../../../..//2008/10/06/the-stock-market-is-not/

The stock market is not doing well. The Dow Jones industrial average fell below 10,000 for the first time since 2004, and is currently down 440 points. [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/10/06/the-stock-market-is-not/

The stock market is not doing well. The Dow Jones industrial average fell below 10,000 for the first time since 2004, and is currently down 440 points. [NYT]

Marketplace has the answer to one of the most troubling questions of our time. Why did people who are supposed to be smart buy all this stupid toxic risky debt? Apparently, it’s because they weren’t that smart, and they didn’t understand what they were buying or selling.

A repeal of a tax on wooden arrows is but one of the many pork provisions getting tacked onto the bailout bill in order to win support from recalcitrant Congress Critters. So while the world watches and waits for us to rescue the financial system, our elected representatives are holding things up until they can grab their piece of the action. Awesome. This one is even better than the $0.10 Michigan recycling refund. I’ve been trying to crunch the numbers on my wooden arrow business for ages. Finally the margins will work. Full text of the passage, inside. What other fun special-interest pork projects can you find tacked onto this bill? Let us know in the comments.

After the failure of the nation’s largest Chevy dealerships brought the plight of the car dealer to everyone’s attention, the bleeding hasn’t stopped. The California New Car Dealers Association says dozens of dealerships in CA have also closed.

So you’re probably sitting around thinking, “I want to know more about stagflation, but I want to have fun clicking stuff on the internet, too.” Right? No? Who cares. We’re still going to direct your attention to this neat interactive graph from the Harvard Business Review.

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

Gone are the days of pushing “premium” food offerings, says the Wall Street Journal— big food manufacturers like Kraft and Campbell are going to be pushing “cheap” foods like tomato soup and cheese singles — foods which are thought of as “easy on the wallet” but are still hugely profitable for the manufacturers.

It’s hard to think of an object that isn’t made of wood or packaged or encounters wood at some point in its journey through the economy. Any number of household items that you can buy at Walmart, like a toilet seat for instance, may very well be made from Russian wood.

Lawmakers are hashing out the details of a huge taxpayer-funded bailout of Wall Street in an attempt to keep afloat the system of banks whose willingness to lend drives this economy’s growth. Constituents have flooded their representatives phone lines and inboxes with with their heated reactions. What do you think?(Photo: Getty)

One of the major sticking points of the inevitable Wall Street bailout was executive pay — but the New York Times says that Treasury Secretary and former CEO of Goldman Sachs, Henry M. Paulson Jr., has agreed to compensation caps for the executives of firms that benefit from the bailout.

A while back the New York Times was concerned about the cost of the Iraq War and published some estimates of what else we could have bought with that money. We didn’t find that very interesting at the time, but now, while trying to wrap our minds around just how effing huge the $700 billion proposed bailout of Wall Street really is, we decided to revisit that article. Here’s what you can buy for less than $700 billion, according to the New York Times.

Forbes says that Wall Street is starting to be concerned about Target because of an increase in the amount of delinquencies in its credit card operation. Uh oh…

../../../..//2008/09/22/crude-oil-surged-today-up/

Crude oil surged today up to $130. [CNBC]

It’s the end of the world as we know it, but that doesn’t mean you should give up on yourself. Here are 10 skills to have in our brave new world…

United Airlines is just super crappy at fuel hedging, says Wired. Now that oil is trading at less then $100 a barrel, it turns out that United is paying more than that — and more than other airlines:

The SEC has temporarily banned short selling of 799 financial stocks, and the Treasury Department has said that it would guarantee (temporarily?) money market funds up to the amount of $50 billion. The New York Times called this move “startling” because money market funds have long been considered one of the safest investments — about as safe as a savings account.

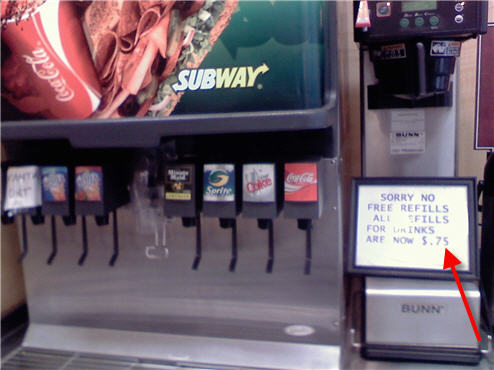

Jon from NJ says describes his local Subway’s new 75 cent refill policy as “silly.” Hmmm.

Markets rallied in late trading in the biggest gain in six years, emboldened by news that Washington wants to create a new agency that will buy up ALL the bad loans on these financial companies’ books. The initiative would be an attempt to fashion a holistic solution instead of bailing out each individual bank as it fails. This would cost many more billions of dollars and require Congressional approval. In order for all those CongressCritters to keep their jobs, there is talk that the deal would be packaged with another stimulus package perhaps including more rebates, along with food stamps and unemployment benefits.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.