You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

debt

How I Talk Myself Out Of Buying Stuff

If you find yourself in one of those moods where you just “have to have it”, and end up in the store staring at it, talk to yourself about it. List all the reasons you want it (want, not need), and all the reasons you don’t want or need it…

Does The Citi "Payment Partner Program" Work?

For several years and in different forms, Citi has had an interesting idea to get you/help you to pay off your credit card called the Citi Payment Partner Program. How it works is if you enroll and make above the minimum payment due for four months, on-time, at the end they will match 10% of the amount you paid off above your minimum payment. The max cap is $550. But there are two important caveats:

Confessions Of A Shopaholic Makes Irresponsible Debting Look Fun And Hilarious

Jerry Bruckheimer turns the lens of his celluloid cyclops away from exploding airplanes to exploding credit card debt in an adaptation of Confessions of a Shopaholic. There’s a scene in the trailer where our heroine has frozen her credit card in a block of ice (see “Stop Spending By Freezing Your Credit Card In Ice“) and, stricken by a frenzy, she chops and hacks at it and uses a blowdryer to free it. Sort of amusing, although most people I’ve read about who freeze their credit card usually don’t ever crack them open. Full trailer inside.

Reader Pays Off $14,330 In 20 Months With Our Tips

Stuck in a $14,300 debt hole, reader Trixare4kids was able to dig herself out using tips she learned about on Consumerist.com. Let’s learn how she attacked her personal finances and learned to live frugally, and did it all in 20 months.

Staying Out Of The Red Is The New Black

All of a sudden, everyone is interested in how their banks, credit cards, credit scores, credit reports, mortgages, and money actually work. Staying out of the red is the new black. Have you found yourself talking more about money matters and strategies with friends, family, co-workers, and even strangers?

How To Get Out Of Debt

J is in a debt hole and needs help getting out. We’re going to give it to him: [More]

Judge Orders Credit Reporting Bureaus To Strike Forgiven Debts From Records

The three big credit reporting agencies—Experian, TransUnion, and Equifax—have been inaccurately reporting debts on millions of consumers’ credit reports even after the debts have been forgiven during bankruptcy filings. Once forgiven, the debts are supposed to be removed from credit reports, but the agencies are continuing to report them as active. They have until October 1st to comply with Judge David O. Carter’s order to “revamp their systems,” writes Jane J. Kim on the Wall Street Journal’s finance blog. Now if you’re in debt trouble, you can look forward (?) to having either unpaid debts on your credit report, or a bankruptcy filing, but hopefully no longer both at the same time.

Is Volkswagen Violating The Fair Debt Collection Practices Act?

Tim’s neighbor received a call from VW Credit asking her to walk across the street and leave a note on her neighbors’ front door and VW Bug asking them to call back their creditor. Calls like these are known as block parties, and they are a direct violation of the Fair Debt Collection Practices Act.

Ex-Credit Card Bankers: "Every Customer Who Calls In Is A Mark. It's A Great Big Con."

CNN has an interview with two former credit card bankers who are admitting that their job was to get consumers to max out their credit cards and take on as much debt as possible, regardless of the customer’s ability to afford it. They both worked for MBNA at their “sprawling consumer call center in Belfast, Maine.” The bankers say that they were told to aggressively push cash advances, and were trained to convince consumers that they needed the maximum amount of debt at the highest interest rate.

House Passes Credit Card Bill Of Rights… But Senate Is Too Busy With The Bailout

The House of Representatives passed legislation that’s commonly known as the Credit Cardholders’ Bill of Rights today, but the bill is expected to be ignored by the Senate while they work on that whole $700 billion bailout thing.

AIG's "Strength To Be There" Commercials Are Suddenly Hilarious

When Treasure Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill last night to discuss giving AIG an unprecedented $85 billion loan, do you think they had a laugh about AIG’s commercials? We picture Paulson saying something like, “Ha, ha, ha… ‘strength to be there.’ That’s rich! Rich! Ha! I’m on a roll!”

What Can You Do With $1,000?

It used to be that $1,000 was a good amount of money. Then again, it used to be 1980 once too.

Zombie Debt Collectors Find You At Grandma's

Palisades Collection is offering Jeremy a great deal: he can pay half off his debt of $237.64 and get the account settled! Small snag, though, Jeremy never ordered the Verizon service they’re trying to collect on, the debt has passed the statute of limitations, and he got it expunged from his credit report years ago. Still, Palisades persists in sending collection notices for him to his grandma’s house. What’s a boy to do? Read on and find out.

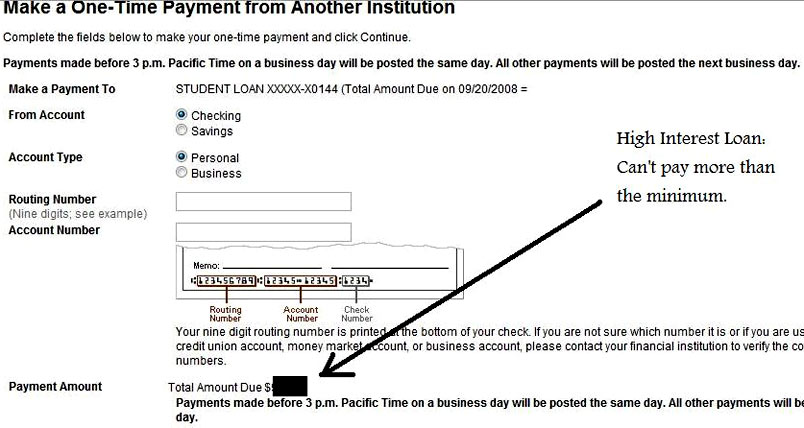

Wells Fargo Forces You To Pay Off Loans Costliest Way Possible

According to reader Caleb, Wells Fargo seems to have recently crippled their loan repayment system in a way that makes it impossible for borrowers to pay off loans the way they want to. That is, unless you prefer to let your highest-interest loans ride for as long as possible while you pay off your lower-interest loans…

PayPal Refunds $50 Defraud, Sics Collections On You

Last year, Gpotato.com fraudulently took $50 from reader Adam’s Paypal account. He disputed the charge, Paypal agreed it was fraud and returned the funds, and Adam closed the account. Now all of a sudden Paypal’s internal collections agency is calling up Adam and making rude and insistent demands that he pay this $50 immediately.