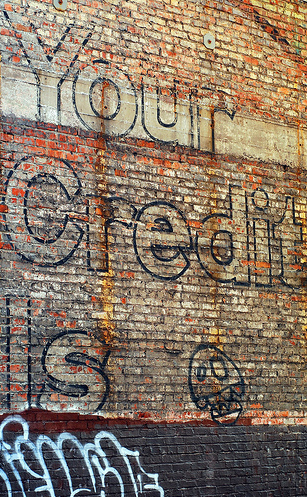

For some people, bad credit is a result of being irresponsible. For others, it’s a matter of bad luck and overwhelming circumstance. Alas, the credit reporting agencies don’t make such distinctions, meaning someone whose house went into foreclosure because he lost his job and also had to be hospitalized is treated the same as the person who stopped making mortgage payments because they didn’t feel like it. [More]

credit problems

The Most Common Forms Of Troubling Debt

In general, there are two types of individuals who seek out my services: the extremely poor who are in a relatively large amount of debt and the middle class who have leveraged themselves into a whole world of debt.

The poor can’t make ends meet (they fall behind and it snowballs), but the middle class buy their way into debt with luxury cars, private schooling, and huge balances on their credit cards.

To help these people that are swimming in debt, I also offer one-on-one counseling where we discuss which assets can be refinanced, such as a car or a home. Another possible solution for many individuals is to look into a tax-deductible HELOC (Home Equity Line of Credit) with a much lower interest payment than their credit cards. Although many of these problems can be solved by paying off high interest debts and using a little creative refinancing, education is essential to making sure that this issue does not arise again.

This advice seems so elementary, and yet there are so many people like the ones CreditPro describes. Why do people buy things they can’t afford? It is a great mystery of life. —MEGHANN MARCO