Bank of America messed up Andy’s credit score by failing to send him credit card statements or giving him online access to an old account he only recently started using again. They also refused to work with him over the phone, telling him each time he called that they had no record of his previous conversations with customer service and therefore no reason to believe him.

credit cards

Credit Card Companies Are Warming Up To Reduced Payoff Deals

If you’ve fallen into a debt pit and can’t make your credit card payments, and now you’re watching them steadily mount with penalties, fees, and steep interest rates, consider negotiating a lower payment. The New York Times reports that while most card companies won’t admit it officially, they know when they’ve got a customer who can’t pay, and they’re much more willing to settle for a lower amount than they were a year ago.

Chase Marketing Credit Cards To The "Twilight" Demographic… And Creeping Them Out

Reader Chloe is a teenager, a college freshman, and she is creeped out by the ads for Chase credit cards that keep popping up on Facebook. Why? Because they want to give her “points” toward Twilight books in exchange for applying for, and using a student credit card.

What To Do When You Love Your Credit Card But Aren't 'In Love' With It Anymore

Reader Suzanne may be on to something that may save credit card users anguish: Try to view your relationship with plastic as a romantic comedy.

Man Gets Chase To Bend To His Iron Will

Brian suffered a couple of credit card maladies: Washington Mutual shut down his credit card due to inactivity and was stuck with a high interest report and credit report hit due to two missed payments in 2006. After Chase absorbed WaMu, Brian got on the horn and worked the customer service labyrinth until he fixed both problems.

Obama To Call For Financial Watchdog Agency

Tomorrow, President Obama is expected to call for the creation of a new watchdog agency that would help protect consumers from abusive credit card, mortgage, banking practices. The banking industry is not happy about the idea, reports CNN. But hey, they’re just looking out for us: “It’s bad for consumers,” a banking industry lobbyist told the network. Oh, well, never mind then, and pass me some more delicious subprime!

Robocallers Cannot Magically Lower Your Credit Card Interest Rate

The Better Business Bureau and Senator Charles Schumer are warning the public to be skeptical of any calls promising to lower your credit card interest rate. While nowhere near at the public annoyance level of the recent car warranty robocaller scourge, they’re still out there, automatically dialing people and promising to lower your rate for a hefty up-front fee. The only problem is, they can’t do anything you can’t do on your own, and unless you’re crazy you’re probably not going to charge yourself a thousand bucks for the service.

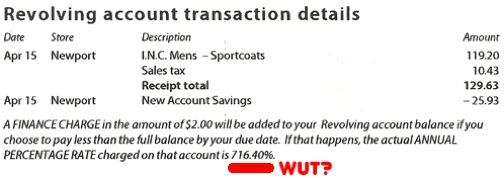

The Variable APR On This Macy's Credit Card Is Either 23% Or 716%

Rick writes: Check out the first bill I received for a Macy’s card I just opened last week (because they offered me 20% off if I did). 716% APR has to be some kind of record. Even loan sharks couldn’t charge that with a straight face.

AmEx Charges You For Having A Negative Balance. What?

American Express hit Mike with a finance charge because his Blue card had a balance. A negative balance. Incredulous, Mike called and said, “so you dinged me for carrying a balance and not making a payment, even though it was a negative balance?,” to which AmEx replied, “Right, even negative balances.”

Should I Reduce My 401k And Put The Money Toward Credit Card Debt?

Given the state of the economy today, is it better for me to reduce my 401k to a minimum and use the extra funds to pay off my credit card debt? This is a good time to put money into the markets, based on my admittedly limited understanding, but with interest rates going through the roof (my personal Chase card went from 12.99 to 23.99), I would like to kick down my cc debt (now at around $6,000) faster. I’m currently only putting 6% in my 401k, and I’m fairly young (35). Have you advice for me?

Store Goes Out Of Business Before Delivering Crib

Christopher and his wife bought a crib through a local store, and two and half months later they still haven’t received it. Now the store is going out of business, and Christopher isn’t sure what he can do to get his money back.

Hey, Skype, Why Can't I Change My Billing Information?

Over the last 1-2 years Skype has gone from being a great alternative to the greedy phone companies, to being worse than AT&T, Time Warner Cable and Comcast combined. Skype’s shady business practices are unlike anything I have experienced with ANY phone or cable company before. And I am saying this as someone who spends $150/year on Skype subscriptions and at least another $50-$75/year on additional Skype out credits.

9/11 Ruins Another Customer Experience

Angela can’t get a new American Express card because Amex can’t verify her Social Security number. They have to verify it because of 9/11. Since they can’t, they’ve canceled her application. Because of 9/11.

No, You Can't Opt Out Of Capital One's E-Mails, Ever

What’s an account-related message from your company, and what’s marketing? Kevin, the subject of this week’s Red Tape Chronicles column, wants to know, because he’d like Capital One to stop sending him advertisements for their products. Capital One claims that he can’t opt out, since the marketing pitches are “account management communications.” Right.

American Express Keeps Emailing Sensitive Customer Info To A Random Stranger

We’re starting to think Amex doesn’t take this whole “data security” thing very seriously. First they confused a customer, and us, a few months ago with their random confirmation phone call, where they demanded a customer turn over bank account information over the phone without giving him a way to verify they were really Amex. Now a reader says the company has “for years” been sending him someone else’s account info via email, including the customer’s name and the last 5 digits of his account number. J.R. writes, “Seriously, I’ve seen better security on a video game forum.”

Interest Rates Will Rise Within The Year, Markets Bet

As growing global economic optimism begins to build, the market is betting that the Fed will raise interest rates by the end of this year. This will mean mortgages will get more costly and credit card APRs will rise, but the interest you make off your savings account will go up. [Bloomberg] (Photo: Ben Popken)

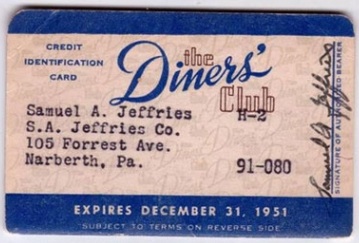

A Visual History Of Credit Cards From 1951-Today

Credit cards weren’t always the adorable little pocket debt machines that they are today. They weren’t even plastic until AmEx decided to class things up in 1959. Travel back to the good old days when credit cards were a “ticket for anyone to spend freely and decide when was best to pay it back” with this revealing photo set from Slate.