A reader who would like to be called CrazyNJConsumer writes in with another one of those “mismatched serial number” PS3 stories. The scenario usually goes like this: You buy a PS3. It’s broken. You return it. The store checks the serial number and finds that it doesn’t match. They accuse you of swapping your old broken PS3 for a new one and refuse to take the return. You are very sad.

fraud

Why Did Advance Auto Still Have Customer Credit Card Numbers On File From 7 Years Ago?

From the Richmond Times-Dispatch:

Advance Auto said a computer hacker may have gotten financial information of up to 56,000 customers at 14 stores in Virginia and seven other states. The Roanoke company said the customers shopped at the 14 stores from December 2001 to December 2004.

Why would a company have customer info on file for so long? I found one credit card processor’s FAQ which said that the max for chargebacks is 180 days, which is only in the case of when a merchant has violated merchant rules (otherwise it’s 120). So Advance Auto was about 2375 days overdue for a records wipe. It’s time to start tightening up the lax security standards on the retail level that have created a playground of plunder for identity thieves.

(Thanks to Volksaddict!)

Sprint Twiddles Thumbs While 12-Year Customers Get Scammed For $2,500

Someone hacked this couple’s Sprint account, and bought four new phones on it, leaving these 12-year customers to pay over $2,500. Every time they called Sprint, the fraud department said not to worry and that the charges would be off the bill next month, but the disconnect notices kept arriving until Sprint shut off their phone. Only after a local consumer reporter got involved was the problem solved. When asked why it took so long, Sprint said, “it takes a while to complete a thorough investigation.” If you’re a legacy Nextel customer now with Sprint, you may want to ask about getting a PIN set up on your account. The account seemed to have been targeted (the fraud department said probably by someone inside Sprint) because it was an old Nextel account that didn’t have a PIN.

Scam Watch: Credit Card Shaving

Have you heard of “credit card shaving?” In this version of credit card fraud, thieves try out 16-digit number sequences until hitting one that works. Then they take gift cards from stores and shave off the digits and glue them onto a credit card. They scratch the magnetic strip so the clerk has to enter the credit card number by hand. It’s apparently all the rage in Portland There’s no defense against it except to monitor your statement for suspicious charges.

Hannaford Credit Card Theft Caused By Malware, Not Database Breach

Most corporate credit card data theft happens at the database level, like the massive T.J. Maxx breach. But Hannaford has notified investigators that the recent theft of 4.2 million accounts was caused by malware that was installed on the servers at each of its 300 locations. The software “intercepted data from customers as they paid with plastic at checkout counters and sent data overseas,” reports CNET.

Manager Defends Retail Renting As Valuable Sales Tool

A former camera store manager came forward to defend retail renting as a common tactic that helps drive sales. Retail renting is when a customer buys a pricey item like a prom dress with the intention of returning it later. Our completely unscientific poll shows that 70% of you disapprove of retail renting, but our tipster insists that it is a victimless crime and a valuable sales tool. Our enlightening chat with the former manager, inside.

Identity Theft + Mortgage Fraud = Home Stealing

* From time to time, it’s also a good idea to check all information pertaining to your house through your county’s deeds office. If you see any paperwork you don’t recognize or any signature that is not yours, look into it.

Thankfully they also say that “home stealing” so far does not appear to be very common.

../../../..//2008/03/27/the-minnesota-financial-crimes-task/

The Minnesota Financial Crimes Task Force has given up on investigating mortgage fraud. “We don’t have the staff or funding to address it,” said Mike Siitari, Edina police chief and oversight council chairman. “We have hundreds of cases of backlog.” [Pioneer Press via Caveat Emptor]

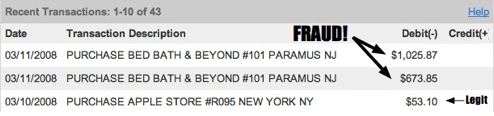

Fight Fraudulent Credit Card Charges

A thief charged over $1,600 to my credit card at Bed Bath & Beyond. Here’s how I responded:

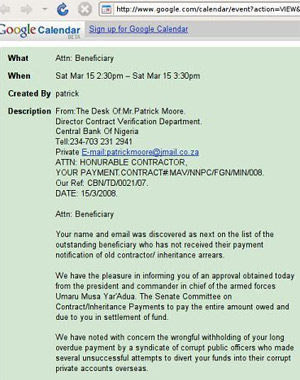

Phishers Target Google Calendars

Phishers have a new target: your Google Calendar. Nigerian-419-type scammers are spamming sending their messages as meeting invites on people’s Google’s Calendars. This happened to me a few days ago. One way to combat it is to change the “Automatically Add Invites To My Calendar” setting from Yes to No.

Best Buy Sells Broken PS3 With Mismatched Serial Numbers, Denies Return

So, I take in my broken PS3 to Best Buy today, to replace it of course, and they refused to because the serial number on the console is different from that of the box. They accuse me of trying to trade back a different PS3 than the one I bought (I guess there are idiots that do that), in order to get out of paying to have it replaced. This, of course, is total crap because I bought this EXACT PS3 the night before.

4.2 Million Credit Cards Exposed In Hannaford Supermarket Security Breach

A security breach at the Hannaford east coast supermarket chain has lead to the exposure of some 4.2 million credit cards. The company said it was aware of at least 1,800 cases of fraud directly connected to the breach. If you shopped at Hannaford’s from Dec. 7 to March 10., when the breach is thought to have occurred, now is a great time to close your current credit and debit cards and get new ones. Side note: when clicking around their official website we found many sub-pages are down, saying they’re currently “undergoing site maintenance.”

Any Joe Sixpack Can Be A Phisher

The popular conception of phishers is of shadowy electronic masterminds, using a mix of technical prowess, deception and anonymity to trick consumers into handing over the bank account details. Actually, most of them are too stupid to design their own websites. That’s what two security researchers found when they delved deep into the online phishing community.

Round 3: Ticketmaster vs Wachovia

This is round 3 in our Worst Company In America contest, Ticketmaster vs. Wachovia. Their crimes?

Check Your Credit Card For Fake Charges From "Ich Services"

Check your credit card statements for fraudulent charges from a company called “ICH Services,” reports KETV. They’re defrauding consumers across the country at $9.95 a pop with unwarranted credit card charges. If you notice it on your bill, call up your credit card company or bank and dispute the charge. And since your information is now in the hands of criminals, you may want to close down the account and get a new card while you’re at it.

Someone Stole Your Tmobile Phone Now You Have To Pay $1500

Tricia asks:

Tmobile is not budging regarding $1500 dollars worth of charges on a SIM card that was stolen from my lost phone and put into another device. Its so obvious the phone was stolen, my bill is typically $40 a month, the person took someone out of my “Fave 5” and put in someone named Mostofo. I called Mostofo who said he wants to help “find the criminal” but Tmobile says they don’t really care about the fact that it was stolen, that I owe the total amount regardless. Super annoying! Anything I can do? I get that Tmobile says, until I officially report it stolen I’m responsible for the charges, I just think that’s ridiculous when its SO obvious the charges aren’t mine.

Chase Rep Cancels Credit Card Because Of Mint

A hyper-vigilant Chase CSR canceled a woman’s credit card and issued her a new one when she called in to confirm her interest rate, because Mint was showing a slightly higher rate. A Mint representative confirms that “while we can generally get pretty good info about APR, APR can vary widely by customer & there won’t always be a 100% match (that’s why we allow customers to edit their account information).”