Piggybacking is back in, baby. FICO was all set to terminate the credit-score boosting technique of adding another authorized user to an account held by someone with good credit, but they demurred. Piggbyack away, little money pigs. Here’s how it went down…

credit reports

Beware Long-Term Cardholders With Perfect Payment Histories, Your Credit Lines May Be Slashed

Oliver paid off his Citibank platinum card on time, in full, every single month since 1989, but that didn’t stop Citibank from slashing his credit limit when a minor mistake popped up on his credit report.

Capital One Will Ruin This Guy's Credit One Way Or Another

Joseph is having problems paying his Capital One card, mainly because Capital One keeps making it hard for him to pay it, and then reports his payments past due after they’ve cleared the bank. Now he wants to know what he can do to remedy the situation.

Third-Party Debt Collectors Misusing Courts To Increase Profits

The Chicago Tribune writes that “More than 119,000 civil lawsuits against alleged debtors are clogging [Chicago] courtrooms,” but since collection agencies make money off of volume business, the suits filed are based on too little information. The result: cases based on mistaken identities, or for debts already settled, or against debtors who have made good-faith efforts to work out repayment plans. “The system is out of control,” one attorney tells the paper.

Former Time Warner CSR Arrested For ID Theft

A woman in Cincinnati was arrested this week and charged with two counts of identity theft and two counts of theft, for allegedly stealing the credit card information of a customer who was paying a bill in November 2007. Time Warner fired her when the investigation started and it appears no other customers were affected, but it’s a good reminder to stay on top of your credit report at all times.

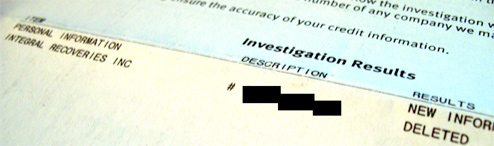

Sallie Mae's 100+ Point FICO Drop Error Getting Fixed

Sallie Mae has publicly apologized for a coding error, potentially affecting around 1 million customers, that caused some consumers credit scores to drop over 100 points, and some consumers report that their dinged scores are already back up. If your score is not back to normal and you are in the middle of a transaction where your good credit is at stake, Sallie Mae said it will provide a credit reference letter. You can also call Sallie Mae customer service at 1-888-2-sallie. Sallie has pledged that the fix is in, but consumers can still take matters into their own hands by pulling their free credit report from annualcreditreport.com and disputing the incorrect information with Experian. Note, it’s against Federal law for creditors to report false information to credit bureaus, and consumers can sue violators up to $1,000.

After a multimillion-dollar verdict, attorneys get fee award, too

To add (just) insult to (just) injury, a Florida judge awarded $518,301 to Angela Williams’s attorneys (PDF link). Ms. Williams recently won almost $3 million in a lawsuit against Equifax for Equifax’s refusal to fix her credit report after her identity was stolen.

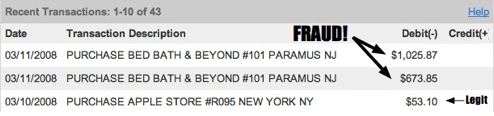

Fight Fraudulent Credit Card Charges

A thief charged over $1,600 to my credit card at Bed Bath & Beyond. Here’s how I responded:

Know Where To Fix Your Credit Score By Getting Your Reason Codes

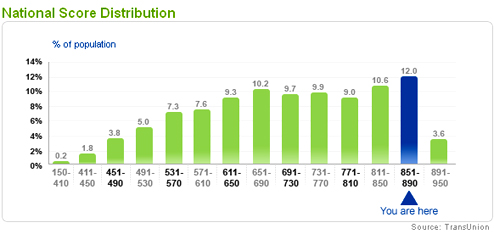

If you want to improve your credit score, a score from 300-850 that lenders use to determine whether you qualify for a loan and how much interest to charge you if you do, you’ll want to know your “reason codes.” These are 2-digit numbers that come with you credit score when you purchase it. Each bureau usually gives you four reason codes with their report, so get your score from each one for a total of 12. One wiki tutorial says that reason codes are listed in order of importance. Armed with that, The Mechanics Of Credit site decodes all the reason codes and prescribes solutions for each one. With this info and tactics, you should be able to boost your score a couple of points and save a bundle.

Woman's Credit History Goes Missing, Giving Her A Credit Score Of Zero

When Cindy X pulled her credit report from TransUnion recently, it was blank. “I am 48, have an active credit history, and my other credit reports were accurate,” she writes in to Kiplinger. TransUnion, however, told her that she was on her own to fix the problem and would have to contact her creditors individually.

../../../..//2008/01/17/when-53-bank-acquired-another/

When 5/3 Bank acquired another bank, a computer glitch in the records merging splooged incorrect information into thousands of customer accounts, in some cases totally fudging up their credit reports and credit histories. The bank says it’s fixed everything but one customer says that’s not true and lost three loans due to the errors. [Orlando Sentinel via U.S. PIRG Consumer Blog]

Reach Equifax Customer Care

If calling the regular Equifax “customer service” (cough, cough) line at 866-640-2273 doesn’t work for you, customer.care@equifax.com is an email address you can use to try to resolve problems with your Equifax credit report. Equifax really doesn’t give a damn about you because you’re not its customer, banks and lenders are, but a reader says that he was able to use this email address to get an Extended Fraud Alert that he didn’t put on taken off his account. You can also try 404-885-8000, which is a direct line into their Atlanta corporate headquarters.