The SEC today announced civil fraud charges against Goldman Sachs and VP Fabrice Tourre. The chargea allege that Goldman ripped off investors by allowing a client who bet against the housing market to pick the mortgage securities being sold to other investors who were also investing in the housing market. [More]

economy

What? An Ad Agency Is Hiring 230 People? In This Economy?

Need a job? One green shoot of the economic recovery is the hiring glut going on over at the R/GA digital advertising agency, with 230 jobs open. That’s on top of the 130 they’ve already hired this year. But I thought advertising was dead, or at least severely atrophied? [More]

Gas Prices On The Rise For No Good Reason

Several states are reporting this morning that average gas prices have crept up slightly, despite the fact that oil consumption has dropped and refiners are operating below capacity. The Miami Herald blames the price creep on Wall Street speculators who are optimistic that the economy is getting better, which in turn will lead to increased gas consumption. [More]

Hoax Dave Matthews Concert Shames Macy's

Macy’s got punked. The fliers announced performances in Missoula, Montana, by Dave Matthews Band and other bands as a special “reinvesting in the community” “Goodbye Celebration” by Macy’s and Smurfit-Stone, two longtime businesses that had recently shut down and laid off hundreds of workers while top company executives received millions in bonuses. But Dave and his band would not be there, nor would Michael Franti or Slightly Stoopid. Nor the Mayor or the Governor. And there definitely would be no $5,000 prize drop. It was all a hoax hatched by angry ex-employees trying to draw attention to the negative economic impact the businesses’ departures would have on the community. [More]

As The Economy Improves, Shoppers Ditch Walmart

The NY Post says that they’ve found a correlation between economic growth and same store sales at Walmart. Their theory is that as the economy improves, people run away from the big blue box. [More]

Credit Unions Ask Customers To Leave

Credit unions might be attractive alternatives to big commercial banks, but they’re not crisis-proof. OregonLive says about a fifth of the nation’s credit unions are having financial troubles right now. To get in better financial health, they’re introducing fees for services that have long been free, and even asking members to move their deposits to other institutions. [More]

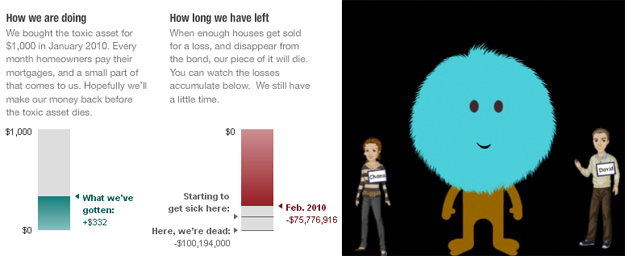

Reporters Buy Up Toxic Assets

To dig right into the meat of the story they’ve been tracking for over a year, NPR Planet Money reporters David Kestenbaum, Chana Joffe-Walt plunked $1000 down and bought up a securitized pack of Countrywide mortgages. At one point it was worth $75,000. Will the homeowners pay their mortgages and the reporters make their money back or will too many houses get sold at a loss and the asset implode? Follow along and find out. [More]

Aw, You Missed Your Earnings Target. Here's A Pity Bonus.

Some execs are getting a “pity bonus” in their stockings this year. With the recession on, many execs are finding it hard to meet earnings targets or suffer from pummeled stock prices. So boards are having heart and changing the rules so the execs can still get a bonus. [More]

Well, The Census Is Hiring

Unemployed? If you’re looking for something to get you out of the house, the Census is hiring and apparently they’re really enjoying the sudden influx of lawyers and other professionals to choose from, says the Washington Post. [More]

Consumers Opting For Cremations Over Costly Funerals

The Grim Reaper wears hand-me-downs; the Great Recession is forcing more people to opt for cheaper cremations over costly funerals. [WSJ via Clusterstock] [More]

80% Of Today's Delinquent Homeowners Will Lose Their Homes

If you know 5 people behind on their mortgage payments, 4 of them are going to end up losing their homes, according to a new study released by John Burns Real Estate Consulting. [More]

Walmarts Kicks Name Brands Off Shelves

Another reason to try/buy generic: you might have to because your favorite name-brand could be getting the boot from store shelves. [More]

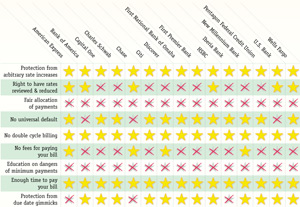

CARD Act: Who's With It, Who's Not

The CARD act is supposed to go into effect next week, Feb 22. As we get close to the deadline, is your credit card complying with the rules? Courtesy of BillShrink, this giant infographic is here to tell you the answers. Teaser: absolutely zero issuers are doing fair allocation of payments. [More]

Wall St. Helped Hide Greece's Debt, Now It's Kablooie!

Looks like Goldman turned the Parthenon into a gunpowder magazine for a second time; Greece’s recently revealed debt crisis is rattling the world economy and familiar culprits are at play: Wall Street banks, off-the books loans, derivatives, and other occult financial instruments. I guess we blame the consumer on this one too? [More]

Break Up With Your Bad Big Bank This Valentine's Day

You know what, it’s just not working out. I’m sorry, giant bank, but it’s time for both of us to move on. This Valentine’s Day, it’s time break up with your big bank, and this website will help snip the ties that bind. [More]

Economy Grows 5.7%, Still Sucks

The US economy expanded 5.7% in the fourth quarter of 2009, making it the second straight quarter of growth, and the fastest in six years. However, it’s important to remember that for 2009 overall, real GDP shrank 2.4%, the largest decrease since 1946. So, it’s a gain for sure, but starting from a very low place and there’s a long way to go. Like jobs. Some jobs would be nice. [Bloomberg] [More]