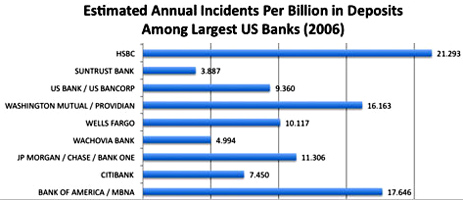

If you’re a customer with Bank of America or HSBC, you’re more likely to be a victim of identity theft, according to a new report. Chris Hoofnagle, a senior fellow at the Berkeley Center for Law and Technology at the University of California at Berkeley, compiled a list of all the banks mentioned in identity theft complaints filed with the FTC for January, March and September of 2006. Bigger banks obviously have more incidents, so Hoofnagle factored in their total number of deposits.”I’ve been working for years to try to spark a market, a true market, for competition on preventing fraud,” Hoofnagle told the NYT. “Some of these institutions have attempted to compete based on advertisements, but I’m a real believer in the idea that if you give consumers information, they can make better decisions.” This is only a fraction of the banks included, showing the worst offenders. Full graphs, inside…

identity theft

"For Security Purposes, This Card Is Not Active" Is A Lie

When you get a new or replacement credit card in the mail, you have to call the number on the back to activate it, or else you can’t use it, right? Wrong. Despite the sticker on the back that says, “For security purposes, this card is not active,” credit card companies are mailing out cards that can be used without phone activation. This is a problem if the letter containing your credit card is intercepted by an identity thief, like what happened to reader PC Guy. The kicker? He didn’t even request the card, it was a forcible reissue when his store-branded card switched from Visa to Mastercard. His story, inside.

Employees Play With Your Private Data And There Is Nothing You Can Do About It

Why play solitaire when you work for the utility company and can look up the mayor’s phone number? An Associated Press investigation reveals that casual snooping is widespread among employees who have access to large customer databases. According to one utility executive, it would be “difficult, if not impossible” to ferret out employees who use sensitive data for identity theft.

CSO Maps State-By-State Data Breach Disclosure Laws

CSO has produced an interactive U.S. map that shows what’s required of companies that suffer a data breach in the 38 states that care enough about consumer rights to have passed disclosure laws. Most are modeled after California’s strict SB1386 anti-ID theft law, but now you can tell at a glance what your state is doing about the issue—and in most cases you can click on the icon in the pop-up info box to see a copy of the actual law.

USPS & FTC Mail Out "Avoid ID Theft" Brochure

Today we received a handy brochure (PDF) in the mail from the postal service. “Deter, Detect, Defend,” it reads, and it offers a bunch of handy reminders of what to look out for when it comes to protecting your identity, and what to do if you suspect it’s been stolen. If yours was stolen (ha ha, we kid!), you can read read or download it from the FTC’s ID theft website.

WaMu Doesn't Know How To Deal With Potentially Fraudulent Account?

A reader writes in to tell us about “the world of suck I encountered at WaMu” over some wrong personal data. A year and a half ago, she started receiving Washington Mutual account mail—including overdraft and collection notices—for someone named Ly Ly V____ at her address. “I’ve lived at my home for 11 years, and have no neighbors with that name.”

Gas Station Attendant Busted For Re-Using Customers' Credit Card Numbers

A 23-year-old gas station attendant in Massachusetts has been charged with identity theft after a customer noticed that her card was used to make additional purchases a few hours after she’d been at the station.

Beware $429 Fradulent "ID Safe" Charges

Check your statements. Fraudulent charges of $429 for “ID Safe” are showing up on some people’s credit card bills. Which is odd, because usually these places use tiny charges so they’re more likely to go unnoticed. If you see a suspicious charge on your credit card, call your card company immediately to check it out and get it reversed if need be. On the credit card statement, the phone number listed for ID safe is 888-261-6045. After the jump, what happened to one consumer when he called the number and got through to the mastermind, who sounded like she was banging pots around in her kitchen…

Red Card! MLSGear.com Shoppers Exposed To Identity Theft

Computerworld is reporting that “a series of SQL injection attacks” on a third-party e-commerce company’s servers has compromised the personal data of customers who shopped at Major League Soccer’s MLSgear.com website. One affected customer told us he received a letter from MLSgear.com letting him know what had happened and offering him free credit monitoring services for a year, which is apparently the standing corporate response to personal data theft.

Mann Free Movie Tickets Settlement Requires Your Credit Card Number

Between December 2006 and January 2007, Mann Theatres in Southern California printed the expiration dates of credit cards on receipts. If you were one of the lucky suckers who saw a movie there during this period and paid via credit card, Mann’s lawyers want to make things right by giving you two free movie tickets and some free popcorn. However, to qualify for the free tickets, you have to provide your credit card number. This is like the end of “The Lion King” where the new cub is held aloft—the circle of life continues.

Missing Data On 650,000 Customers Related To Credit Card Fraud Surge?

On Tuesday we speculated that the surge in credit card fraud and forcible card reissues our readers have been reporting to us were the result of a recently discovered breach at a “major retailer,” and now GE Money Bank reported that the data of over 650,000 customers of JC Penney and hundreds of other retail stores is missing. Are these two events related? The official line is no. GE Money Bank says the data, which was stored on magnetic tapes, “was created in such a manner to make unauthorized access extremely unlikely and difficult, even for experts with specialized knowledge and technology.” But guess what?

Data Tape On 650k Customers From 230 Retailers Is Missing

Today GE Money reported that a data tape containing personal information on 650,000 customers from “about 230 retailers including J.C. Penney Co” is missing. Social Security numbers for about 150,000 customers were also on the tape. It was “being stored at a facility operated by Iron Mountain Inc, an information protection and storage company,” but there’s no evidence currently that it was stolen—it may just be sitting somewhere in a vast matte-painted warehouse like the Ark of the Covenant. However, it may also be the source of the recent wave of ID theft issues we’ve noticed.

Worst Business Reply Postcard Ever

Can you spot what’s wrong with this Business Reply postcard? That’s right, The Huntsville Times wants you to write down your full contact information and credit card number on a postcard and send it through the mail where anyone can see it. Hellooooo, identity theft.

"Major Retailer's" Data Breach Results In Wave Of Credit Card Fraud?

Anecdotal evidence suggests that a recently reported data breach by an undisclosed “major retailer” has resulted in a jump in consumers having their debit cards forcibly reissued, or calls from their bank to verify their recent purchase history. The problems seem to have started just around Christmas time and have continued into mid-January.

Thief Buys $812.28 In Shoes Using Personal Finance Columnist's Stolen Identity

A Washington Post personal finance columnist got her identity stolen and someone tried to use it to buy $812.18 worth of running shoes. Somehow, the thief had gotten access to the Nancy Trejos personal information and stolen her Bank of America debit card number. The crook placed an order online with the store and arranged for an in-store pickup. The clerk grew suspicious when the woman couldn’t produce the card used to place the order.

TSA Traveler Website Exposed Private Citizens To Risk Of ID Theft

The Transportation Security Administration’s traveler redress website—which was launched to give travelers a way to get their names removed from the government’s toddler-centric no fly list—operated for months without proper security in place, leaving citizens who submitted detailed personal information to it wide open to identity theft. Gee, we’re this close to thinking that the TSA is run by a bunch of grotesquely incompetent, slug-like bureaucrats.

../../../..//2008/01/13/please-tell-the-ftc-that/

Please tell the FTC that credit freezes help prevent identity theft. [Comment Form via All Consuming]

Mother Daughter Identity Thief Duo Used Jobs To Rip Off Citizens

A Washington mother/daughter tag-team of identity thieves abused their jobs as realtor and bank vice president, respectively, to apply for credit cards and cellphones in other people’s names. Cassidy Janosky, the daughter, would rifle through customer records at Bank of the West and get the necessary personal and financial details. Cynthia Walker, the mother, had access to unoccupied for sale homes through her job at Caldwell Real Estate and set them up as drops for the fraudulently obtained credit cards and cellphones. The pair were arrested spending thousands of dollars at Sears. Over 25 victims have been identified so far, and two flat screen TVs and an iPod seized. The number of victims, fraudulent goods, and even suspects could rise as the investigation continues.