Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he got his tax refund early this year and is on vacation, taking a salmon-watching cruise on the Pacific coast. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

death and taxes

Ask Tax Dad: A Recovering Slacker, An Incompetent Accountant, And The Tax Return Of The Dead

Guard Against An IRS Underpayment Penalty

If you pulled in more money than you’re used to making — especially if it came from untaxed work — you could be facing a higher-than-expected tax bill that will grow even higher due to a prepayment penalty of 3 or 4 percent if you owe more than $1,000. There’s not much you can do to avoid the penalty for your 2011 taxes, but you can take steps to avoid it next time. [More]

You Get Two Extra Days To File Your Taxes This Year

When April 15 falls on a weekend or holiday, as it does this year and did last year, the IRS cuts you a break and gives you until the next business day to file your taxes. That means tax procrastinators won’t have to file until April 17, giving them two extra, frantic days to delay the inevitable. [More]

The Potential Tax Perils Of Catching A Historic Baseball

If you’re a dreamer who totes a baseball glove to a ballgame and seeks bleacher seats in hopes of catching a home run ball, you may want to consider the tax implications of your whimsy. The man who chased down the home run ball that was Derek Jeter’s 3,000th hit — and gave it back to Jeter — may face financial peril because of the windfall of swag the Yankees showered upon him. The IRS may consider the free season tickets and signed merchandise the team gave the man to be taxable income. [More]

California Takes Step Toward Taxing Online Purchases

With hopes of collecting possibly $1 billion a year in sales taxes, the California State Assembly approved a bill that would require buyers to pay taxes on Amazon and other online purchases. [More]

Cell Phone Tax Rates Are Highest Ever

Cell phones are crafty little tax machines for local, state and federal governments, now raking in their largest amount of taxes ever and posting sizable increases each year. [More]

What To Do When An Employer Goofs Up Your Tax Form

Although it’s tempting to duck and cover to protect yourself from the onslaught of tax forms filling up your mailbox these days, it’s a good idea to examine the numbers on your W2s and 1099s to ensure they’re accurate. If an employer or bank screws up and reports it gave you more money than it really did and you don’t notice, you’re on the hook for the extra taxes. [More]

Amazon Tries To Make Itself Exempt From Tenn. Sales Tax

Everything is negotiable when you’re a company that’s as big as powerful as Amazon. After landing a sweet incentive deal to build a distribution hub in Tennessee, the online sales giant is trying to get the state to excuse its customers from paying state sales tax on their purchases. [More]

IRS Goes After Executive Whose Pay Is Too Low

Targeting executives who pay themselves too little in order to shield some of the money they make from taxes, the IRS is focusing its sunshine-concentrating magnifying glass on potential offenders. [More]

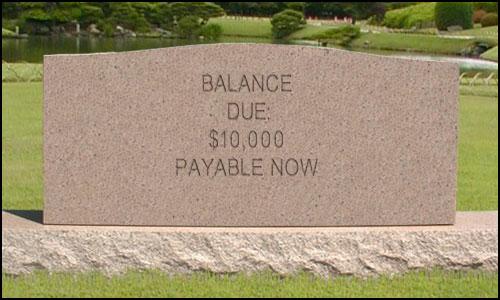

Wait Until You're Dead To Pay For Your Funeral

You’re gonna die. Why make your family suffer even more by burdening them with the cost of your funeral? That’s the pitch made by companies that try to get you to pay for your funeral years in advance. But, in most cases, you’re better off putting your money into normal savings accounts or life insurance instead.