You’ve all seen the $10 minimum signs at Mom & Pop stores, and while these stores aren’t supposed to be placing this type of restriction on their customers (it’s a violation of their agreement with the credit card companies) it’s important to understand why the signs are there in the first place. Fees.

fees

Game Crazy Customer Gets Response From District Manager

Lu, who caught a Game Crazy cashier adding bogus fees to a purchase, has sent in a couple of updates.

Chase Sends You Debit Card You Don't Need, Tells You To Activate It

Chase isn’t just acting in shady ways toward their credit card customers. Their latest sneaky move is sending new debit cards that impose fees to their banking customers, hoping that customers will simply activate the new debit cards with no questions asked. Not so fast.

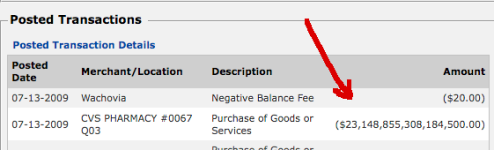

Unruly Teen Charges $23 Quadrillion At Drugstore

Kids these days! Hawkins writes, “My lectures about financial responsibility appear to have failed: yesterday [my teenaged daughter] charged $23,148,855,308,184,500.00 at the drug store.” You would think Visa would have caught the error and addressed it, if you were high. What Visa actually did was slap a $20 “negative balance” fee on it, of course. Update: Here’s what happened!

Beware The Costco And American Express Membership Fee Double Dip

Last week we mentioned that Costco has a habit of backdating the starting date for lapsed membership renewals, which prompted Monica to write in and let us know of another issue they seem to have with billing. If you renew your executive membership with Costco but then apply for the Costco American Express card, Amex will charge you the membership fee a second time. Monica says the Amex CSR who fixed the problem told her it happens all the time.

Bank Of America: "That's Why You Don't Open New Accounts Online"

After reading about how Jesse was banned for life from Bank of America for no clear reason, other readers wrote in with similarly bizarre BoA stories. Wayne was locked out of his new account after he opened it and charged a $75 overdraft fee. Chris was sent checks linked to a duplicate account and then charged penalties when the checks bounced. Edward’s new account was closed but the CSR refused to tell him why, and he was charged a $60 “research fee” for the closing. When Edward went to a BoA branch to clear things up, he says the employee there told him, “That’s why you don’t open up accounts online.”

Getting An Employee Discount From AT&T? You'll Have To Pay Up

An exciting new policy change took effect last week at AT&T Wireless. Have you recently started a new job, or joined a group that provides discounts on your cell phone service? Guess what? You get to pay a $36 fee per line in order to get your discount!

Banks To "Earn" $38.5 Billion From Overdrafts This Year

Consumers aren’t the only ones looking to save money and gain a little extra cash on the side. Banks are people too, you know! In the face of toxic assets and credit card delinquencies, they’ve come up with a plan to increase their revenue: New fees! Higher fees! Higher minimum balance requirements! Trickier overdrafts!

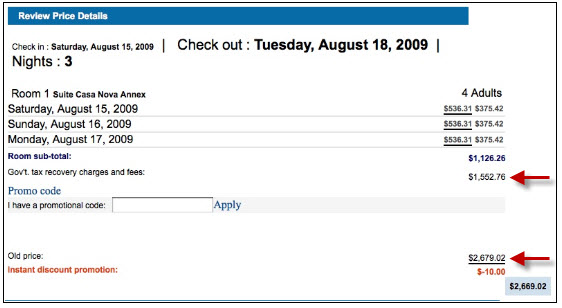

Surprise! Fees And Taxes Are More Than The Cost Of The Hotel Room!

Over at Elliott.org a reader has sent in a screenshot from a recent attempt to book a discounted hotel room in Venice. The price was supposed to be $375 a night marked down from $537. It seemed like a good deal until he saw the taxes and fees…

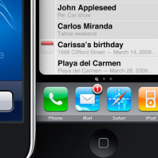

AT&T Will Expand iPhone Upgrade Window For Early Adopters

In preparation for the phone’s launch on Friday, AT&T wrote today: “We’ve been listening to our customers. And since many of our iPhone 3G customers are early adopters and literally weeks shy of being upgrade eligible due to iPhone 3G S launching 11 months after iPhone 3G, we’re extending the window of upgrade eligibility for a limited time.”

AT&T Isn't Going To Reduce iPhone Data Plans

For a while now, there have been rumors and speculation that AT&T was considering reducing its data plan by $10 per month in an attempt to be more competitive with other carriers. Today AT&T officially put the kibosh on that scuttlebutt, which is how I write once the cocktail hour kicks in on Friday. Says an AT&T spokesman, “We’ve been very happy with our pricing.”

Think The iPhone 3G S Costs Too Much? Don't Buy It

Apple fans around the country are foaming at the mouths over the jacked-up pricing AT&T has announced for the upgraded iPhone. AT&T apparently can’t afford to subsidize the phones for existing customers, because if you currently have an iPhone and more than 6 months left on your contract, you’ll have to pay $417-$517 for the newer model (that includes an $18 “upgrade” fee).

Beware Credit Cards Charging Foreign Transaction Fees On Domestic Purchases

Banks are increasingly charging foreign transaction fees on domestic purchases, a dangerous practice that’s likely to expand as banks look for new ways to generate profit. Tripso tells us the story of Sunil, who bought tickets with Qatar airlines, which sounds ever so expensively foreign. Citi charged a 2% foreign transaction fee, even though the tickets were bought in U.S. dollars and processed by the airline’s central reservation system based in Washington D.C.

Hulu May Start Charging For Content

Just when free tv on the internet was starting to get good, Hulu board member Jon Miller had to go and talk about subscription fees. Miller, an AOL refugee who’s now squeezing cash out of consumers for News Corp, said last week of subscription fees: “in my opinion the answer could be yes. I don’t see why that shouldn’t happen over time… it seems to me that over time that could be a logical thing.” Charging for content isn’t his only big idea…

Bank of America Wins Right To Seize Social Security Benefits To Pay Overdraft Fees

The California Supreme Court has effectively reversed a 2004 San Francisco trial court decision that ordered BofA to pay $284.4 million in damages to more than 1.1 million customers. The California Supreme Court ruled that banks can tap Social Security benefits in bank accounts to cover bounced-check fees, a practice consumer advocates say is abusive because Federal law prohibits Social Security benefits from being seized to pay a debt. California law apparently doesn’t consider overdraft fees to be debt, so the fee party will be allowed to rock on indefinitely.

updated: WaMu Accounts Become *Almost* Totally Chase July 24

Starting July 24, 2009, WaMu accounts will get fully transitioned to Chase. After that, ex-WaMuers will be able to fully enjoy the benefits of Chase banking, like making deposits into Chase ATMs, the full range of Chase branch banking services, and the luxury of paying Chase’s service fees which are higher than WaMu’s were.