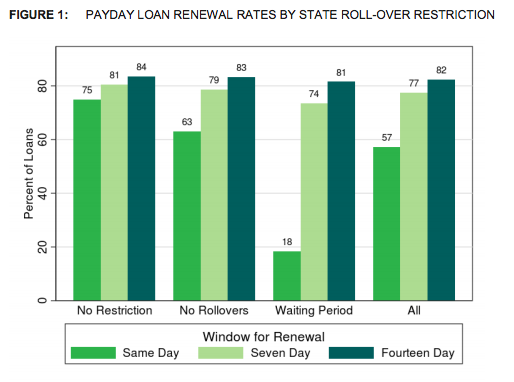

The revolving door that is the payday lending debt trap is real. The high-interest, short-term loans may even be more damaging to consumers that previously thought. Four out of five payday loans are rolled over or renewed every 14 days by borrowers who end up paying more in fees than the amount of their original loan, a new Consumer Financial Protection Bureau report finds. [More]

debt trap

Montana Consumers Win Fight Against Online Payday Lender, Loan Debt Will Be Forgiven

Montana consumers fill the winner’s column after winning a long-standing fight with the online payday lending industry. After three years of litigation, hundreds of hundreds of affected borrowers in the state will have their loans forgiven and receive their share of a $233,000 settlement. [More]

How Universities And Credit Card Companies Make Money Off Of Students

How can an educational institute act in its students’ best interest if it stands to make money off of increasing their debt load? The symbiotic relationship between universities and credit card companies is being questioned more than ever by student groups and politicians, writes the New York Times.