Ask someone if they’d rather walk 75 yards for free or maybe get pushed in a wheelchair and most everyone is going to say they’d rather do that than shell out $3,000 for an ambulance ride. An 84-year-old man says he doesn’t quite get why nurses told him he had to take an ambulance from the hospital to the medical offices next door to get an MRI. [More]

health insurance

Woman Moves 10 Miles, Gets Hit With 25% Health Insurance Hike

Health insurance companies are allowed to charge different rates depending on where you live, but one would think that moving within the same region you’ve been in for more than a decade would not have a serious impact on your monthly rate. Try telling that to the woman in California who now faces an additional $1,272 in insurance premiums after moving 10 miles. [More]

If You Haven’t Seen Your Doctor In A Few Years, Expect To Pay ‘New Patient’ Fee

For years, a growing number of healthcare providers have been tacking on fees that most patients didn’t notice because they were being paid by insurance companies. But as insurance companies trim the list of fees they’ll cover — and employers shift to cheaper health plans to keep costs from skyrocketing, consumers are being hit with fees they weren’t expecting. [More]

Darden Experiments With Cutting Worker Hours To Avoid Paying Health Insurance

As more pieces of the Affordable Care Act federal health care law come into effect, employers are evidently beginning to brainstorm ideas to save money and avoid having to provide health care for their employees. Darden Restaurants, owner of chains such as Red Lobster, Olive Garden, and LongHorn Steakhouses is trying out a venerable tactic from the retail industry: keeping employee hours just a hair under “full-time” so they don’t have to provide benefits. [More]

Is CVS Pressuring Pharmacists To Refill Prescriptions Automatically?

While a lot of medications are intended to be taken on a regular, predictable basis, a number of drugs are only taken when needed, which means customers are getting refills less regularly. But recently uncovered e-mails seem to indicate that at least some CVS pharmacists are being pressured to automatically refill prescriptions in order to cash in on insurance payments. [More]

Sears & Olive Garden To Give Workers Money To Go Choose Their Own Health Insurance

The powers that be at two large U.S. companies — Sears and Darden Restaurants (Olive Garden, Red Lobster, LongHorn Steakhouse, and others) — are looking to transition away from their traditional employer-sponsored health insurance and toward a model that gives employees a fixed amount of money with which to buy coverage. [More]

This Is Why People Hate Health Insurance Companies

For many people, health insurance premiums take a sizable bite out of their paychecks. Which would be somewhat tolerable if insurance companies did anything to ease the process of actually receiving medical care. Heck, most of us would tolerate the pricey payments if insurers just did the bare minimum of what they are supposed to do and didn’t put up roadblocks to getting the proper care. And yet that simple concept appears to be too complicated for some insurance providers to grasp. [More]

State Insurance Regulators Don't Always Have Authority To Regulate Insurance Rates

Earlier this week, the Dept. of Health And Human Services announced that consumers had saved $1 billion thanks to a condition of the Affordable Care Act that requires state insurance authorities to review health insurance premium increases of at least 10%. But in some states, those reviews are merely a formality that have no ability to rein in insurance premiums. [More]

More Uninsured Americans Not Filling Prescriptions, Delaying Doctor's Visits, Skipping Medical Procedures

While the U.S. economy is arguably inching toward improvement, costs for health insurance continue to climb. Combined with still-high unemployment and a growing number of employers requiring employees to pay a larger share of their insurance premiums, and there are a lot of uninsured and under-insured Americans out there. And according to the Consumer Reports annual prescription drug poll, a growing number of these people are going without needed care or medication. [More]

Will Affordable Care Act Lead To More Or Less People With Employer-Sponsored Insurance? (Hint: No One Knows)

With the clock ticking down to 2014, when many of the controversial portions of the Affordable Care Act start kicking in, the folks at the Government Accountability Office thought they would look into whether or not certain provisions in the law would cause some employers to stop offering health insurance to employees, or cause them to add benefits, or lead consumers to look for cheaper options elsewhere. After sifting through available studies, the GAO came to a conclusion that we’ll probably just have to wait and see. [More]

My Insurance Rebate Disappears Into Black Hole. Anthem Tells Me To Complain To Someone Who Cares

You may be one of the millions of Americans who, as part of the Affordable Care Act, should be receiving a rebate from your health insurance provider, usually distributed to your employer. But what if you’re also one of the millions of Americans whose employer is no longer in business? [More]

Some Employers Plan On Dropping Health Benefits To Deal With Rising Medical Costs

In somewhat troubling news for the more than 160 million Americans who get their healthcare through employer-sponsored programs, almost 10% of those employers say they’ll likely drop health coverage for their workers in the next three years, blaming rising medical costs. [More]

12.8 Million Americans To Get Health Insurance Rebates

Good news for 12.8 million Americans — insurers will start doling out $1.1 billion in rebates to reimburse consumers for spending too much of premiums on overhead, instead of mostly on medical care. [More]

Anthem BCBS Decides Boy Who Can’t Sit Up On His Own Doesn’t Need A Wheelchair

There’s a 2-year-old in New Jersey whose cerebral palsy makes it impossible for him to walk or even sit up without support. But according to the computers at Anthem Blue Cross Blue Shield, he should give a cane a try before Anthem forks over the cash for a wheelchair. [More]

Aetna Says Doctor Made Billing Error, But The Patient Is The One Who Owes $6K For MRI

The wonderful world of medical billing, where not up is down, left is right, and the patient is somehow the one left with a hefty bill if their surgeon screws up on the paperwork. [More]

Sometimes It's Cheaper To Pay Cash Than Use Your Insurance

We all know that health insurance is supposed to lower our hospital and doctor bills to a level below the list price for procedures and services, but that doesn’t mean you’re getting the lowest possible price. In fact, you can sometimes end up getting the best deal on health care if you can afford to pay cash. [More]

Ohio Man Selling $1000/Cup Kool-Aid To Raise Money For Doctor Bills

When life hands you three bouts of pancreatitis, gall stones, a cholecystectomy, and possibly kidney stones, you make incredibly expensive lemonade in the hopes that some generous folks will pay — and that the local news will pick up your story. [More]

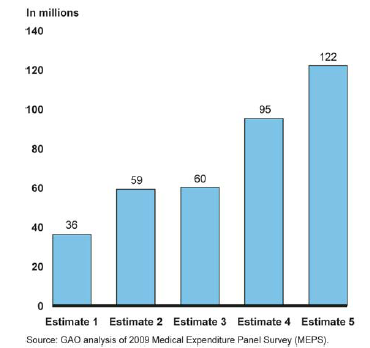

Between 36-122 Million Americans Have Pre-Existing Conditions That Would Restrict Health Insurance Coverage

Health insurance providers have a long history of telling individual policyholders — and people shopping for individual policies — that their care isn’t covered or their policy is voided because of a pre-existing condition. Starting in 2014, that is all supposed to stop when a condition of the Affordable Care Act kicks in, making it illegal for health insurers in the individual market to deny coverage, increase premiums, or restrict benefits because of a pre-existing condition. Question is: Just how many people are we talking about? [More]