Harry’s got a problem: the Bank of America card he’s had for years is paid off, but now it’s been set to explode in Harry’s wallet if he ever uses it again because the variable APR will jump to 29.99 percent. What’s worse, his other card has been canceled. Now Harry doesn’t know if he should start using the BofA card or back away quietly from it. [More]

credit cards

If I Read The Fine Print I Would Still Have A House

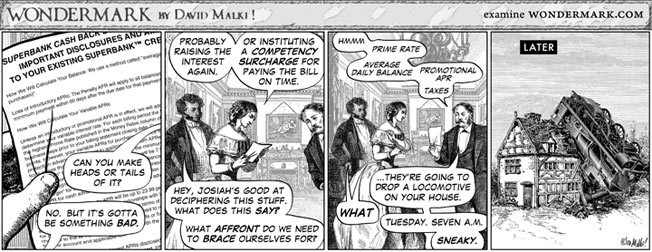

Credit card companies stuffed all the crazy they could into their contracts in advance of the CARD act taking effect. This time they might have taken it too far, even for banks. Shoulda read that boilerplate!

#599; The Boilerplate Clause [WonderMark] (Thanks to MercuryPDX!)

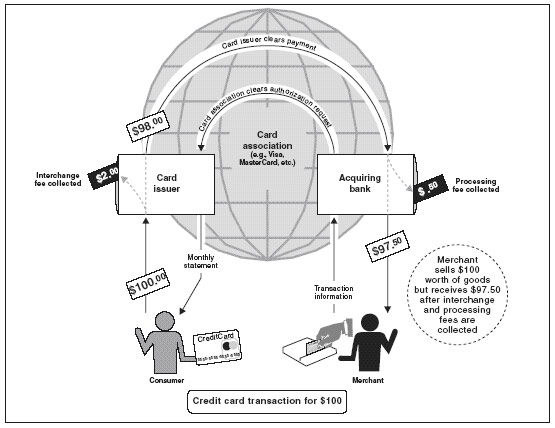

The Hidden Fee That Happens Every Time You Swipe Your Credit Card

It’s invisible to you but each time you swipe your credit card, a fee fairy gets its wings. An interchange fee fairy, to be exact. How does it work? This chart from the Government Accountability Office attempts to shed some light on the murky world of merchant processing fees. Did you know that over the past 10 years, while the technological costs of processing transactions has gone down, interchange fees have more than doubled? A cost that then gets passed on to you in the form of higher prices. [More]

Just Calling Bank Of America Invokes The Cancel Monster

Be careful if you call Bank of America. You might wake the beast. April called BofA about a credit card that she hand’t used in a while to see about getting her interest rate reduced. At first they told her she qualified for a new card with an APR 10 points lower, but then the bloodshot eye of the guardian cast its fell gaze upon her for the first time in years and something nasty happened… [More]

Credit Card Companies Target Goody Two-Shoes

Like the nerdy girl in the movies who loses her glasses and gets a new haircut and all of a sudden she’s popular, consumers who pay off their credit card bills in full every month may soon find themselves the center of some unexpected courting. [More]

Let's Ask BillShrink About Credit Cards Under The CARD Act

Greg wrote to us and said that he’s in the market for a new credit card: “I canceled my Chase card because they raised my interest rate to 29.99% + prime. What credit card companies should I be looking at for a replacement card? What are their perks, their drawbacks?”

I spoke with Samir Kothari, the co-founder and vice president of products at BillShrink.com, to see what he thinks about the CARD Act and how it will change the credit card marketplace.

Bank Of America Only Lends You Money When You Have No Income

Reader James writes in with a story we hear a lot lately. During the run up to the credit meltdown –Bank of America kept raising James’ limit. He ran up a balance while caring for someone who eventually died — and now that he has paid off his debt, his limit has been cut. In the long run, however, he feels that he’s better off without credit cards. [More]

What Changes Should You Expect From The CARD Act?

After several months of waiting (during which, banks have had plenty of time to jack up your interest rates and cut your credit limits), the Credit CARD Act of 2009 has finally kicked in. If you haven’t been following the news, here’s a quick run-down of what’s changed and what hasn’t. [More]

I Canceled My Chase Account Twice, But They Keep Contacting Me

Charles says he first canceled his Chase credit card in 2008, but was surprised to find it was still open a year later. He canceled it again, but Chase kept hassling him with mailings, and when he called to see what was up he was told the company was keeping in contact with old customers to comply with the CARD act. [More]

Make Only Minimum Credit Card Payments, And Your Heirs Will Still Be Paying During The Robot Wars Of 3510

Cracked shares a cautionary tale of what will theoretically happen to a person who makes only the minimum payment on a credit card balance of about $10,000. Like all solid financial advice, it begins with an Amazon.com addiction and ends with the Earth being destroyed two thousand years in the future by a power-mad Bank of America. [More]

Why Did The Strip Club Throw Me In Jail For Not Giving A Thumbprint?

Going from strip poles to iron bars in one night, a Consumerist reader says he got tossed in jail when he refused to give a strip club his thumbprint. Their ATM was broken so he had to pay his tab using a credit card cash advance. The club demanded a thumbprint and he refused, so cops that were already there threw him in jail. Was this legal? [More]

Remember To Use Your Credit Cards Occasionally Or The Bank Will Close Them

We regularly get letters from people who are upset that their bank “unilaterally” closed a credit account they hadn’t used in years. They’re always quite surprised that the bank can do this, and usually want to get their accounts back. Unfortunately, that’s not how it works. You really do have to use your account occasionally to keep the bank from closing it. [More]

How I Learned To Start Worrying And Hate Showing My ID

In response to yesterday’s post about a guy who likes showing his ID to checkout clerks when he makes credit card purchases, Adam rebuts with his explanation of how he used to be OK with the practice, but has now turned against it. [More]

Disney Store Apologizes For Refusing To Sell Stuff Without ID, Says It's Not Their Policy

Terry, who was annoyed that the Disney Store refused to sell his family less than $10 worth of stuff without ID, has sent an update. [More]

If I Can't Check ID's, How Am I Supposed To Prevent Credit Card Fraud?

We’ve told you that it stipulates in the contract between merchants and credit card companies that stores aren’t allowed to force you to show ID when you buy stuff, but what about the other side of the story? Alex is a 26-year old small business owner and Consumerist lover, but he doesn’t know how he’s supposed to prevent fraud if he can’t check people’s ID’s. Contrary to what some commenters assume, when a stolen credit card is used, the money gets yanked out of Alex’s bank account and he is unlikely to get it or the missing merchandise back. He gets jacked twice: once by the fraudster, and once by the credit card company. What should he do? Switch to cash only? His story, inside… [More]

I'm Happy When Clerks Demand I Show My ID With Credit Card Purchases

James is just fine with companies violating the merchant agreement by checking his ID when he pays via credit card. His rationale is that the practice only increases his sense of security. He writes: [More]

Citi Socked Me With Fee, Rate Increase Because I Lost My Card

Justin says he couldn’t pay his Citibank credit card balance because he lost his card and couldn’t log into the system because he hadn’t yet received his replacement. As a result, he was stuck with an interest rate hike and a missed payment fee. [More]

How Do I Build Credit When No One Will Give Me A Credit Card?

Clarice is financially recovering from a divorce. Her husband handled all the finances, and it turns out that he had a card in her name but never paid off a $300 outstanding balance on it. Besides this card, she’s never had a credit card. Now she wants one and no one will give it to her, because of the outstanding derogatory item and lack of credit history. She’s tried applying for credit cards online, with her bank and with stores. She could get a co-sign from her father but “doesn’t want to wrap him up in all of this.” What can Clarice do? Well, the last thing she can try is to apply for a secured credit card. [More]