Uhh, apparently this week is National Consumer Protection Week, which is supposed to “highlight consumer protection and education efforts around the country.” Translation: the government put up a mini-website from, like, 1976, with a page of links and some banners for the taking. That’s fine with us—we’ll just claim the other 51 slots as National Consumerist Weeks.

fraud

HSBC Fraud Story On WNBC4

If you live in the New York Metro area, tune into NBC channel 4 like right now to see a followup on the widespread HSBC fraud story we broke. They interview Corey, the fiance of Emily, a Consumerist reader and HSBC fraud victim. WNBC tells us that the FBI said they they were generally aware of fraud in the area, but not this specific HSBC matter, and will be looking into the case. It’s par for the course that the bank would be more interested in avoiding bad publicity quiet than going after the scammers stealing your money. UPDATE: Just watched it, HSBC is saying that a credit card payment processor lost the customer data and so other banks could be affected too. However, when WNBC contacted other banks, Chase and Citi said they had not heard of missing money, Mastercard said they have not issued a system-wide alert, and VISA said they’re looking into it.

HSBC Confirms Customer Card Data Was Stolen

HSBC confirmed that thieves stole card payment data from the bank and they were reissuing 6,000 atm/debit cards to customers affected by the breach. One Consumerist reader, Keith, had $2000 stolen from him via an ATM in Bulgaria, and another, Emily, had $2,800 siphoned from her account from ATMs located clear across the country. (Emily also got interviewed on WCBS and we got a mention and a screenshot). Checking the comments section, it looks like 11 other Consumerist readers were affected by the HSBC fraud as well, with a number of the fraudulent withdrawals being made from Montreal and Canada. Sounds like the thieves stole the data, which contained both card numbers and PIN codes, and then cloned ATM/debit cards. If you’re an HSBC customer, might be a good time to change your PIN number.

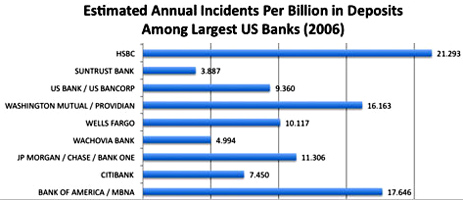

HSBC Is The Most Identity-Theft Prone Bank

If you’re a customer with Bank of America or HSBC, you’re more likely to be a victim of identity theft, according to a new report. Chris Hoofnagle, a senior fellow at the Berkeley Center for Law and Technology at the University of California at Berkeley, compiled a list of all the banks mentioned in identity theft complaints filed with the FTC for January, March and September of 2006. Bigger banks obviously have more incidents, so Hoofnagle factored in their total number of deposits.”I’ve been working for years to try to spark a market, a true market, for competition on preventing fraud,” Hoofnagle told the NYT. “Some of these institutions have attempted to compete based on advertisements, but I’m a real believer in the idea that if you give consumers information, they can make better decisions.” This is only a fraction of the banks included, showing the worst offenders. Full graphs, inside…

"For Security Purposes, This Card Is Not Active" Is A Lie

When you get a new or replacement credit card in the mail, you have to call the number on the back to activate it, or else you can’t use it, right? Wrong. Despite the sticker on the back that says, “For security purposes, this card is not active,” credit card companies are mailing out cards that can be used without phone activation. This is a problem if the letter containing your credit card is intercepted by an identity thief, like what happened to reader PC Guy. The kicker? He didn’t even request the card, it was a forcible reissue when his store-branded card switched from Visa to Mastercard. His story, inside.

Is Your Vet Ripping You Off?

KNBC went undercover and found a bunch of vets are more sales people than pet doctors, using fear to sell more treatment than is necessary. They took pets with minor ailments, checked out by a vet, to several different vets. Instead of getting the minor fixes they should have been recommended, these vets advised expensive extra tests, procedures, and medicines geared more towards lining their pockets than healing the pets. One dog had an upset stomach but was recommended a $300 “eyelid scraping,” despite his eyes being perfect. When confronted, the vet said she had done nothing wrong, and “eyelid scraping is not done in the states, but she used to do it in Austria.” She also admitted there was nothing the matter with the dog’s eyes. The report says that if you get recommended an expensive procedure, get a second opinion.

Very Strange Circuit City iPod Touch Bait And Switch

Ian writes:

Last Thursday 2/14, I ordered a 32GB iPod touch from CircuitCity.com at $474 + tax for a total of about $514. After thinking about it for a bit, I logged back in and canceled the order – just a bit too steep for an iPod, you know? I figured I’d have to wait a while for the price to drop, and left it at that. Well, believe it or not, I received a call at work today from a Circuit City sales rep at corporate telling me he’d offer me the iPod at a discount, so CC could keep my business. I was baffled – nothing like this has ever happened to me before, but the price he gave me $420 + tax… was too good to pass up.

Enzyte's Steve Warshak (And His Mom) Found Guilty!

Hooray! Steve Warshak, the snake oil salesman responsible for Enzyte (and consequently for those awful “Smiling Bob” ads) was found guilty today of conspiracy to commit mail fraud, bank fraud, and money laundering. So was his mom.

Is Retail Renting Ethical?

The Boston Globe has an interesting article in which they attempt to explain the phenomenon of “retail renting” or “wardrobing”–where consumers buy items with the intention of returning them when they’re done with the prom or the meeting or whatever. The article blames a mix of influences, including the economy and celebrities who obviously borrow many of their fancy gowns and jewelry.

USPS & FTC Mail Out "Avoid ID Theft" Brochure

Today we received a handy brochure (PDF) in the mail from the postal service. “Deter, Detect, Defend,” it reads, and it offers a bunch of handy reminders of what to look out for when it comes to protecting your identity, and what to do if you suspect it’s been stolen. If yours was stolen (ha ha, we kid!), you can read read or download it from the FTC’s ID theft website.

Is HSBC Straining Under An "Unprecedented" Wave Of Fraud Activity?

If you’re an HSBC customer, check your account, as there may be a wave of fraudulent activity hitting your bank. Two days ago we wrote about the guy in the U.S. who discovered his account had been drained by someone in Bulgaria. Later that day we received an email from Emily in NYC who was having similar problems, only her fraud-buddy was in California and Canada making withdrawals on her account.

Emily’s fiancé wrote back to us today with an update, and according to Emily, the HBSC Fraud Investigator who spoke to her “said that their fraud department was so overwhelmed, it was ‘still in the developing stage of how we’re going to handle’ it. I asked if she knew how many customers were affected and she stated ‘We don’t even know.'”

WaMu Doesn't Know How To Deal With Potentially Fraudulent Account?

A reader writes in to tell us about “the world of suck I encountered at WaMu” over some wrong personal data. A year and a half ago, she started receiving Washington Mutual account mail—including overdraft and collection notices—for someone named Ly Ly V____ at her address. “I’ve lived at my home for 11 years, and have no neighbors with that name.”

HSBC Won't Tell You Someone In Bulgaria Is Stealing $2,000 From You

Keith writes:

On Friday February 15th I called HSBC customer service. I explained that there was a $1,000 difference between my “Bank Balance” and I was concerned because I hadn’t used my ATM card. They said that the money was “on hold.” They could give no further explanation. I pressed them and said “How is it possible that $1,000 of my money is out in space” They had no reply. I asked to speak to a supervisor to which the person I was speaking to refused and said “They have the same information I do and they are not available.” I was talking to outsourced “customer service reps” from the Philippines so I hung up and dialed 716.841.7212 again. I kindly explained my store from scratch to Helga REP # 6124, also in the Philippines, not Buffalo, NY. She said the same thing as the guy before (at least they were consistent), and refused to let me speak to a supervisor.

Beware $429 Fradulent "ID Safe" Charges

Check your statements. Fraudulent charges of $429 for “ID Safe” are showing up on some people’s credit card bills. Which is odd, because usually these places use tiny charges so they’re more likely to go unnoticed. If you see a suspicious charge on your credit card, call your card company immediately to check it out and get it reversed if need be. On the credit card statement, the phone number listed for ID safe is 888-261-6045. After the jump, what happened to one consumer when he called the number and got through to the mastermind, who sounded like she was banging pots around in her kitchen…

Top 20 Consumer Fraud Complaints Of 2007

The FTC today released its top consumer fraud complaints of 2007. Based on complaints filed by consumers, identity theft is the number one complaint by a very wide margin, taking 32% of all complaints. The next closest complaint category was Shop-at-Home/Catalog Sales, which only took 8% of the complaints. Here’s how the bastards break down:

Seller Gets Scammed On eBay Despite Doing Everything Right

Read the tragic tale of this screwed eBay seller over on Metafilter. He did everything Paypal told him to do to avoid being scammed when he sold a cellphone, including, when the buyer returned the item, opening it in front of a police officer. Problem was, the buyer/scammer sent back a smashed gold cellphone instead of nice $500+ cellphone that was sold. Seller protection policy should apply, right? Nope, it doesn’t cover “items not as described.” Failure.