Whether you shop online or at brick-and-mortar retailer this holiday season, you’ll undoubtedly be offered countless chances to save money with store-branded financing options offering “0% interest” for six, 12, 18 months. These can be incredibly tempting, but many people don’t realize they are often signing up for deferred interest accounts that can come back to bite you on the rear-end in a very nasty way. [More]

credit cards

Restaurant Accidentally Overcharges Customers Anywhere From $8K To $99K

Some Knoxville, TN, residents are fuming mad at a local chain restaurant after seeing that their debit and credit cards have been charged 1,000 times what they should have been for their meals, leaving people in the red for anywhere from $8,000 to $99,000. [More]

Costco May Finally Start Accepting Something Other Than American Express

Costco may be very generous with the free food samples and might have a very forgiving return policy, but when it comes to paying with a credit card at the warehouse club, customers have only one option: American Express. But a new report claims that we could be seeing the end of Costco customers being forced to use their AmEx when buying 872 lbs. of steak and enough toilet paper to keep a small nation clean. [More]

Bogus Credit Card Charges Look Like They Were Made With Chip-Enabled Cards

As banks begin rolling out new credit cards embedded with microchips intended to help prevent fraudulent use, some financial institutions are reportedly seeing a spike in bogus transaction charges that appear to be coming from these newer cards, even though chip-enabled cards have yet to be sent out. [More]

Citibank Raises Fees For Accounts, But Plans To Offer Free Credit Reports To Some Customers

Citibank is poised to become the second financial institution to provide customers with free credit scores each month. But that’s only if customers stick with the company after its latest fee hike. [More]

Why Paying Your College Tuition With A Credit Card Is A Bad Idea

A few weeks ago, we listed for you a wide variety of creative and mundane ways to pay for college. What we didn’t get into were ways to get money from your bank account to the school’s hands. While you might put every other expense on a credit card and pay it off every month, there are reasons why it can be a terrible idea to put your tuition on a credit card. [More]

The Secret To Lowering Your Credit Card Interest Rate (Spoiler: Just Ask)

Are you sick of being slammed with an 18% interest rate on your credit card even though you regularly pay down your balance and don’t miss payments? “How can I possibly get that rate down a few points to make my finances more manageable?” you ask to no one in particular, but that’s a question to ask your credit card issuer because there’s a decent chance they’ll knock down that APR for you. [More]

Jimmy John’s Confirms Credit Card Data Breach At 216 Locations

Months after it was first reported that payment systems at sandwich chain Jimmy John’s may have been compromised, the company is finally confirming that 216 of its stores were indeed hacked, putting customers’ credit and debit card data at risk. [More]

Did Home Depot Ignore Hack Warnings From Employees?

While the millions of us who shopped at Home Depot during the five months in which hackers were siphoning off customers’ credit/debit card data from in-store payment systems are keeping our eyes on our accounts and credit reports, former employees at the nation’s largest home improvement retailer claim they warned the company about the possibility of a breach years ago. [More]

The 5 States (Plus D.C.) With The Highest Levels Of Credit Card Debt

If you were asked to guess which states had the highest average credit card debt, you might assume it would be dominated by places with high real estate costs, where consumers need to spread out their other purchases in order to make the rent or mortgage every month. Or you might go the other way and guess that states with low costs of living but high unemployment rates would top that list. But a new analysis of credit card data paints a different picture than either of these assumptions. [More]

Chase Proactively Replacing Some Debit, Credit Cards Involved In Home Depot Breach

Home Depot has yet to confirm the estimated number of customer credit and debit card accounts that were compromised during the data breach that affected thousands of stores for five months, and it’s not known whether much of the stolen card info will ever be sold by the hackers now that everyone knows about the massive theft. Regardless, JPMorgan Chase has already begun the process of replacing some cards for customers who may have been affected. [More]

4 Ways You Can Save Your Self Into Financial Trouble

In general, saving money is good. But if you are overzealous about your thriftiness or think only in terms of immediate or short-terms savings, you could end up paying more in the long run. [More]

Home Depot Confirms Data Breach; Started As Far Back As April

After nearly a week of only saying it was investigating reports of a massive data breach, Home Depot has confirmed that its in-store payment systems were indeed compromised by hackers. [More]

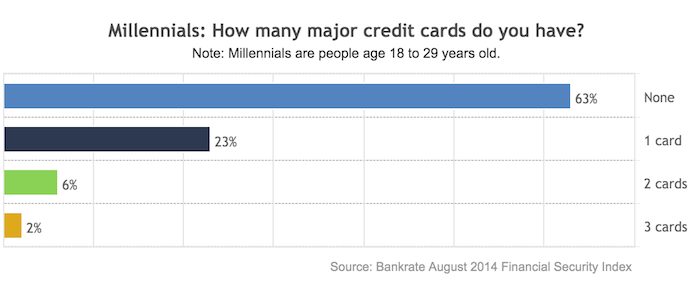

Nearly 2 Of 3 Millennials Don’t Have Credit Cards

Millennials — those Americans currently between 18 and 29 years of age — never really lived in a world without debit cards, when the only way to make a non-cash purchase was to use a credit card or hope the store accepted personal checks. So it may come as little surprise to some that nearly two-thirds of the consumers in this age group don’t have a single credit card to their names. [More]

CFPB Warns Consumers That Some Credit Card Companies Aren’t Disclosing Risks Of Promotional Offers

With a plethora of credit cards on the market, consumers may be drawn to companies and banks that offer the best promotion at any give time. While those deals might seem like a steal at first, the Consumer Financial Protection Bureau is concerned that companies aren’t clearly disclosing the costs and risks of those offers in a way that consumers can easily understand. [More]

What The Numbers On Your Credit Card Indicate

Over the years, countless people have looked at 16-digit credit card numbers and said things like “Why do they need so many numbers? It’s not like there are 9.999 quadrillion bank accounts out there.” Well, that’s true. But the numbers on your card aren’t just about how many accounts or cardholders exist. They also indicate information about your card issuer, its network and tells processors whether or not the number is valid. [More]

Home Depot Joins The Data Breach Party, Investigating Possible Hack

Did you shop at Home Depot recently? Then you will probably want to keep an eye on your bank and/or credit card account. The retailer has confirmed it is investigating the possibility of a data breach that may have resulted in customers’ information being stolen. [More]

Restaurant Realizes Maybe It Shouldn’t Force Servers To Pay Credit Card Fees Out Of Tips

Earlier this month we told you about the Minnesota restaurant owners who decided the best way to offset increases to the state’s minimum wage was to deduct credit card transaction fees from servers’ tips. While it’s legal for businesses to do this, a poll of Consumerist readers found that 91% of you think it’s not a wise idea. Looks like the restaurant owners have finally gotten that message. [More]