Imagine that you open up your email and find a message from your credit card company with the attention-getting subject line, “Important: What you can do now about the recent data breach.” Would you think that Discover had had a customer data breach? You wouldn’t be alone. [More]

discover

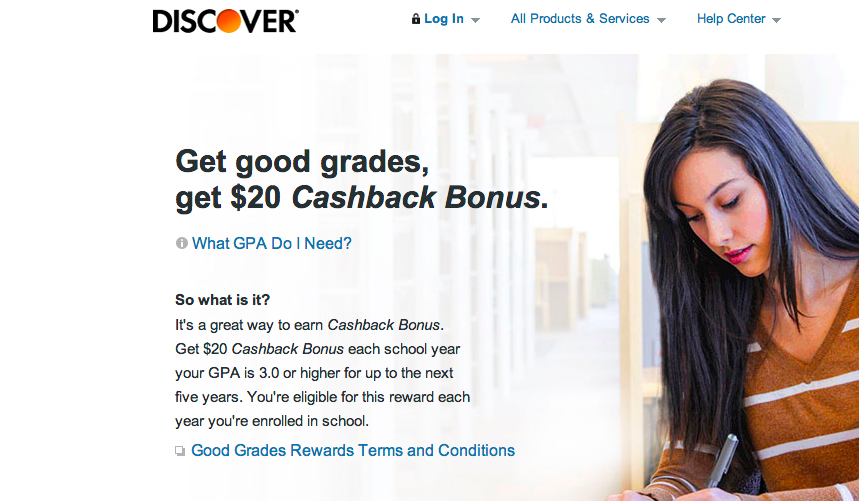

Discover Card Program Rewards Students Who Get Good Grades. Is That Legal?

Not so long ago, many college campuses regularly played host to credit card company shills, giving away T-shirts and pizzas to students in exchange for filling out account applications. Then the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 put an end to most of these practices, leading card issuers to devise new ways to market directly to the under-21 crowd. [More]

Discover Financial Ditching Home-Lending Business

Just three years after getting into the mortgage origination business, Discover Financial Services plans to shutter its home lending operations. [More]

Discover To Let You ‘Freeze’ Credit Card When You’re Not Sure If It Needs To Be Canceled

If you’ve ever found yourself without your credit but unsure whether you left it another coat, dropped it on the sidewalk, or had it stolen from your wallet, you’ve really only had one safe option: cancel the card ASAP to prevent anyone else from using it. But Discover is reportedly going to offer its Discover It card customers the option of temporarily shutting the card off without cancellation. [More]

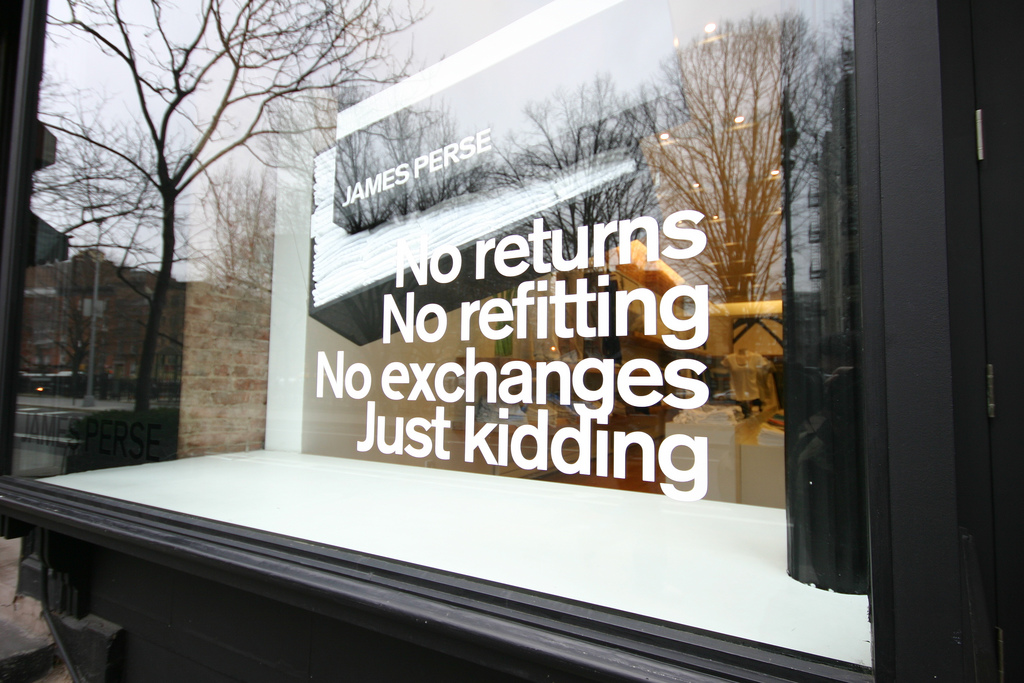

Forgot To Return A Purchase? Maybe Your Credit Card Issuer Can Help

While racking up unsecured debt is generally a bad thing, there can be hidden advantages to using your credit card for everyday purchases. Two benefits that we often recommend as weapons for consumer justice are chargebacks and warranty extensions, but here’s another one that you may not be aware of: return period extensions. Yes, buying with some credit cards can give you longer to return an unwanted item to the retailer. [More]

Discover Giving Free FICO Scores To All Cardholders, But Are They Actually Useful?

All Americans are, as Consumerist is happy to remind you, entitled to access their own annual credit reports for free. But those reports are just that: reports. They don’t come with credit scores on them. For those, you still have to pay. Unless, that is, you happen to have a Discover card–and maybe, someday, other major credit cards, too. [More]

How Do Different Credit & Debit Cards Stack Up In Terms Of Consumer Protection?

We’ve mentioned any number of times how federal laws offer more protection to consumers who make purchases with credit cards because $50 is the most you can be held responsible for a fraudulent purchase, while the sky could be the limit with debit cards. But how do the various networks compare? [More]

Watch Your Credit Card Statement: Refunds Arriving Soon From AmEx, Capital One, Discover

Getting money back from a credit card issuer doesn’t happen every day, so plenty of Discover, American Express and Capital One customers are in for a treat in the form of refunds hitting their accounts soon. Those three companies were ordered to pay up a total of $435 million to almost six million customers after the Consumer Financial Protection Bureau took action against deceptive credit card practices. [More]

Data Shows Bank Of America Is Also Bad At Dealing With Credit Card Complaints

Earlier this year, the Consumer Financial Protection Bureau launched a complaint portal for people with credit card-related issues. Banks and card companies are not obliged to provide a happy ending to the complainant, but they are obliged to reply in a timely manner. And even with the bar lowered that much, Bank of America still manages to disappoint. [More]