Reader Rebekah has a question about credit cards. She and her husband pay off their cards every month, but like to charge most of their expenses because they enjoy the reward points. She’s wondering if this is a good idea and how it affects her credit.

credit score

American Express Randomly Cut My Credit Limit From $25,000 to $1,800

Reader Pierre is a small business owner who has an American Express Business Account that used to have a $25,000 limit, but has now been cut to $1,800. He says his company’s bill is usually around $12,000 a month, and it is always paid in full — on time. While Pierre is clearly upset with American Express, the Wall Street Journal says that all banks are cutting access to credit.

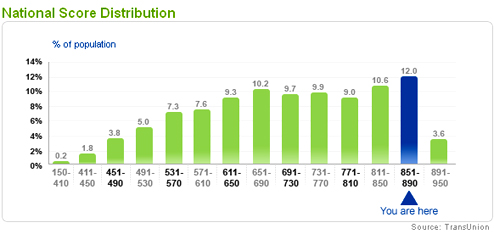

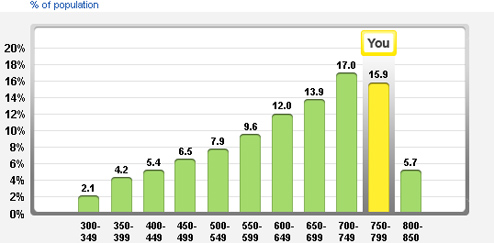

CreditKarma.com Makes Free Credit Score More Like FICO's

The CreditKarma.com site we told you about in our roundup of “5 No BS Ways To Get A Credit Score For Free” has changed its calibration system so the free, advertising-supported, credit score it gives you is now on the 300-850 range, just like your FICO score. It’s still not your FICO score, but it does make the approximation, based on TransUnion data, more relevant. If you’re do some major money moves, like getting a mortgage, you would still want to pay for the FICO score for total accuracy, but if you just want a general sense of how you’re doing, CreditKarma.com is a great way to do it for free.

Who Has A Subprime Mortgage? People With Good Credit

The Wall Street Journal analyzed more than $2.5 trillion in subprime loans made since 2000 and found that as the number of subprime loans grew, the loans were being issued to borrowers with better and better credit scores—borrowers who could have qualified for traditional loans with more reasonable terms.

Experian, Equifax, and TransUnion To Offer Credit Freezes

All three credit reporting agencies recently announced plans to let consumers freeze their credit files. Credit freezes provide security at the cost of convenience: access to credit reports and scores is prevented without the consumer’s express authorization, making it difficult to open new accounts or lines of credit. Freezes are considered one of the best, albeit drastic, ways to guard against identity theft.

Credit Card Companies Slashing Credit Limits

The continuing subprime meltdown is leading jittery creditors to reduce cardholder credit limits at the first sign of trouble. According to a recent survey, up to 75% of banks are cutting credit limits to minimize their exposure to risk. The move can adversely affect credit scores, which are determined by considering the percentage of available credit used. From the Chicago Tribune:

A change can stem from late payments of any kind, a drop in your credit score or the addition of new lines of credit. Bryan found out limits on three cards were actually cut after he took out a home equity loan to pay off some debt.

Capitol One Stops Harming Customers' Credit Scores, Starts Reporting Credit Limits

Capital One will start reporting cardholder credit limits to the three credit bureaus, a common practice from which most cardholders had no idea their creditor abstained. Credit limits help TransUnion, Experian and Equifax determine credit utilization, which accounts for 30% of a credit score. Capital One’s decision, which will take effect by the end of the year, will likely boost its cardholders’ credit scores. From the Washington Post:

Your Credit Score Demystified!

Bankrate has an interview with Craig Watts, public affairs manager at Fair Isaac Corp., the creator of the popular FICO credit score. Craig talks about credit myths and strategies for people who are looking to raise their credit scores. Nothing terribly ground-breaking, but we know our readers tend to obsess over their credit scores, so it’s good to get some info straight from the horse’s mouth.

Improved Your Credit Score? Tell Your Car Insurance Company

Since them I received an updated bill and it was $67.50 cheaper (for 6 months)–just based on a new credit check! Obviously if readers credit history worsens, wouldn’t recommend an updated credit check, but for most people, if you don’t ask for the current credit check, you could be losing dollars.

Good tip, Jeff. Insurers compare your credit score to the scores of their other clients and use it as a way to predict how likely you are to have an accident. Apparently, people with similar credit scores have similar driving habits. For more info on how Progressive uses this information, click here. —MEGHANN MARCO

HOW TO: Get Your First Credit Card

Hello. I read the consumerist every day and since I turn 18 later on this month I wanted to ask how do I start a credit score or getting credit or a loan to start my credit score?

Experian Announces Service That Notifies Collection Agencies Of Your Ability To Pay

The introduction of additional trigger criteria and attributes within Collection Triggers increases the ability for companies to act quickly when new information is available. Subscribers to Collection Triggers are notified within 24 hours when the financial status of a consumer within their collection portfolio has improved.

“Collection Triggers increases revenue by allowing companies to be first to the door of consumers who have improved their ability to pay,” said Zaydoon H. Munir, senior vice president, Experian’s Consumer Information Solutions. My, what a lovely industry. —MEGHANN MARCO

Repair Your Credit By Disputing

Max started his journey with a credit score in the low 500s, and now, in a matter of months, it had crested above 600. Eventually, and through great discipline, Max managed to eliminate every negative item on his credit report, simply by asking for proof that they belonged there in the first place.

Help! Gambling Site Threatening To Ruin My Credit

benpopken: How often are they contacting you and by what means?