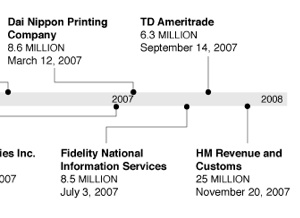

The info-loving people at Flowing Data pulled the figures on data breaches (available at Attrition.org) and created a chart showing the top 10 biggest breaches in the past eight years. The most disturbing trend, which probably will surprise few Consumerist readers, is that the breaches are increasing in frequency.

ID theft

8 Ways To Opt Out Of Junk Mail Lists

Direct mailers don’t believe in the concept of opting in, so if you want to cut down on the amount of straight-to-the-trash mail you receive, you’ll need to contact them directly and request that your name is removed. ForestEthics—the group behind the Do Not Mail Registry petition we blogged about earlier, has gathered several ways to contact the offending parties.

FDIC Call Center: Former Employee Says It's A Great Place For Bank & Credit Union Info

A former FDIC employee writes that the FDIC’s call center (877-275-3342) is “a tremendously helpful place to get basic referral information if you’re having trouble with your bank, lender, or finance company.” They can’t help you with complaints, but they can route you to the correct agency, provide credit union contact info, and give you the names and numbers of state agencies where your bank is located.

Medical Records Sold As Scrap Paper

A fourth grade teacher in Salt Lake City, Utah, bought a box of scrap paper for $20 and discovered it was actually a box of medical records of 28 patients from Central Florida Regional Hospital. The hospital shipped the box via UPS to an audit company in Las Vegas last December. The hospital claims it had been tracking the box since February, but hadn’t told the patients. As for the teacher’s class, her next assignment for the students will be, “Apply for credit card offers using SSNs from the scrap paper box.”

Chase Rep Cancels Credit Card Because Of Mint

A hyper-vigilant Chase CSR canceled a woman’s credit card and issued her a new one when she called in to confirm her interest rate, because Mint was showing a slightly higher rate. A Mint representative confirms that “while we can generally get pretty good info about APR, APR can vary widely by customer & there won’t always be a 100% match (that’s why we allow customers to edit their account information).”

Hey Kids, It's National Consumer Protection Week!

Uhh, apparently this week is National Consumer Protection Week, which is supposed to “highlight consumer protection and education efforts around the country.” Translation: the government put up a mini-website from, like, 1976, with a page of links and some banners for the taking. That’s fine with us—we’ll just claim the other 51 slots as National Consumerist Weeks.

../../../..//2008/02/29/the-top-10-most-common/

10. Business fraud: 722

Yikes, that’s a lot of ID theft complaints. You should really consider shredding all of your paper garbage before you throw it out and all that other good stuff—whether you live in Illinois or not. [Sun-Times]

Watch Out For Medicare Scams

The March issue of Kiplinger’s features an article that will help you spot a medicare health scam before you (or your family) get taken for a ride. Watch out for sneaky insurance agents who ask for personal information or say they are from medicare and can reduce your premium:

CSO Maps State-By-State Data Breach Disclosure Laws

CSO has produced an interactive U.S. map that shows what’s required of companies that suffer a data breach in the 38 states that care enough about consumer rights to have passed disclosure laws. Most are modeled after California’s strict SB1386 anti-ID theft law, but now you can tell at a glance what your state is doing about the issue—and in most cases you can click on the icon in the pop-up info box to see a copy of the actual law.

USPS & FTC Mail Out "Avoid ID Theft" Brochure

Today we received a handy brochure (PDF) in the mail from the postal service. “Deter, Detect, Defend,” it reads, and it offers a bunch of handy reminders of what to look out for when it comes to protecting your identity, and what to do if you suspect it’s been stolen. If yours was stolen (ha ha, we kid!), you can read read or download it from the FTC’s ID theft website.

Retail Management: "We Have To Check ID Or We Get Screwed By Credit Card Companies"

Scott, a member of management for a retail chain, wants to share the other side of the checking-ID debate:

Your website continually runs stories about how merchants aren’t allowed to ask for ID during a credit transaction. I work on the management team at a nationwide retailer, and credit card fraud occasionally hits our location. Every so often, we are hit with something called a ‘retrieval request’ from one of the big 4 credit authorization companies (Discover, AMEX, MC, Visa). This means we have 48 hours to provide a legible signed receipt, and video evidence of my staff checking a photo ID to verify the cardholder.

A Stranger Is Using The Bank Of America Debit Card That Is Sitting In My Desk Drawer

The other day reader Dave wrote us because he’d noticed a bunch of strange debits from Sprint on his bank account. Since he uses Sprint, he thought it was a billing error, albeit a serious one, because Sprint had debited $1,717.49 in the past two weeks. Dave hadn’t been able to find anyone at Sprint to help him reverse the charges and wrote to us for advice. Yikes!

I Call This My WaMu Nightmare

Reader Krissy writes in with an absolutely horrible story about dealing with WaMu after her purse was stolen. She’s been living without a checking account or debit card since October because of WaMu.

Card Skimmer Harvests $10,000 From 45 Victims At California Gas Station

Police suspect that a card skimmer installed at a gas station in El Monte, CA is responsible for $10,000 in credit card fraud, says KNBC:

“It looks like the victims were gassing up here and using the outside pump terminals, and their credit card information was compromised,” El Monte police Detective Brian Glick said.

National Retail Federation: Credit Card Companies Don't Care About Data Security

Last Sunday’s 60 minutes had a report by Lesley Stahl about the now-infamous TJX data breach.

Phishing Scams Hurt The Brands They Target

Ars Technica reports that “42 percent of adults in the UK feel that their trust in a brand would be greatly reduced by receiving a phishing e-mail claiming to be from that brand, according to an online survey conducted by research firm YouGov.”

Commerce Bank Might Have Given Out SSNs And Account Numbers, Not Sure

Commerce Bank isn’t sure whether it accidentally gave out your SSN and account number, so its going to write you a letter to offer you some free credit report monitoring.

Home Depot Employee Caught Issuing Store Cards To Fake Customers

Criminals beware. You can be charged with “first-degree id theft” even if the “person” you’re “ID thefting” is Harvey the Rabbit.