One of the results of the regulatory overhaul was that banks couldn’t automatically enroll people in “overdraft protection.” This kicked off a mammoth effort by banks to try to convince customers it was in their best interest to sign up for a program that would let them get charged $35 for overdrafting a $1 candy bar rather than go through the pain and humiliating of having a card declined. But a new survey by the Center for Responsible Lending found that most of the people who did opt in either had a misconception about how the overdraft protection, or simply wanted the ceaseless onslaught of pitches from their bank about it to stop. [More]

fees

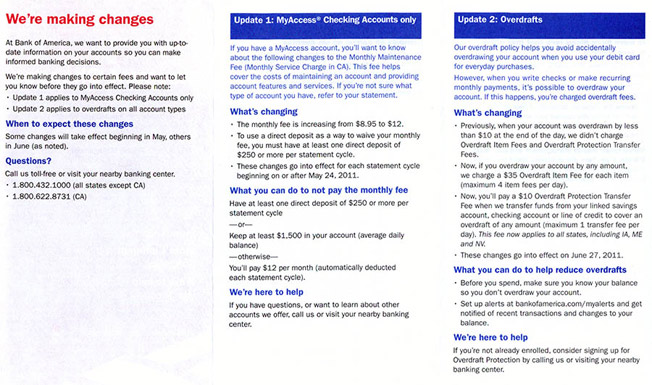

Bank Of America Adds New Checking Account Fees

Now that the regulatory heat is off on overdrafts, Bank of America is jumping back in with overdraft-related fees. They are also increasing the monthly fee and changing their requirements for avoiding it. [More]

US Bank Replaces "Free Checking" With "Easy" Checking (Hint: It's Not Free)

US Bank was one of the last large banks to keep offering free checking but that will be no more after May 15. All customers will migrated over from “Free Checking” to “Easy Checking.” While it’s not certain how it might be any easier, like a US Bank truck drives to your house and picks up your deposits and gives you a free lollipop, it is certain that the checking accounts will have monthly maintenance fees. But you can avoid those fees if you sign up for the right level package and abide by certain behaviors. [More]

Flight Attendants Stage Mini Mutiny, Give Away Free Booze On Flight

No one — aside from airline shareholders — is a big fan of the numerous ancillary fees airlines continue to nickel-and-dime travelers with, not even the flight attendants. And at least on one recent flight, some attendants decided they were going to quietly flip the middle finger to their overlords by giving out a bunch of free stuff. [More]

An Airline Actually Reduced A Fee

Airlines have tacked on more and more fees over the years as a way to recoup costs without having to raise their base fares as much, but Frontier has broke with these seemingly relentless upward tradition and actually reduced some fees this week. Thunderclap! [More]

Car Seats Fly Free, So Pack Other Stuff In There To Avoid Bag Fees

It’s sort of sneaky, but you can take advantage of the fact that a few items, like strollers, car seats and some medical items, never get a fee for getting checked in order to avoid checked bag fees on your other stuff, writes the Money Crashers blog. [More]

Study: Less Than 40% Of Bank Branches Willing To Openly Disclose Account Fees To Customers

In spite of legislation requiring banks to disclose all fees associated with consumer deposit accounts, a new study from the Public Interest Research Group shows that only around four out of 10 bank branches don’t make it difficult or impossible for consumers to see the full schedule of fees.Additionally, banks are reluctant to let customers know about the availability of free checking accounts. [More]

BofA Charges Fee After 3 Withdrawals To Discourage You From Making More Than 6

Here’s a funny fee that I just found out about, even though it’s been in place for at least a year. So, Federal regulation, Regulation D, prohibits more than six withdrawals per month from a savings account (ATM withdrawals don’t count towards the 6). Most banks will just charge an “excess activity fee” if you go over that amount, but Bank of America charges a $3 fee if you have more than three withdrawals in a statement period. When Paul questioned why, customer service told him it was a “deterrent fee” to discourage him from hitting the Federal limit. “That’s like giving me a speeding ticket for going 27.5 miles per hour as a deterrent so I don’t go 55,” he writes. The rep was unmoved by his analogy. [More]

Citibank Pledges To Pay Small Checks First, Minimizing Overdraft Fees

Overdraft fees may be devious mechanisms that suck funds out of the customers who can least afford them, but their administration doesn’t have to be downright evil. [More]

Even With New Fees, Most Checking Accounts Beat Prepaid Debit Cards

Pushers of prepaid debit cards say the fees they charge are comparable to a checking account, but a new study by Consumers Union, publishers of Consumer Reports and this blog, finds that by and large, checking accounts are still a better deal. [More]

Spirit Airlines Adds Fee For Not Paying Your Baggage Fees Far Enough In Advance

Perhaps upset that its decision to begin charging fees for carry-on bags was not enough to make into this year’s Worst Company In America bracket, the fee-happy folks at Spirit Airlines have begun making their case for next year by adding a surcharge for passengers who wait until 24 hours before departure to pay the airline’s base fees for checked and carry-on bags. [More]

Prepaid Debit Cards Rack Up Fees As Soon As You Even Think About Getting One

Using TurboTax to file his taxes last month, Sam chose an interesting new option for his refund: a TurboTax-branded Greendot prepaid debit card. He doesn’t have a bank account at the moment, and wasn’t receiving a huge refund, so this seemed like a good option. He tried to use up the card soon after receiving it in order to avoid the monthly “maintenance fees” that come with prepaid debit cards. What he didn’t know was his account really began on the day that he requested it online, so he was paying monthly fees when he had the card for barely a week. [More]

Chase Tests Out $5 ATM Fees

Banks are continuing to amp up the threat of making consumers pay for the price of increased regulation. Chase is testing out charging non-customers in Illinois $5 for withdrawal fees. In Texas, they’re trying a $4 charge on for size. Consumer advocates say its a scare tactic meant to muddy up Congressional waters, but banking experts disagree. “I think customers have taken for granted the cost of banks’ infrastructure,” says Margaret Kane, president and CEO of Kane Bank Services told ABC News. “ATMs are very expensive to install and maintain.” [More]

Jetblue And American Increase Fees, Airlines Dream Up More

The airline fees just keep edging up. Jetblue has increased the 2nd checked bag fee to $35 from $30. They have also increased the fee for their “Even More Legroom” seats by $5. Not wanting to be left out, American is increasing the fee for making a reservation by phone to $25 from $20. With fuel costs rising, airlines are looking for ways to increase revenue without increasing airfare, as they’ve already done that six times this year already. They use fuel costs as the reason, but you know if the price of fuel drops, they’re not going to cut back on fees. And according to the Journal, airlines are looking for more ways to add fees, like a surcharge for a chair that reclines more, a champagne brunch fee, or blizzard insurance. [More]

10 Ways To Make The TSA Crotch Grabbers Profitable

Last week, the the Director of Homeland Security suggested to Congress that the TSA get a cut of airline baggage fees. The fees encourage travelers to carry on their bags, and this in turn leads to more bags that have to be inspected by hand at security checkpoints. Should taxpayers keep picking up the tab, or should airlines give the TSA a piece of the baggage fees? How about neither? What if instead the TSA looked for more creative ways to offset costs and even increase revenue? Here are 10 modest proposals: [More]

TSA Wants To Increase Airport Fees Because You're Not Checking Your Bags

To avoid bag check fees, travelers are routinely opting to carry on their bags, but the TSA says that the cost is just getting shifted to tax payers, to the tune of $260 million a year. That’s because the more bags that don’t get checked, the more bags the TSA has to inspect by hand at security checkpoints. Now the TSA is looking to get a cut of some of the checked baggage fees the airlines collect. [More]