A life of stealing started with the snatching of a candy bar and transformed into an illegal multi-million dollar online payday lending scheme that allegedly defrauded thousands of people. At least that’s what federal prosecutors say led to charges against a Pennsylvania man recently. [More]

fees

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

Class Action Suit Filed In California Over Wells Fargo’s Alleged Customer Account Abuses

A lawsuit filed earlier this month by the city of Los Angeles accuses Wells Fargo of pushing employees to engage in fraudulent conduct with regard to consumer accounts in order to meet the bank’s sales quotas. Now, one of those customers has filed his own lawsuit against the San Francisco-based bank alleging the same misconduct deceived and defrauded consumers across the country. [More]

Banks Continue To Improve Consumer Safeguards, But Progress Isn’t Coming Fast Enough

Opening a checking account with a bank is a rite of passage of sorts for many consumers, but the plethora of small-print disclosures, fees and other services are enough to confuse even the most seasoned account holder. While banks attempted to simplify their practices over the years, a new Pew Charitable Trusts report shows that some banks – and regulators – have a long way to go before they’re truly doing everything they can to protect consumers. [More]

Chase Raising Fees On Some Checking & Savings Accounts In 16 States

Chase customers in more than a dozen states will be seeing a slight change to some of their account statements next month, as the bank announced it would increase service charges for both checking and savings accounts. [More]

Los Angeles Sues Wells Fargo Over Unfair Customer Account Conduct

The City of Los Angeles has filed a lawsuit against the largest bank based in the state, accusing Wells Fargo of a plethora of unfair practices including encouraging employees to open unauthorized consumer accounts and then charging those accounts phony fees. [More]

Airlines Raking In More Cash From Bag, Reservation Fees

While airlines didn’t bring in as much income last year as they did in 2013, a new report says they’re still sitting pretty thanks to people willing to pay reservation and checked bag fees. [More]

CFPB Fines Regions Bank $7.5M For Collecting Illegal Overdraft Fees

Each year consumers spend nearly $32 million in exorbitant overdraft fees to their banks and credit unions without fully understanding the way in which these fees work or how much they spend on each overdraft. Today, the Consumer Financial Protection Bureau reminded banks that using consumers’ lack of knowledge to collect more fees isn’t acceptable by imposing a $7.5 million fine against Regions Bank for unlawful overdraft practices. [More]

Many Americans Still In The Dark About Overdraft Fees & Other Bank Practices

While millions of consumers contribute to the $32 billion in overdraft fees collected each year, a new video shows that many checking account holders don’t fully understand the way overdrafts work or how much they spend on the fees each year. [More]

Student IDs That Double As Debit Cards Carry Significant Overdraft Fees

The cozy relationship between institutions of higher education and credit card issuers has come under increased scrutiny in recent years as consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks. According to a new report from the Center for Responsible Lending, the excessive overdraft fees surrounding the use of the cards suggest the latter point. [More]

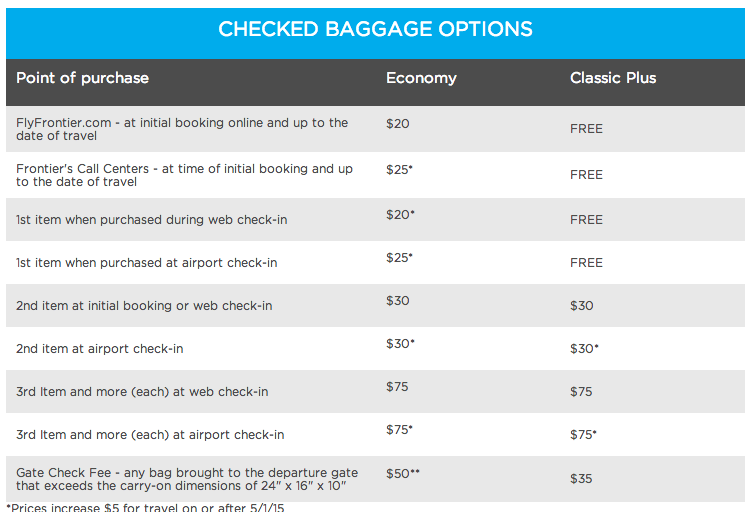

Frontier Increasing Checked Baggage Fees By $5 To $10 Starting May 1

A year after Frontier Airlines unveiled an “ultra-low-cost” fare structure including new fees for bags, the airline is once again revising those costs. [More]

Comcast Eliminating One Annoying Fee By End Of Year

Cable companies are notorious for their fees — modems, set-top boxes, HD service, DVR service, repair visits, early termination fees; the list goes on. But Comcast tells Consumerist that it is ditching one annoying little fee over the next few months. [More]

Charging Fewer Fees Doesn’t Mean Banks Aren’t Making Billions Of Dollars From Customers

Despite the fact that consumers pay more than $32 billion annually in overdraft fees alone, a new report found that the amount of money banks make off customer-account fees declined for the first time in seven decades. [More]

Hotels Taking Cue From Airlines, Making Mountains Of Money From Add-On Fees

Airlines have long since discovered that they can make billions by charging consumers for everything, from daring to have luggage to calling customer service. Now, it seems, their travel partners up the line are joining them in the bold new future, as hotels find ever more creative ways of adding to your bill. [More]

Is ActiveHours A True Payday Alternative Or Just Another Too-Good-To-Be-True Letdown?

We’re largely a society built on convenience: fast food, one-stop shops and other we-need-it-now services. Unfortunately, that need for timeliness seeped in to the financial system in the way of quick-fix payday loans, which can provide the convenience of a quick, low-value loan but which often result in a revolving cycle of high-interest debt. Now a new lending product aims to take the predatory stigma out of short-term loans, but, like many payday alternatives of the past, a closer look reveals reason for concern. [More]