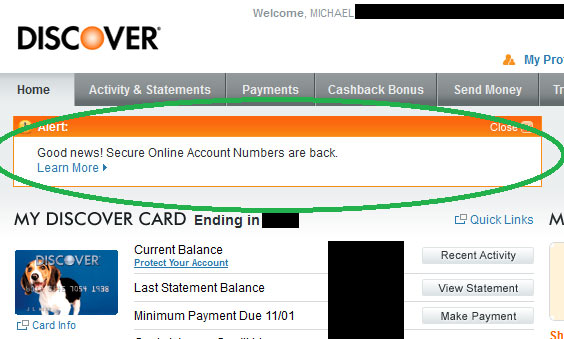

Discover has a neat account security feature: the ability to generate numbers that only work with one merchant. Imagine how handy this would be in the case of a credit card number breach! Only PayPal, arguably the biggest third-party payment processor in the solar system, won’t accept one of these numbers. It could have something to do with that third-party nature…or do they hate account security? That’s what Doug thinks. [More]

discover

Get Ready To Pay Surcharge Every Time You Pay With Credit Card

Visa and MasterCard know there is nothing that American consumers love more than fees and surcharges. That’s why the credit card companies are reportedly looking to do away with longstanding rules that prohibit merchants from adding on extra costs to customers who pay with credit. [More]

Discover Aware That Strangers' Bank Accounts Are Linked To My Card, Doesn't Know If I Should Worry

It’s surprising and unsettling enough to find that strangers’ information is suddenly linked to your private credit card account –¬†but what was even weirder for our reader Jessica is that Discover wasn’t even sure if she should be worried about her own info going astray. Definitely a case where customer service was shrugging over the phone. [More]

Discover Accidentally Steals From Foundation To Pay My Credit Card

Phil (no, not the one who works here) had to make a payment to an art foundation, and learned that he could use his Discover card to do so. Neat! So he put the payment through, and all was well…until he learned that somehow the transaction went through backwards, transferring the money from the foundation’s bank account to pay his Discover bill. Oops. This seems like it would be easy enough to reverse, but Discover won’t do anything unless the foundation calls them up and nicely asks for their money back. [More]

Discover's Purchase Protection Doesn't Extend To Purchases With Cash-Back Rewards

One of the benefits of using a credit card for all of your purchases (and paying it off every moth, naturally) is the extension and sometimes expansion of a product’s original warranty. That’s what Cindy does, making purchases with her Discover card for protection and cash back. What she learned not long ago is that you can have the warranty extension, or use the balance in your cash back account, but you can’t do both. [More]

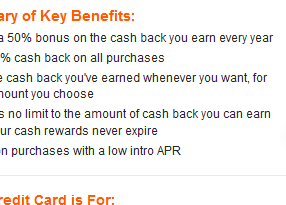

Credit Card Bumper Crop Boasts Low Teaser Rates, New Snags

After being such prudes for so long, credit card companies are raising their hemlines and lowering their standards. They’re actively deluging customers with credit card offers and using low teaser rates as a crooked finger. However, they’re also coming with new hidden baggage you need to watch out for, like cash back rewards that are high, but have to be opted in again every few months. [More]

People Are Back To Making Late Payments On Their Credit Cards

Two months ago, the number of people making late credit card payments was at its lowest since Justin Bieber was a twinkle in his parents’ eyes. Of course, when you reach a low like that, there is often nowhere to go but up. [More]

Discover Brings Back Disposable Account Numbers

Without explanation as to why, Discover card is telling customers that they’re bringing back the disposable account numbers they got rid of at the end of August. [More]

Discover Ends Disposable Credit Card Number Program

Discover sent around an email last night informing customers that it would be ending the “Secure Online Account Numbers” service. This feature helped you mitigate the potential for online fraud by letting you generate unique credit card numbers you could use per online retailer or even per transaction. A few Consumerist readers were bummed to see it go. [More]

FDIC Scrutinizes Discover's "Payment Protection" Plan

The FDIC is looking into Discover over concerns that they deceptively marketed their “payment protection plan” for their credit card. Under the plan, if you were experiencing hardship you could put payments on hold for up to two years. Sounds great, but buried in the fine print was that you would end up paying a 10.5% monthly fee for the pleasure of doing so. [More]

Banks Use Your Shopping Info So They Can Send You Targeted Coupons That Make More Money For The Banks

The banks of America recently pitched enough of a hissy fit to effectively neuter swipe fee reform — after they raised rates, instituted fees and canceled rewards programs — claiming they’d be swiped into the poor house by the reduced fees. But not to worry, bankers are a clever folk and they always have a way to profit off your transactions. Like, for example, colleting information about your shopping habits. [More]

Netflix Tops Customer Loyalty List

The results of Brand Keys’ annual survey of customer loyalty have been released and in its first year of inclusion, Netflix came out on top of the list of all 528 brands, beating out reigning champ Apple. [More]

Transcripts Of Discover Card Allegedly Tricking Customers

The Minnesota AG is suing Discover Card for allegedly duping customers into thinking they were just getting a courtesy call about their card but then actually signing them for a payment protection plan. The AG gave copies of the audio files of the customer calls to the New York Times. Here is a salient selection of one of the transcripts. [More]

MasterCard: Walmart Should Not Have Demanded ID For Purchase

A couple weeks back, we brought you the story of Michael, a Walmart customer who was told it was company policy to require a photo ID on all credit card purchases over $100, even though that appears to be in violation of MasterCard’s merchant agreement. After trying to get someone at MasterCard to clarify/confirm their stance on ID-checking, Michael finally got the reply he was looking for. [More]

Discover Tells Me It Requires Merchants To Check Your ID Now

When Andrea tried to use her Discover Card at Home Depot, the clerk told her she needed to show ID. Alarmed with this apparent violation of the merchant agreement, she called Discover and was told the ID-checking violated no agreement and was in fact company policy. [More]

Add Discover To The List Of Credit Cards That Allow Minimum Purchase Requirements

Yesterday, we told you how Visa and AMEX now allow merchants to require customers up to a $10 minimum for credit card payments and how MasterCard will soon be changing their policy to allow for the same. We’d naively hoped that Discover — who hadn’t yet replied to our query — would be the lone holdout, but… not so much. [More]