So, this is weird. A credit union in Florida charges a $2 fee if your arm isn’t hanging out of your window with your deposit slip in hand as you pull up to the drive-thru window. And that’s not the only fee that SunState Credit Union charges. They’ve got a $2 fee for coming in more than 4 times a month, and another charge for not using the telephone banking system.

fees

Walmarts Tries To Become Your Bank With The "Walmart MoneyCard"

“Would you like to load your check onto a Wal-Mart MoneyCard?”

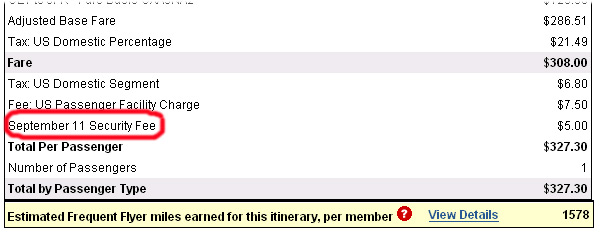

Man Finds September 11 Security Fee Peculiar

We know we’re the last people to notice this, but while booking some airline tickets we saw a line item for a “September 11 Security Fee.”

Verizon Increases Fee For NOT Making Long Distance Calls To $4

In case you weren’t aware, Verizon charges you a $2 fee for the “ability” to make long-distance calls. The only way to get this fee removed is to have your long-distance service blocked or to make more than $2 worth of calls every month. Sound stupid? Well, according to the bill that reader Troy just got, that stupid fee is about to double.

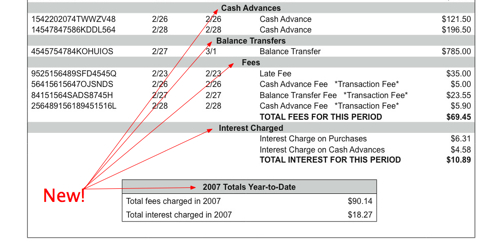

Credit Card Fees, Penalties, On The Rise

A nationwide study by non-prof group Consumer Action found rising trends for credit card rates and fees. Compared to 2005

Credit Card Companies Cheer New Regulation?

The Federal Reserve Board wants credit card companies to clean up their act, and the credit card companies couldn’t be happier. The Fed’s proposed regulation would give customers 45 days notice before a change to their card’s terms, require fees and interest to be shown separately on each bill, and would transform default APR into the more menacing-sounding penalty APR. None of this is objectionable to the credit card companies:

“We strongly agree that improved disclosures empower consumers to make better choices in our competitive marketplace,” said Edward Yingling, head of the American Bankers Association, a lobbying group that represents the biggest credit-card issuers.

We tell you why creditors are grinning, after the jump…

Banks Make $50 Billion A Year From Fees

Things seems to have gotten out of hand when banks are raking in $50 billion a year just from service charges, MSN reports. Consider how banks maximize over-draft charges:

In recent years, changes in federal laws have all but eliminated “float” — the time it takes for a check to clear from the writer’s bank account. What used to take days now often takes hours or less. What hasn’t been speeded up is the time it takes for deposits to clear and be available for your withdrawal.

In other words, your money goes out faster than ever, but comes in as slow as ever. Which leads to… overdrawn checks. Which leads to… nice, juicy bank fees.

Oh, You Use Quicken Or Microsoft Money? That'll be $5.95 Per Month

Wachovia is charging customers a $5.95 monthly fee to access their accounts through Quicken or Microsoft Money. The fee, which took effect April 1, aligns Wachovia with the 27% of banks that penalize consumers who access their accounts through money management software.

BusinessWeek: The Poverty Business

Business Week’s top story concerns the “subprime” lending industry in the United States. It’s a good read, one of those articles that makes you feel smarter for having read it. It’s shocking too, reading about a Navajo woman who makes $15,000 a year being lent $7,922 at 24.9% (to buy a 1999 Saturn with 103,000 miles on it) makes us slap our foreheads in frustration. But that’s how it goes when you’re poor. Your bank is a car dealer, your tax accountant is Jackson Hewitt and you’re screwed. —MEGHANN MARCO

Florida To Ban Gift Card Expiration Dates And Maintenence Fees

The measure (SB 1638) now goes to Gov. Charlie Crist, who must sign the bill for it to become law. He could not be reached for comment Wednesday, but the governor has long portrayed himself as a consumer advocate.

Get your pen ready, Chuck. —MEGHANN MARCO

Verizon: That'll Be $2 For Not Making Long Distance Calls, Please

“Even though I don’t have a plan with them, they say I still have the ability to make a long-distance call if I ever need to, so I have to pay them $2 a month?” Bius said. “What am I supposed to do? Am I supposed to pay them $2 for no reason?”

Airlines Thinking Up New Fees For Summer

Airlines are gearing up for summer with a suite of new fees and costs for travelers. Among them:

7 Overdrafts Refunded After Reader Writes Bank of America CEO

Yet another reader confirms that if Bank of America is hitting you with overdraft fee after overdraft fee, you can get them waived by writing a complaint letter to CEO Kenneth D. Lewis.

Bank Fees Schedules Are Hard To Find

It can be hard to figure out all the various fees, typically referred to as a “fee schedule”, that a bank can charge.

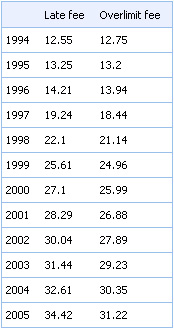

Credit Cards Fees Doubled Over Ten Years

Since 1994, credit card late and overlimit fees have more than doubled. We’re no economist, but that doesn’t seem to keep pace with inflation.

5 Bank Fees To Watch Out For

The nice thing about putting your money in a mattress is that it’s never going to charge you a “pillow fluffing fee” or a “paisley-colored sheet fee.” Your bed also won’t pay you interest and it’s not FDIC insured, so SmartMoney has five bank fees to watch out for and how to avoid them.

Save Money On Fees

Frugal For Life has a couple of tips for saving money on fees. For one, she advises swiping debit cards as credit because some stores will charge you to process the transaction otherwise.

Man Gets $280 Back From Bank Of America After Writing CEO

If you recall, Travis got charged $280 in overdraft fees after Bank of America gave him some wrong information about his bank account when moving to a new state. He wrote a letter the CEO, which we posted. Now, good news. He writes: