Spammy “discount health care” pitches are hated by anyone who owns a fax machine, but now scammy health insurance vendors have taken to robocalling people, too. Reader Dustin was annoyed enough that he decided to track the calls to their source.

health insurance

ADP: Unemployed Need To Apply For Program In Which They Were Already Enrolled

One of the programs of the American Recovery and Reinvestment Act is COBRA Continuation Coverage Assistance. It helps people who have lost their jobs pay the sometimes hefty premiums for continued health insurance coverage, paying 65% of their premium. The program started in February, and Renee was enrolled right away. This month she was billed for her full premium again with no warning.

Ask The Consumerists: Should Everyone Take Advantage Of $4 Generics?

Back in April, reader B. e-mailed the Consumerist tipline about a change to his health insurance plan’s prescription drug schedule. It raised a drug that he’s taken for years, the generic version of Prozac, to a different schedule—more than tripling B.’s co-pay, from $8 to $25.

Pfizer Offers Free Medication To Unemployed Or Uninsured Patients

It’s hard for journalists (and bloggers) to resist a story that they can entitle “Free Viagra,” and pharmaceutical company Pfizer knows it. This recent publicity stunt is still newsworthy even without that headline, because of its purpose, and the problem for drug companies that it illustrates.

What's HIPAA All About?

If someone says “HIPAA” and you think they might be talking about a herd of hippos, you got some reading to do. The “Health Insurance Portability and Accountability Act” protects the health insurance workers and their families when they lose their jobs, and also protects the confidentiality of patients’ records. Like all big laws, it’s a bit of a thicket to navigate, so the World Privacy Forum just published a “Patient’s Guide to HIPAA” to help chop your way through it. Check it out and bone up on your rights.

Former CSR: Was Following Federal Law To Help Someone The Right Thing To Do?

Jason writes in with an ethics question that’s been bothering him for the past seven years: should he have helped a cancer-stricken patient who lost her family in the 9/11 attacks qualify for COBRA coverage? Sure, it sounds like a no-brainer, but it gives us a chance to see the sort of conflicts that gnaw at customer service representatives. Do they follow the rules and keep their jobs, or do the right thing and help the customer? Consider his conundrum, inside…

Family Of Daughter Who Died After Cigna Denied Her A Liver Transplant Files Lawsuit

Remember last December when Cigna delayed approval of a liver transplant for a leukemia patient and she died? The girl’s family has filed a lawsuit against the insurance giant.

FTC Launches Older Patient Info Site

The FTC launched the strangely named “Who Cares” resource site for older patients and those who care for them. It’s a reliable source for knowledge about generics, hormone therapies, hiring caregivers, hearing aids, and alternative treatments, located at ftc.gov/whocares.

Faced With A Broken Health Care System, Some Doctors Are Opting-Out

A combination of rising costs and low insurance reimbursements is forcing some primary care physicians to opt-out of the insurance game completely — accepting a flat fee instead of private insurance or Medicare. For a $4,500 annual fee, patients who formerly used their insurance to pay for doctor’s visits can get 24-hour access to doctors, unhurried appointments, home visits and state-of-the-art annual physicals. Or they can find another doctor.

Hospital Bills Woman For Waiting 19 Hours Without Seeing Dr

Amber Joy Milbrodt waited for 19 hours in a Dallas emergency room to get her broken leg fixed without seeing a doctor before she finally left. Two weeks later, she got a bill for $162. The hospital says it was for when a nurse checked her vital signs. “She’s not paying for waiting…She’s paying for the assessment she received.” said Rick Rhine, the hospital’s vice president in charge of billing. “It should have been more like them paying me for having to sit in the emergency room for 19 hours,” Amber told The Dallas Morning News. Amber says she’s not going to pay the bill.

Tonik Insurance Sneaks 20% Premium Increase On Customer After Approval

Tonik is the rad, x-treme! lifestyle health insurance for young people who can’t afford regular insurance—sort of the Poochie of health insurance, except it’s not going to go away. Aasma wrote to us to let us know that when she signed up for it over the weekend, she got a nasty surprise after she submitted her credit card information.

Your Best Investment: Your Health

It’s been suggested that your career is your biggest financial asset because it fuels all of your financial progress — it grows your net worth, pays for your living expenses, sends your kids to college,funds your retirement, and the like. That’s why we protect our careers with products like disability, medical, and life insurance, because without the ability to work — even for a limited amount of time — most of us would experience severe financial hardship.

BCBCS Must Think Your Breasts Are A "Pre-Existing Condition"

Marc’s girlfriend found some lumps in her breasts, the mammogram and ultrasound came back ok, but BCBS is denying coverage for the biopsy, saying it’s a “pre-existing condition.” The out-of-pocket cost is over $2,000. We’re confused, BCBS. What pre-existing condition? That she has breasts? That she might not have cancer?

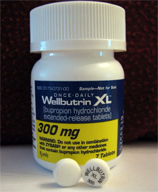

Shun Brand Name Drugs With Two Letters After The Name And Save

What do those little letters, CD, ER, SR, etc, after a brand name drug’s name mean? The exact terminology varies, but they usually translate to the same thing: unnecessary ripoffs.

14 Ways To Save On Drugs Big Pharma Doesn't Want You To Know

It’s no secret that prescription drugs are expensive, but it is a bit of one that they don’t have to be. Dr. Edward Jardini’s book, How To Save On Prescription Drugs, has 20 methods that anyone can use to drastically cut the costs of long-term medications, without sacrificing quality. Here’s 14 of them:

Your Brother Committed Suicide? No Insurance For You

Consumer Reports has an interview with the mother of a young man who couldn’t get any insurance because, after his brother committed suicide when he was younger, he saw a psychiatrist for a few sessions. He went uninsured after he aged out of his father’s coverage and taking jobs with no health benefits. Then, while he was cleaning it, his pickup truck burst into flames.

Doctor Holds Patient Hostage Until She Pays Her Bill

A doctor named John Drew Laurusonis and two of his assistants in Georgia have been accused of locking a woman in an examination room “when concerns arose about her ability to pay the bill.” The three were indicted last week on charges of false imprisonment for the October 4th, 2007 incident.