In 2015, nearly 40% of all federal student loan borrowers over the age of 65 were in default, thanks in part to issues they faced when it came to the servicing of their debts, including problems enrolling in income-driven repayment plans and accessing protections as co-signers. [More]

garnishments

Report: Nearly Four Million Workers Had Wages Garnished For Consumer Debts In 2013

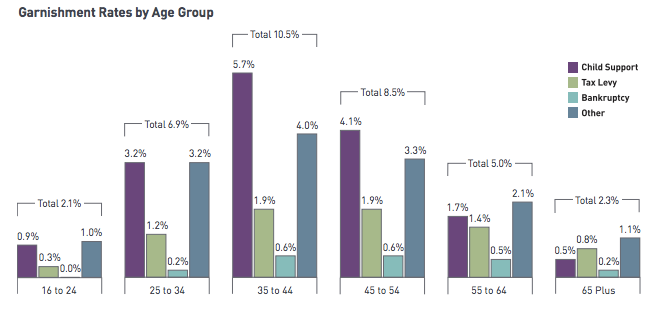

For most Americans every penny counts when it comes to their paycheck, but for some workers nearly a quarter of their wages are taken to pay for past debts in a process known as garnishment. The prevalence of this type of pay seizure grew significantly in the last few years leaving more consumers struggling financially. [More]

Debt Collectors Use Pocket Service Laws For No-Courts-Required, Insta-Garnishment!

In Minnesota, debt collectors can send a garnishment request directly to your bank and start snatching your dollars without even having through a court of a law.