Ever feel like the poor state of the economy is impacting every area of life? Well, it is! A few examples popping up in some surprising places, like animal shelters…

economy

Santa's Not Coming: All KB Toys Stores To Be Liquidated And Closed

KB Toys has returned to Chapter 11 bankruptcy, says the Wall Street Journal, and will be liquidated by its parent company — Prentice Capital Management.

America's 10 Fastest Dying Towns

Here’s a bleak list from Forbes — America’s 10 Fastest-Dying Towns. Many of the towns have something in common — manufacturing jobs moving overseas or to cheaper, more rural, areas.

Peanut Butter, Dessert Of The Year

You know things are bad when Bon Appetit names “peanut butter” as “dessert of the year.” Wait ’til you see what fancy restaurants are doing with Hamburger Helper! [Bon Appetit] (Photo: Derek Purdy)

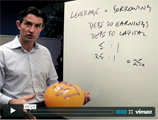

What The Hell Is Leveraging?

Leverage leverage leverage. Everyone’s talking about it, but what does it mean?

I Love The Recession Because Things That Suck Are Dying

The good thing about the recession is that everything that is most bloated and cheesy and garish is imploding. Witness:

- Harrah’s, the McDonald’s of casino chains, is in big trouble. So is Claire’s. They’re owned by the same private equity firm.

- Sharper Image, Circuit City, and Linen’s n’ Things. Suck suck and suck, dead dead and dead.

- Those glass condo towers disrupting your nice bo-ho “sweet spot of gentrification” neighborhoods? Building has stopped because they can’t get any construction loans.

- Gas-gorging SUVs will soon be worth more being turned into the toasters they look like.

What excesses are you glad to see on deathwatch?

Labor Department Screwing Unemployed By Not Answering Phones

The waiting area of the New York Department of Labor Office is getting increasingly crowded. It’s not just the economy, more people are showing up because they can’t get anyone on the phone.

Tweeter Turns Over To Liquidators Early, Customers' Pre-Paid Items In Question

Tweeter, a MA mid to high-end electronics retailer, and not a misspelling of a popular microblogging service, decided yesterday to close its doors 6 days ahead of schedule, and send home everyone without paying them. Furthermore, customers who have already paid for the merchandise, expecting to be able to come by and pick it up, will have to deal with the liquidators. [BoingBoing Gadgets] (Thanks to Hawkins!) (Photo: dalvenjah)

../../../..//2008/12/03/harvard-universitys-endowment-the-largest/

Harvard University’s endowment, the largest of any university, has lost 22% of its value in the past year — or approximately $8 billion. Ouch. [MarketWatch]

Black Friday Sugar Rush Won't Last For Retailers

While Black Friday revenues were up from last year, retailers are just getting a quick high. The crash starts tomorrow.

US In Recession Since Dec '07, Says Official Stat Group

We’ve been in a recession since December 2007, according to a fancypants stat group. WSJ reports, “In a statement, the National Bureau of Economic Research said its Business Cycle Dating Committee determined that the U.S. entered recession in December 2007, marking the end of the economic expansion that began in November 2001.” I don’t think Americans need a committee to tell them the economy has been on the express the train to Suck City for over a year…

Airfares Sinking Due To Lack Of Demand

The crappy economy is taking its toll on airfares. Demand is sinking taking airfares with it, says USAToday.

ReFi Time: Mortgage Rates Drop On New $800 Billion Intervention

If you’re looking to refinance a home and have cash and good credit, now is a good time to pull the trigger. Yesterday the government announced the latest Federal golden bandaid: a pledge to inject $800 billion directly into the credit markets, news which pushed national average mortgage rates for a 30 year fixed to 5.81%, down from 6.07%, according to bankrate. Bankrate also suggest that if you’re trying to refi to act quickly, before rates rise or home values drop.

How Uncle Sam Killed The Liberty Dollar

There’s a new story in Triple Canopy about The Liberty Dollar, an alternative American currency started by Bernard von NotHaus that experienced a grassroots backing among some shoppers and merchants, until the Feds shut it down. Unlike the “real” dollar, Liberty Dollars are in fact…

Data Points

Retail sales dropped 2.8 % in October. November Consumer Confidence level up .3 points in November from October, 57.6 to 57.9. [Reuters]

../../../..//2008/11/13/the-recession-in-the-eu/

The recession in the EU might be even deeper than the one in the US. Case in point: Ireland, which thrived off now-dormant construction cranes. [Washington Post]

Banks Want To Forgive Credit Card Debt — But The Government Says No

The next wave of the credit crisis — the skyrocketing defaults on credit cards — is coming in and odd alliances are being formed. The Consumer Federation of America, along with the Financial Services Roundtable ( a self-described “major player on Capitol Hill and with the regulators” which represents the securities, investment, insurance and banking industries) has requested a “special program that would allow as much as 40 percent of credit card debt to be forgiven for consumers who don’t qualify for existing repayment plans.”