PayPal exists to make money, not to help you. That’s why the unregulated money broker likes to ensure that when you pay with a linked account, you pay via the ATM debit card setting, because it’s cheaper for PayPal. Of course, that “savings” is sometimes deducted from you in the form of a transaction fee by your bank, but PayPal doesn’t care. If you want to change that payment method the next time you use PayPal, be prepared to jump through a lot of hoops. [More]

credit cards

Cut Debt Faster By Sending In Your Payments Sooner

One little trick you can do to get out of debt faster is to send in your credit card payments as soon as you can, says No Credit Needed. [More]

FTC Shuts Down Bogus Credit Card Robocallers

Three companies that made claims that they could help consumers reduce their credit card interest rates — and then charged fees of up to $1,590 — have been shut down by the Federal Trade Commission. “The last thing debt-ridden consumers need is to be deluged by illegal robocalls – especially when all the calls are offering is a scam,” said FTC Chairman Jon Leibowitz. [More]

Credit Card Limits Going Lower, Rates Staying High

A FICO survey of risk officers at various financial companies found that they overwhelmingly agree that credit cards are going to get even crappier for consumers in the coming months. 83% said that card limits are going to go lower. 95% said that interest rates could go higher or stay at the currently high levels. Just two more reasons to cut the plastic. [More]

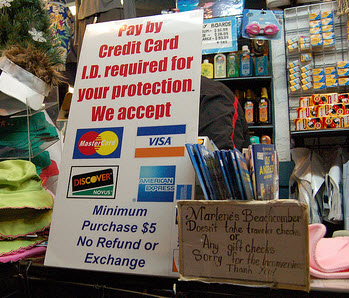

"$10 Minimum For Credit Card Purchase" Signs May Soon Be Totally Legit

As we all know, merchants are generally not supposed to mandate minimum credit card purchases. It’s a violation of the merchant agreements they sign with the credit card companies. (For more info, check out this article.) The proposed finance bill, however, may legitimize those handwritten signs if it ends up passing. [More]

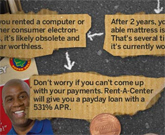

Rent-A-Center Responds To Predatory Lending Infographic

Sonia, Rent-a-Center’s Public & Community Affairs person, saw our popular post, “How Predatory Lending Works, From Payday Loans To Rent-To-Own” and has a rebuttal that shows how they do math. I showed it to Jess, the creator of the infographic, and he has a rebuttal to the rebuttal. Let the chips fall where they may: [More]

Late Payments Are Dropping Thanks In Part To The CARD Act

Banks and card issuers warned against the credit card reforms that went into effect a few months back, but so far it’s been a good thing for consumers, according to new delinquency numbers. [More]

Okay, Who's Been Using Tyler Perry's Credit Card?

Writer/director/actor Tyler Perry updated his website on Friday with a friendly letter to his fans. He talked about wrapping up his latest theatrical tour, and how beautiful his vacation spot was, and then ended on a strange note: “By the way, some idiot stole my credit card number. Can you believe that? Take a look at all the stuff they charged. If you know any of these people, call the police.” The charges, mostly airfares between L.A., Las Vegas, New York and Fort Lauderdale, came up to more than $28,000. [More]

Senate Bill To Curb Credit Card Swipe Fees Passes

The bill to curb credit card fees that was being floated last night ended up passing. Credit card industry stocks fell Friday on the news. [More]

Senate May Break "Price Fixing" On Credit Card Swipe Fees

As the Senate debates the financial reform bill, one amendment may be good news for small businesses — though it could offer a mixed bag to consumers. The amendment, floated by Sen. Richard Durbin (D-IL) would give small businesses more flexibility when it comes to working with companies like Visa and Mastercard that process credit card transactions. And it would give the government the ability to force processors to cut the rates they charge to manage debit card transactions to fees that are “reasonable and proportional to the actual cost incurred.” [More]

Tricard Credit Card Shows Off Your Debt

The Tricard concept from Park Mi-na is based on a simple idea: It displays your available credit every time you take it out, so you can avoid overspending. Not surprisingly, the design has yet to be picked up by any actual banks, since they’d just as soon let you keep swiping that card until you’re close to the edge, and then bump up your credit line so you can keep racking up debt. [More]

How Predatory Lending Works, From Payday Loans To Rent-To-Own

You’re a savvy, savvy consumer. You pay your credit card bills in full every month, auto-deduct a generous portion of your paycheck into savings, invest in index funds, and always make sure you’re getting the best deal from your cable and wireless providers. Unfortunately, some of your brethren do not read Consumerist and can get caught up in the jaws of predatory lenders, wasting limited cash on things like payday loans, bad credit cards, and using rent-to-own stores. So let’s take a walk down the wild side and see how each of these bad choices work, in a giant infographic, courtesy of Mint and WallStats, after the jump. [More]

Square Mobile Credit Card Payment App Is Awesome Yet Freaky

Bill is understandably terrified of the Square app, which lets devices with audio input jacks and online connectivity accept credit card payments. That means iPhones, Droids and what have you are every bit as equipped to siphon money out of your accounts as crusty convenience store clerks with cash registers. [More]

Ben Stiller, Other Celebs, Allegedly Targeted In Credit Card Scam

It makes sense that David Duchovny, director Paul Haggis, Ben Stiller and a few other of Hollywood’s big names would all lose their credit cards and need replacements mailed to the same address in Chicago. Or at least, it made enough sense for Citibank to send out a few new cards out before they and the police got a wee bit suspicious. [More]

Test Your Credit Card IQ

So you think you’re pretty smart with your credit know-how? Got a good credit score and line of credit? Well here’s another number to watch, your credit card I.Q. Take this 10 question test and see how you stack up. Even I got a few of these wrong. For instance, “The typical American carries a balance of about $5,500 in credit card debt. If you make no more charges and pay only the minimum payment each month, how long will it take to pay that debt off at 19 percent interest?”

10 questions to test your credit card I.Q. [Philly.com via LowCards.com]

VIDEO: VISA Is A Monster That Feeds On Human Wealth, And VISA Is Hungry

“Go. Get it. Run. Use your VISA card right now. It doesn’t matter what you use your VISA card to buy. It doesn’t matter what you use your VISA to buy. All that matters is that VISA is a monster that feeds on human wealth. And VISA is hungry.” The credit card companies’ rapacious desire for your debt is laid bare in this commercial parody video. I guess you would call what we’re going through now the purging stage? NSFW due to naughty words and suggestive simulating gestures. [More]